To generate consistent returns on cryptocurrency trading, a trader needs to have the right tools for the job. Traders need to be able to view and access market data, formulate and test theses about the market, and take action. While cryptocurrencies are a relatively new entrant to the world of financial trading, there are already many tools available for traders seeking to optimize their trading strategies.

We’ve curated a list of 26 tools for traders seeking to stay current with the best trading practices, broken down into the following categories:

- Charts and Analytics

- Trade Execution

- Security and Storage

- Mobile

- Tax and Accounting

- Miscellaneous

These tools are ranked in no particular order, offering traders the opportunity to develop their knowledge and strategies around trading. Let’s take a look.

Charts and Analytics

Good data analytics tools are invaluable in cryptocurrency trading. Being able to take a close look at the granular activity of a cryptocurrency through different trading metrics and visualize the data is key to understanding and anticipating price action.

There are a variety of solutions available that focus on everything from on-chain data and network usage to market indicators and charting tools — here are the ones we recommend.

1. FoxEye

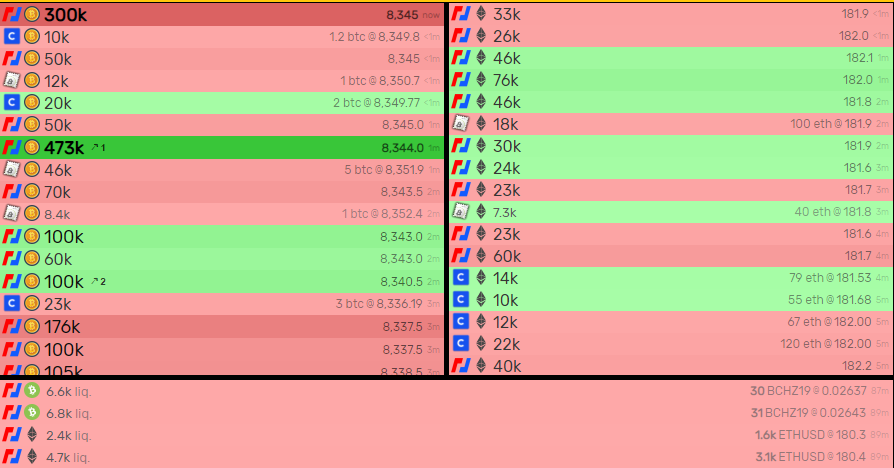

FoxEye is a suite of trading tools designed by SFOX which allows users to view and analyze the crypto market. Tools in the suite include Time and Sales, a live feed of trades for a given crypto asset across multiple exchanges.

Instead of monitoring a crypto’s trading activity on one exchange, users can see market-wide performance including trade amounts, trade times, price direction, and the relevant exchange. This allows traders to see how active the market is, monitor momentum, and find arbitrage opportunities.

2. TradingView

TradingView is a tool used by millions of traders in a variety of markets, including the crypto market. The TradingView chart features over 100 indicators and over 50 charts that allow users to create bespoke charts to suit their trading strategy. There is a free option that is limited to three indicators per chart, as well as three paid tiers ranging from $14.95 to $59.95 per month, with increasing access to indicators, devices, and customer support at higher levels.

Cryptocurrency traders can monitor the price action of different cryptocurrencies on any of the major crypto exchanges. This allows them to hunt for arbitrage opportunities and monitor trading activity at a more advanced level than is possible with the basic charts on most exchanges. A key selling point of TradingView is the user-friendly interface and intuitive nature of the software.

3. The TIE

The TIE is a market data and sentiment analysis tool that offers a broad view of activity in the crypto markets. Users can view the current market cap, 24 hour capitalization change, trading volume, average trading volume, sentiment, tweet volume, and average tweet volume from the home page. The home page also shows these metrics on a number of major cryptocurrencies individually, provides a weighted sentiment index of the top 20 coins, and a live news feed of the crypto markets.

4. TensorCharts

TensorCharts is a software solution that caters to cryptocurrency day traders with free and paid versions. In either version, the order book heat map is designed to give deeper insight into recent trading activity, helping traders spot buy walls and sell walls as well as support and resistance levels.

Traders can also view trading volume as “candlestick footprints,” a feature allowing them to zoom in on candlestick charts for more granular volumetric analysis. There are also a number of paid options offering lower latency on charts, with prices ranging from $18 to $25 per month.

5. BitInfoCharts

BitInfoCharts is another charting website used by traders, offering advanced options for on-chain data analysis. This allows users to view total supply, market cap, current price, number of transactions over 24 hours, average number of transactions per hour, units of currency sent over the last 24 hours, average and median transaction values and fees, and much more.

In total, there are 36 different criteria by which a user can analyze a cryptocurrency on the site, ranging from blockchain information to information on how many GitHub commits or tweets per day are associated with the coin. Users can visualize this data in charts and compare several cryptocurrencies against each other by these metrics. BitInfoCharts is a very useful tool for performing the kind of in-depth research around a cryptocurrency that can help understand and anticipate price action.

6. CoinMarketCap

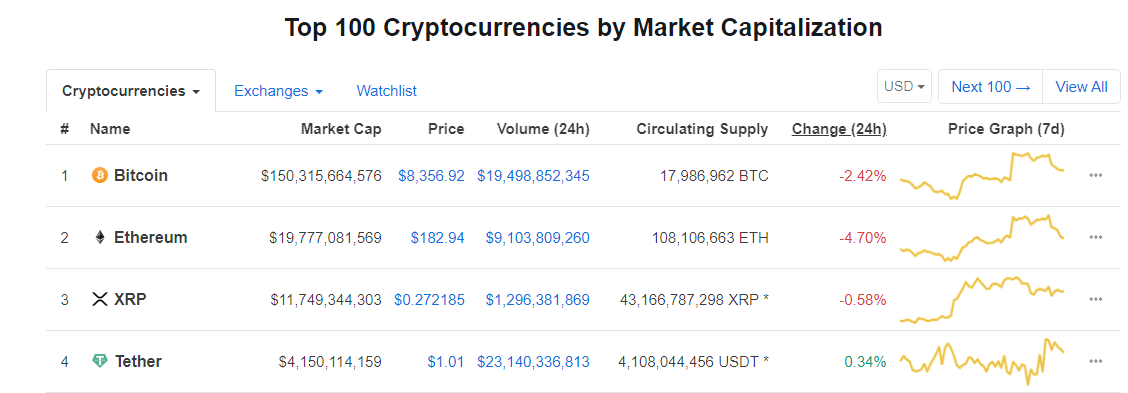

CoinMarketCap is a widely used charting website designed specifically for the cryptocurrency industry. The website lists all actively traded cryptocurrencies in order of market capitalization from high to low, with Bitcoin at the top. Beside each cryptocurrency, CoinMarketCap displays the market cap, the current price, the 24-hour trading volume, the circulating supply, the 24-hour price change by percentage, and a 7-day price graph.

There are a number of options, such as filtering by top 100 coins and filtering only coins that are mineable. Users can view the historical data for any cryptocurrency since its launch, and the site also lists the top 100 cryptocurrency exchanges by reported volume and adjusted volume. Beyond that, there are ancillary tools and resources on the site, such as currency converters, a blockchain explorer, and a blog. It’s worth pointing out that while CoinMarketCap is frequently used by the media to cite updates on volume and price action, the data can be faulty at times, so it’s worth checking it against the other sources listed here for total accuracy.

7. Kaiko

Kaiko provides current and historical data analytics for 10,000 different cryptocurrency pairs across 80 exchanges. Kaiko distributes market data or institutional investors and market users via a livestream WebSocket, REST API, and cloud-based flat-file Data Feed, and users can integrate data into third-party platforms and apps. Kaiko offers a free trial for one week and charges $630 per month after the trial has expired.

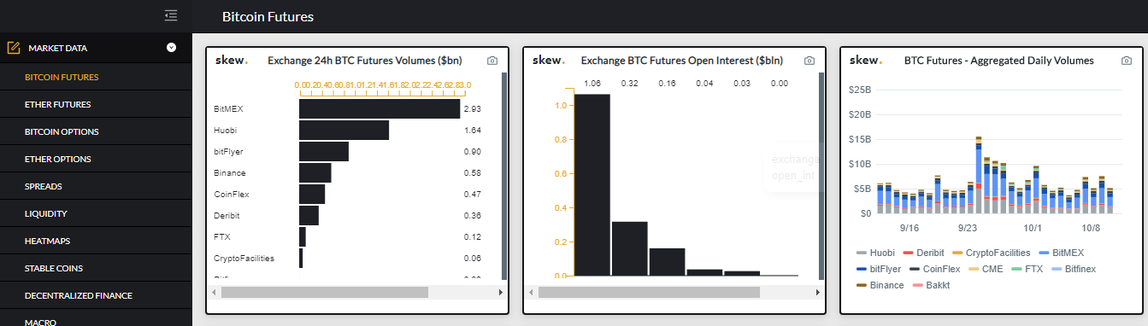

8. SkEw

Skew is an analytics tool focused on providing insights into cryptocurrency derivatives. Skew offers real-time data on futures term structures, open interest, order-book depth, volatility curves, and other key metrics. The firm’s software is aimed at institutional traders and corporations. Centered on futures and options trading for both Bitcoin and Ethereum, Skew is available to use for free but also offers professional account options on request.

9. Corn.lol

Corn.lol is a tool that aggregates cryptocurrency trades and provides live updates of the BitMEX liquidation engine as well as access to site-embedded TradingView charts. Traders use Corn.lol to view large market orders and liquidations across eight cryptocurrency exchanges, including BitMEX, Bitfinex, Coinbase, and Binance.

10. Messari

Messari is a registry that cryptocurrency projects join voluntarily, aimed at creating transparency in the industry. Messari offers standardized sets of data to users as well as research available to Pro Users who pay a $24.95 monthly subscription fee.

This includes weekly asset reports, regulatory news, macroeconomic analyses, and other information traders may find useful. The Messari API also offers real-time low-latency prices and trades for 1,000 assets over 40 exchanges.

11. SFOX Edge

SFOX Edge is more than a blog: it’s a tool. Our deep dives into crypto trading topics, our monthly volatility reports, our detailed case studies comparing crypto projects beside one another, and our interviews with industry leaders are all valuable resources that traders can use to learn more about a given asset or the industry as a whole.

You can subscribe to our blog or follow us on Twitter to access high-level analyses of the cryptocurrency space.

Trade Execution

80% of stock market trading is assisted by algorithms. Software can make trading decisions many times faster than the human brain and can make a major difference in the outcome of a given trade through a number of separate functions.

12. SFOX Trading Algorithms

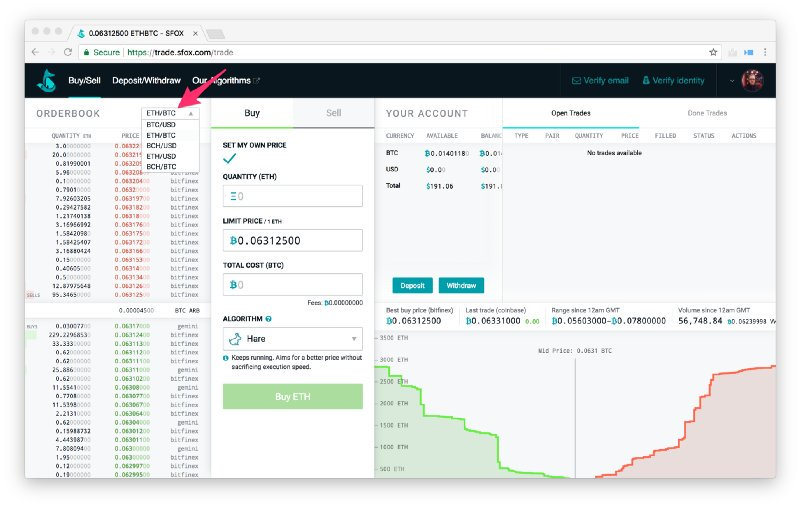

Our trading platform, SFOX, connects traders to all major crypto exchanges and finds the best possible price and liquidity for the digital asset they want to trade. Traders can use nine different advanced trading algorithms, each with unique functions.

For example, the Hare algorithm, supported through the SFOX API, optimizes order routing for best price and speed, aiming to place your trade at the top of the order book and solving the frustrating problem of getting pushed out of line in the order book.

The Gorilla algorithm, on the other hand, allows traders to place large orders (recommended for 20+ BTC trades) spread across multiple exchanges to avoid moving the market. All algorithms come with instructions on how and when they should be used. SFOX allows users to trade across all major exchanges from one account and supports enterprise-grade security features to protect user funds and data.

Security and Storage Tools

Profits earned in cryptocurrency training are only worth as much as the security system that protects them. Luckily, there are encrypted web, mobile, and hardware wallets you can use to store your cryptocurrency funds.

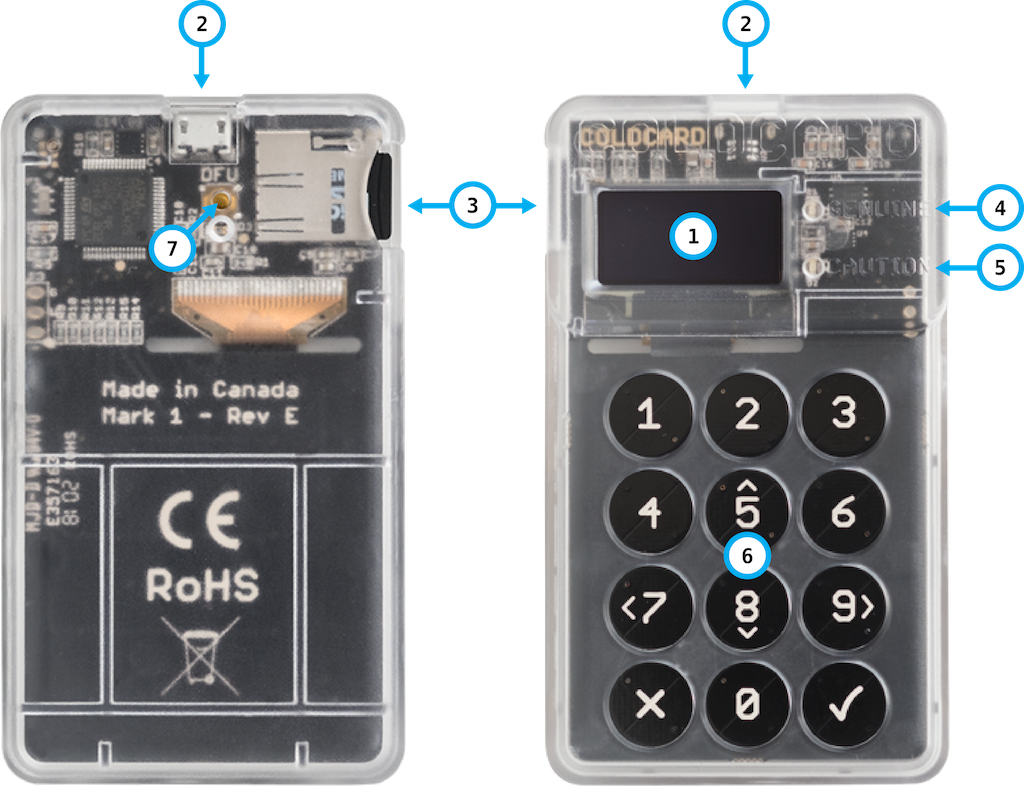

13. Coldcard Wallet

Coldcard Wallet is a hardware wallet for Bitcoin that stores private keys and seed words in a dedicated chip, never connecting to a computer. The code for the device is open source, so users can look through it themselves.

Users can also enter a “duress PIN” to redirect to an unlimited number of dummy wallets in the event that someone tries to coerce funds from them in person, or they can destroy the information in the device by entering a separate PIN. The Coldcard MK3 wallet currently costs $109.97.

14. Trezor

Trezor is the original cryptocurrency hardware wallet and was created to solve a number of pain points when it comes to storing cryptocurrencies (or, rather, cryptocurrency keys). The private keys to cryptocurrency funds are never actually exposed to a user’s computer directly, making the transaction process more secure. Trezor stores funds offline, where they cannot be stolen by internet hackers, and supports over 1,000 currencies. Trezor also has an Android app for mobile support.

Users can (and should) create a backup code so they can restore funds even if they lose or damage their hardware wallet. There are two models: The Trezor One costs $59, while the Trezor Model T costs $179, with the main difference being the touchscreen available on the Model T.

15. Ledger

Ledger is a hardware wallet solution with two versions, the Ledger Nano S and the Ledger Nano X which cost $59 and $119 respectively. Both Ledger wallets support over 1,000 cryptocurrencies, with native support for many major cryptocurrencies.

Ledger funds are stored on a chip inside the device, and private keys are not exposed directly to users’ computers, mitigating the risk of online hackers stealing funds. Users can recover funds from a lost or damaged wallet with recovery seed phrases.

Mobile Tools

Modern solutions to crypto trading allow traders the freedom to trade and monitor their funds and portfolio on the go. Here are some useful mobile apps you can use for trading and operational security.

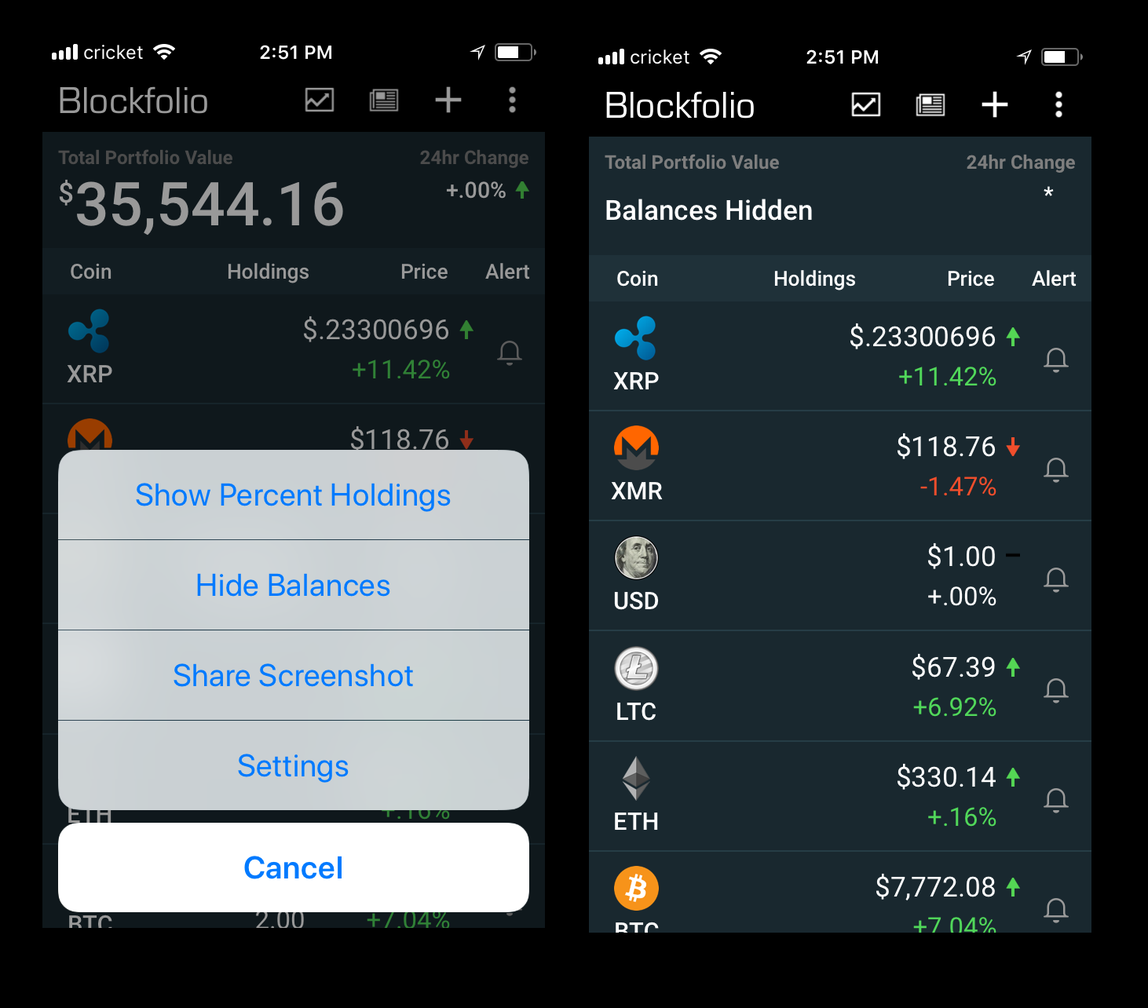

16. Blockfolio

Blockfolio is a portfolio-management app used by over 5 million crypto traders and investors. Users can enter the information from each of their trades so that the app can track how much value has been lost or gained in their overall portfolio, or by individual currency, since they started investing. The app is integrated with most major exchanges, meaning users can enter their exchange login details and have the app track their activity automatically.

The app supports 8,000 cryptocurrencies and blockchain assets over 300 exchanges. The project has also developed Blockfolio Signal, a communications platform designed for token development teams to engage with their communities, meaning Blockfolio users can receive live updates from crypto project teams as they’re released.

17. CoinStats

CoinStats is a mobile portfolio manager that allows users to keep track of their trades through different wallets and exchanges, all of which are automatically synced. The app supports 3,000 cryptocurrencies and 100 exchanges, and the CoinStats Direct feature allows users to chat directly with project developers and staff. CoinStats is available on the App Store and Google Play.

18. Blockstream Green Wallet

Blockstream Green is an app by Bitcoin development firm Blockstream. The app is a mobile Bitcoin and L-BTC asset wallet available on Android and iOS devices with multi-signature capabilities that allow for two-factor authentication (2FA), adding a layer of security to user funds. 2FA is available through SMS, email, Google Authenticator, and phone call.

With SegWit integration, users can control the fees associated with a transaction by toggling transaction speed. The app co-signs user transactions without actually holding the keys to the wallet, and it supports the Ledger Nano S and Trezor One hard wallets for cold storage.

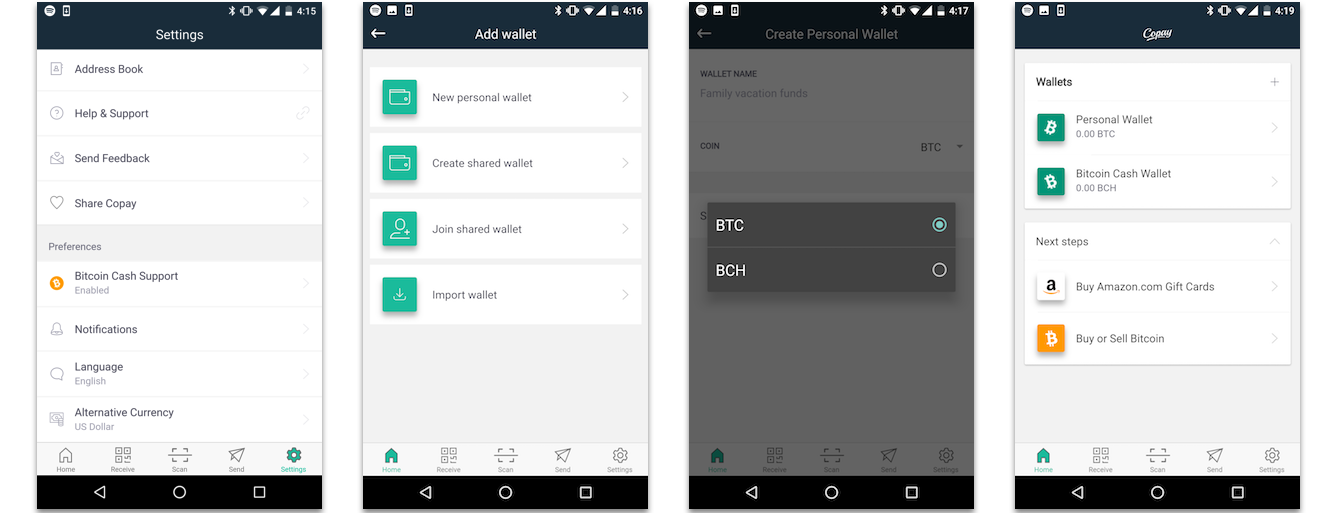

19. CoPay

CoPay is an open source multi-signature Bitcoin and Bitcoin Cash wallet developed by BitPay. The app allows users to avail of multi-sig security by requiring a third party to approve their transactions before sending. Users can take advantage of multiple disconnected bitcoin wallets within the app with granular security options for each one.

Users can receive email notifications for payments and transfers for added security. Push notifications are available for Android and iOS users, and the app is also supported on OS X, Windows Phone, Chrome App, Linux, and Windows.

Miscellaneous Tools

Beyond charting tools, trading platforms, and wallets, there are a number of niche tools you can use to transform your trading practices.

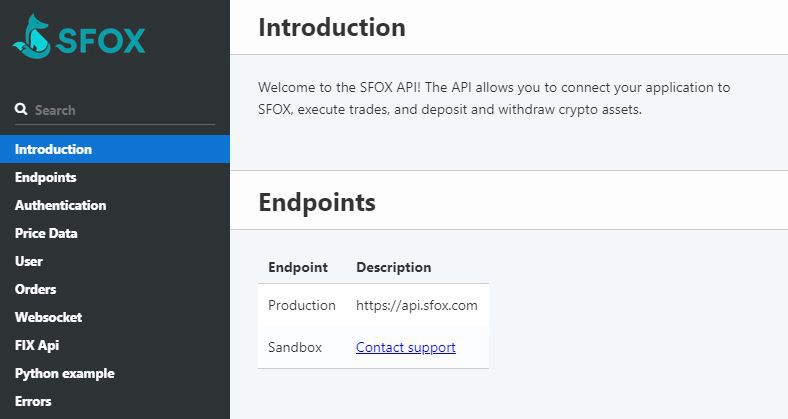

20. SFOX API

The SFOX API is a tool that can handle a variety of functions, allowing developers to connect their app to SFOX and avail of the features our platform has to offer. Once connected by the API, users can find the best price for a cryptocurrency across dozens of exchanges, capitalizing on the arbitrage opportunities found in volatile market conditions.

The API offers a blended order book of all the connected exchanges, visualizing a market-wide view of price action. The API can also access balance, view trade history, execute market and limit orders, and connect to bank accounts to send bank transfers for trading purposes.

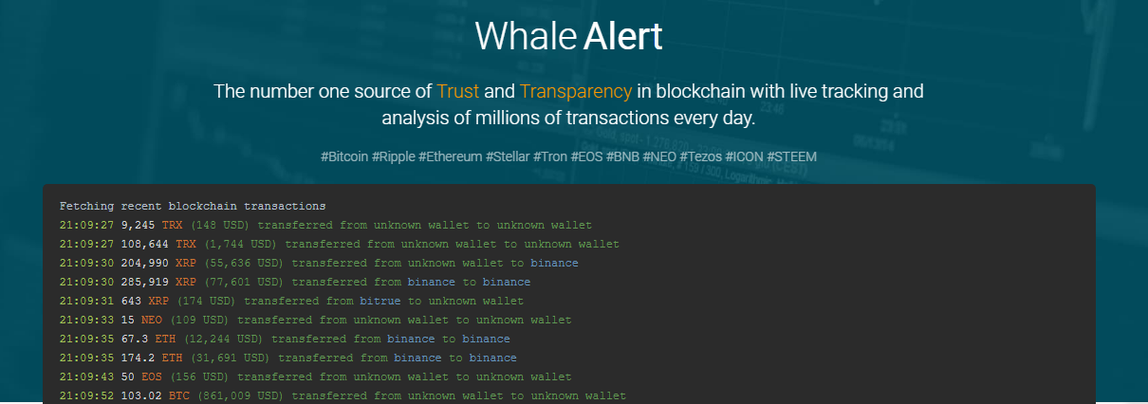

21. Whale Alert

Whale Alert is a site that tracks major transactions within the crypto ecosystem. Large transactions can have a ripple effect throughout the market, so some traders have taken to keeping an eye on potentially market-moving activity. The site tracks thousands of known addresses of individuals, exchanges, and companies with large sums of cryptocurrency and uses AI as well as manual methods to update the database. The aim of the project is to increase accountability for high-value entities (known as “whales”) in order to inform the public and combat trading manipulation.

Whenever a major sum of BTC is moved to Coinbase, or when Tether prints a large sum of USDT, Whale Alert notifies followers. The project’s staff tweets major crypto transactions live as they happen from the Twitter handle @whale_alert, alerting traders to trades that could theoretically cause spikes or drops in price action.

Tax and Accounting

Calculating tax on crypto trades has long been a pain point in the industry. Recently, with more regulatory clarity on the classifications of cryptocurrencies in different countries, companies have taken the opportunity to create useful tools that make accounting and taxation on crypto trading a lot easier. Here are some tools we recommend.

22. SFOX Transaction Reports

SFOX has developed two different kinds of transaction reports for users to avail of. U.S. traders are required to know the dollar value of their trades at the time of execution; SFOX transaction reports provide automatically track this value for easy presentation.

SFOX users can review their entire trade history on SFOX by month, quarter, year, or custom time periods. These reports include the asset pair traded, the exchange rate between pairs, the quantity of the trade plus fees, the USD value at the time of trade and the total value in USD.

As well as time-based reports, users can generate monthly summaries filtering by asset to view deposits or withdrawals of that asset, the total amount bought and sold, and the total value of trades of that asset in USD. SFOX users can generate transaction reports free of charge without integrating a third-party solution to their trading.

23. CoinTracker

CoinTracker is a tool designed to help traders with an activity that has often been a source of stress and confusion: calculating tax on crypto trades. The tool allows users to connect all exchanges, wallets, and DeFi platforms; all balances and transactions are then automatically synchronized for the purpose of record-keeping. CoinTracker supports fee tracking, margin trading, and other aspects of crypto trading that can be hard to calculate when the time comes. The project currently supports 300 exchanges and 2,500 cryptocurrencies.

Once everything is synchronized, users can automatically generate tax reports. CryptoTracker can be integrated with accounting software and offers full support in the US, UK, Canada, and Australia, with partial support in all other countries. Prices for CryptoTracker start at $48 for a one-time annual tax payment of up to 100 transactions. The highest standard tier is priced at $1000 for 15,000 transactions, and custom prices are available for up to 1 million transactions.

24. CoinTracking

CoinTracking is is a tool that analyzes trades and creates real-time reports on profit and loss to make taxation more straightforward. The reports also include information on the value of your holdings as well as realized and unrealized gains. The tool supports over 7,000 cryptocurrencies. There are three tiers of service. The first is free for up to 200 transactions per year, the Pro option costs $113 for up to 3,500 transactions, and users can access unlimited transactions for $241 per month.

25. Blox

Blox is a cryptocurrency accounting software solution that allows users to manage their cryptocurrency portfolio through a variety of tools and management features. Blox provides daily snapshots of account balance and activity to keep traders in the loop, and users can import and export CSV files for accounting purposes.

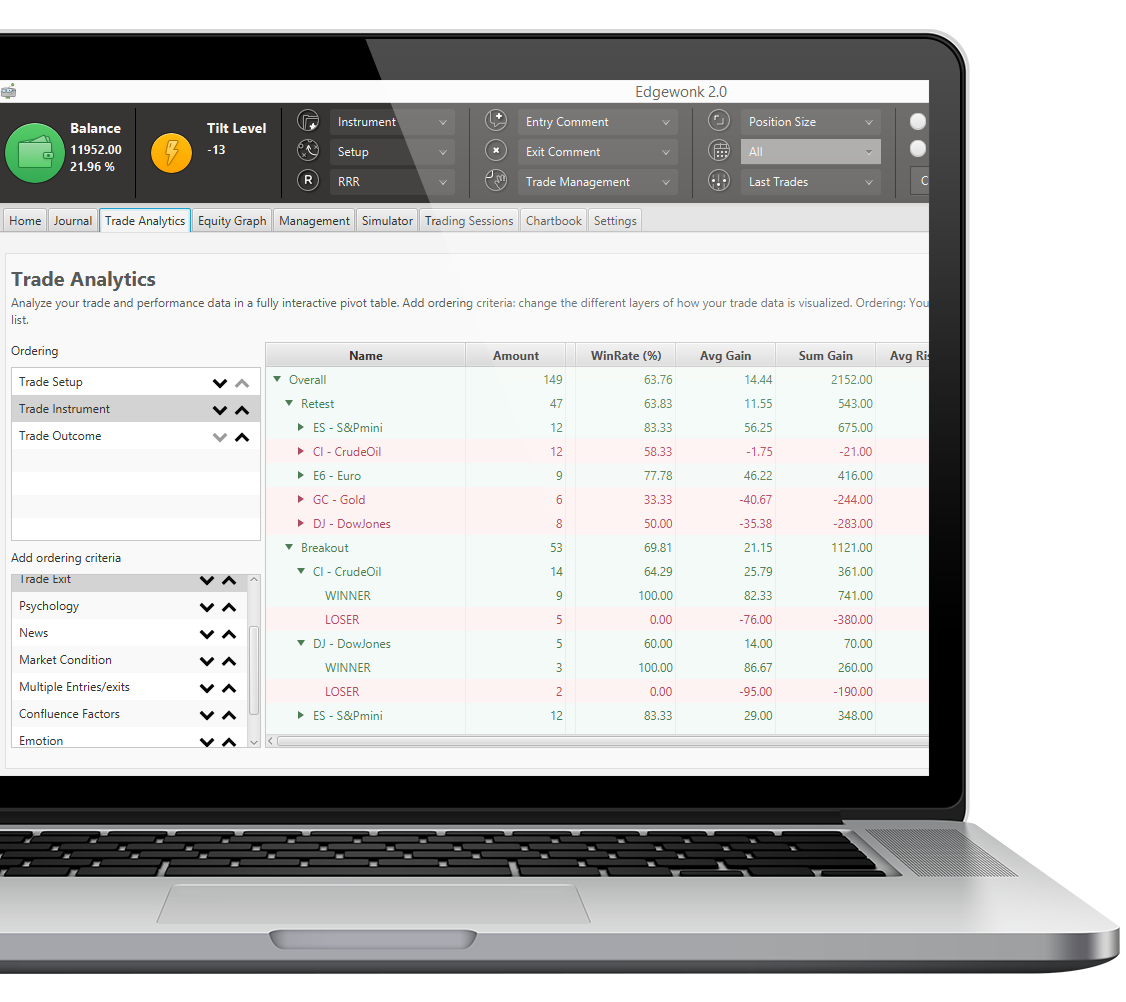

26. Edgewonk

Many traders advocate keeping a written record of trades in order to learn from experience. This is typically a journal that simply records the sum wagered, the opening and closing values, and other basic info. Edgewonk is a software tool designed to improve the user experience for traders keeping journals, with an interactive UI that lets you store trading info on the cloud for future reference.

More than a mere record, Edgewonk analyzes and interprets trading behavior, allowing you to refine your strategies over time. Edgewonk offers a free trial and costs $169 after the trial has ended.

Missing Something?

This is our list of recommended tools for both institutional and retail traders.

What other tools do you use for crypto trading? Let us know in the comments if we’ve missed any essential tools so we can add them in our next article — or if there are any tools that you wished existed, so that we can build them.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.