In August 2017, Bitcoin Cash initiated a successful hard fork from the Bitcoin network. Bitcoin Cash proposed to deliver on what it saw as the original promise of Bitcoin: digital cash with high transaction throughput and low fees.

History appeared to repeat itself in November 2018 when the Bitcoin Cash network itself split in two, leading to the creation of Bitcoin Satoshi Vision, or Bitcoin SV.

Earlier that August, Bitcoin Cash had proposed an upgrade to the protocol. This included:

- Canonical Transaction Ordering (CTOR), which would require transactions in each block to be included in a specific order.

- OP_CHECKDATASIG, an opcode that would provide more flexibility to the BCH scripting language, enabling oracles and atomic swaps with other chains. The goal was to introduce noncash transactions that would bring a level of smart-contract functionality to Bitcoin Cash.

A faction within the Bitcoin Cash community, led by Craig Wright and Calvin Ayre, disagreed vociferously with these proposed technical updates. They argued that the proposed upgrades weren’t secure and that they would corrupt the original vision of Bitcoin as digital cash by allowing for noncash transactions. This faction launched a competing version of the protocol with a higher block size limit of 128 MB on November 15, 2018, leading to a contentious hard fork that split the chain into Bitcoin Cash and Bitcoin SV.

The Bitcoin SV hard fork is interesting in that it involved not only an initiative to roll back Bitcoin Cash’s protocol changes, but also an attempt, by some members of the community, to effectively wipe Bitcoin Cash out by taking all of its hash power. Six months later, it’s time to assess how both chains are faring — and how they compare to their progenitor, Bitcoin.

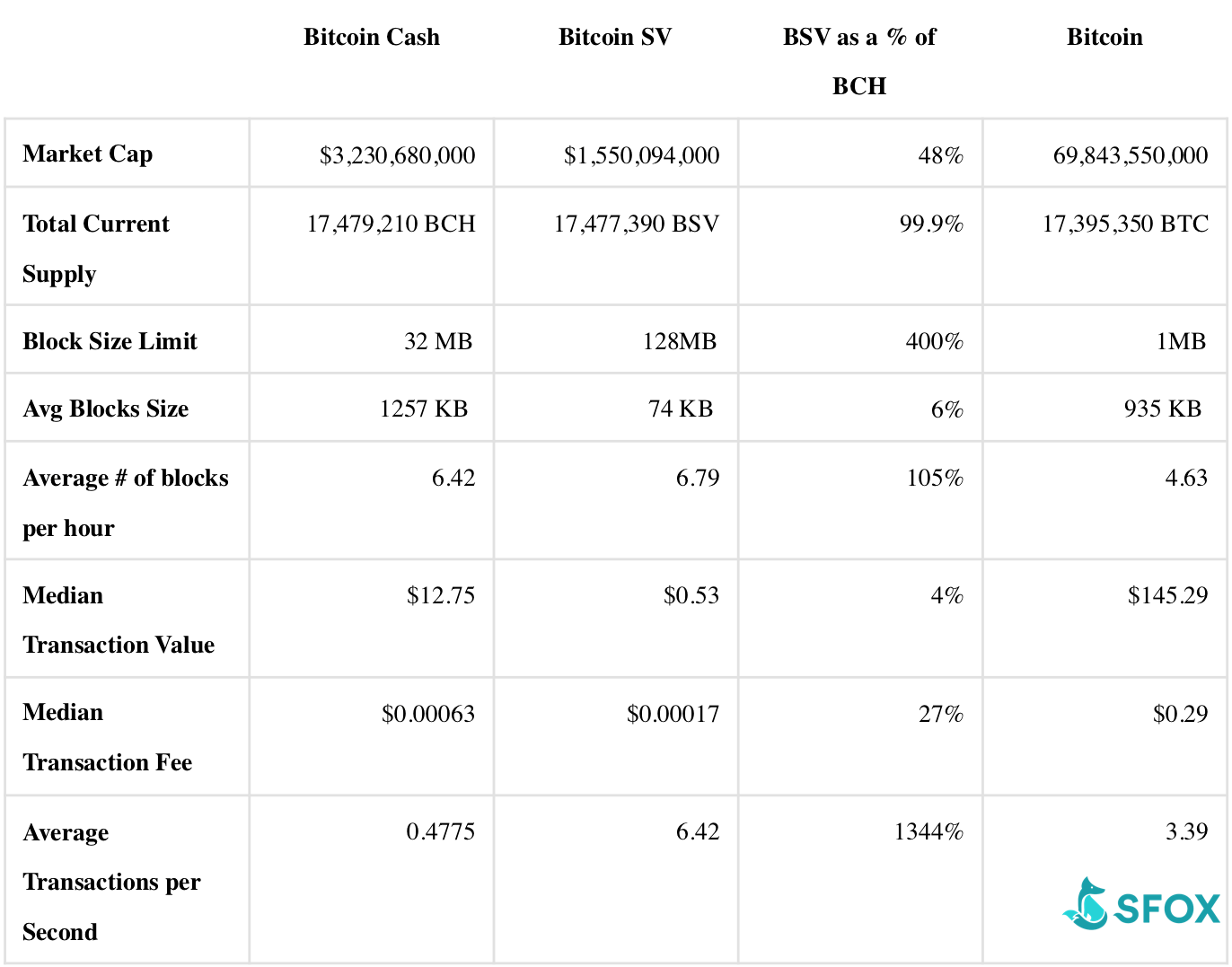

Let’s look at how BCH stacked up against BSV along with BTC a little over a week following the hard fork, on November 26, 2018:

Despite all the initial talk of a hash war, both chains are still subsisting independently. To understand how Bitcoin SV is stacking up against Bitcoin Cash, we’ll compare the chains along three key dimensions:

- Mining: Bitcoin SV hard-forked without replay protection, which posed an existential risk to Bitcoin Cash. This led miners on both chains to contribute hash power unprofitably. What’s the state of mining across both chains today?

- Block Size: Bitcoin Cash increased its block size limit from Bitcoin’s 1 MB to 32 MB. Bitcoin SV subsequently increased its own block size limit from Bitcoin Cash’s 32 MB to a whopping 128 MB. How have Bitcoin Cash and Bitcoin SV scaled their respective networks?

- Transaction Volume: Bitcoin Cash and Bitcoin SV both claim to fulfill the original value proposition of Bitcoin. What does transaction volume show us about how people and institutions are currently using Bitcoin Cash and Bitcoin SV?

In this article, we’ll dig into the state of both cryptocurrencies since the fork.

In a Hash War, Miners Lose the Most

Both Bitcoin Cash and Bitcoin SV use Bitcoin’s SHA-256 hashing algorithm, which means that the same mining hardware can be used to generate hash power on BCH, BSV, and BTC. This is what led to the “hash war” between Bitcoin SV and Bitcoin Cash at the time of the hard fork.

Unlike the Bitcoin Cash fork from Bitcoin, where the chains cleanly split and went their separate ways, some Bitcoin SV supporters wanted their chain to emerge from the hard fork as the only survivor. nChain’s Craig Wright explicitly stated that he and other Bitcoin SV supporters intended to use their mining hash power to 51%-attack the Bitcoin Cash chain. With such an attack, they could theoretically discourage miners from mining on Bitcoin Cash by mining only empty blocks or orphaning blocks from honest miners. In this scenario, Bitcoin Cash miners would be incentivized to switch to mining Bitcoin SV.

Bitcoin Cash supporters, including Bitmain’s Jihan Wu and Bitcoin.com’s Roger Ver, responded to the threat by redirecting hash power from Bitcoin to Bitcoin Cash. Bitmain reportedly mobilized 90,000 Antminer S9s in preparation for the hard fork. While Bitcoin SV did receive hash power from Calvin Ayre’s CoinGeek pool and nChain’s SVPool, this didn’t wipe out Bitcoin Cash.

Within the first week of the split, Bitcoin Cash managed to attract more mining hash power than Bitcoin SV, although there were points at which Bitcoin SV’s hash power exceeded Bitcoin Cash’s.

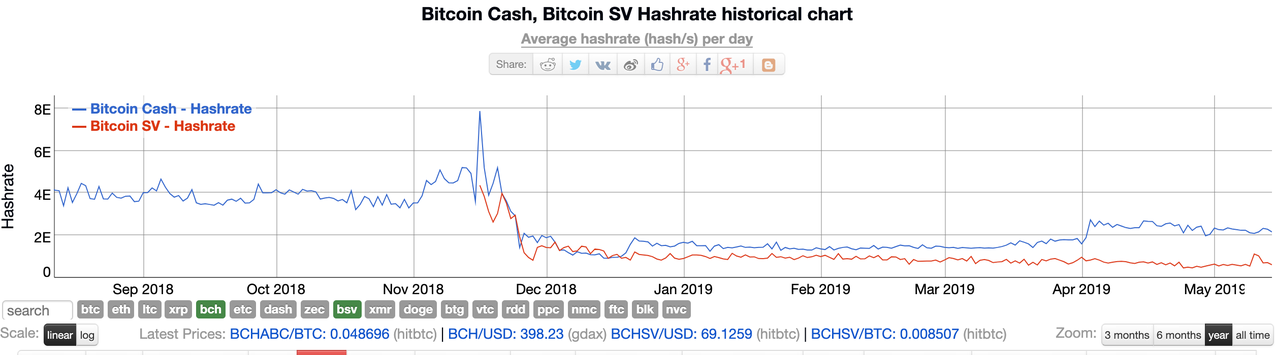

The “hash war” led miners to mine unprofitably on both chains. As shown in the chart above, Bitcoin Cash’s network hash rate was around 4 Exahashes per second in the months prior to the fork. Immediately after the fork, Bitcoin Cash’s hash rate nearly doubled, increasing to 7.8 Exahashes a second. Research from BitMEX indicates that by December 10th, Bitcoin Cash miners had lost $3.45 million and Bitcoin SV miners had lost $2.49 million.

Around 10 days after the split, and a costly — if short — hash war, the hash war ended as the Bitcoin SV team announced a permanent split from Bitcoin Cash, enabling replay protection on the chain. Since then, hash rates on both chains have fallen substantially. The Bitcoin Cash network now has 2.13 Exahashes a second compared to Bitcoin SV’s 447.19 Petahashes per second — or nearly five times the hash power.

The Bitcoin Cash hard fork presents an interesting case study in a blockchain governance conflict, illuminating that, in a sufficiently acrimonious situation, a forked chain could theoretically wipe out the original chain. Ultimately, though, while this fork led to losses for miners on both sides, Bitcoin Cash and Bitcoin SV both survived and stabilized following the hard fork.

Bigger Blocks Aren’t Necessarily Better Blocks

As Bitcoin’s network grew, so did transaction times and fees. Bitcoin Cash’s bigger blocks were intended to help the network scale with fast transaction times and low fees. Following the hard fork with Bitcoin, Bitcoin Cash first increased the block size limit to 8 MB and eventually to 32 MB. Bitcoin SV subsequently quadrupled that limit to 128 MB.

Bitcoin SV’s massive block size limit was intended not only to allow faster and cheaper payments but also to open up the chain to broader business use. In the words of nChain’s Craig Wright:

These are concepts and seeds of businesses that we will provide to developers seeking to extend the Bitcoin protocol on SV — not as a means to take down the state or anything along those lines, but simple and boring uses such as technological data plumbing. This will be tax invoices and contract-exchange platform — systems that allow a user to purchase an item in the local store, and have it recorded and available later for use as a tax record. It could even be automated to load into an accounting system.

Wright posited that bigger blocks would allow Bitcoin SV to work as a kind of “commodity layer” for businesses, which they could use to store records of invoices, receipts, and more. While this usage hasn’t materialized yet on Bitcoin SV, it’s possible that the chain’s larger blocks could allow for greater business usage than Bitcoin Cash in the future.

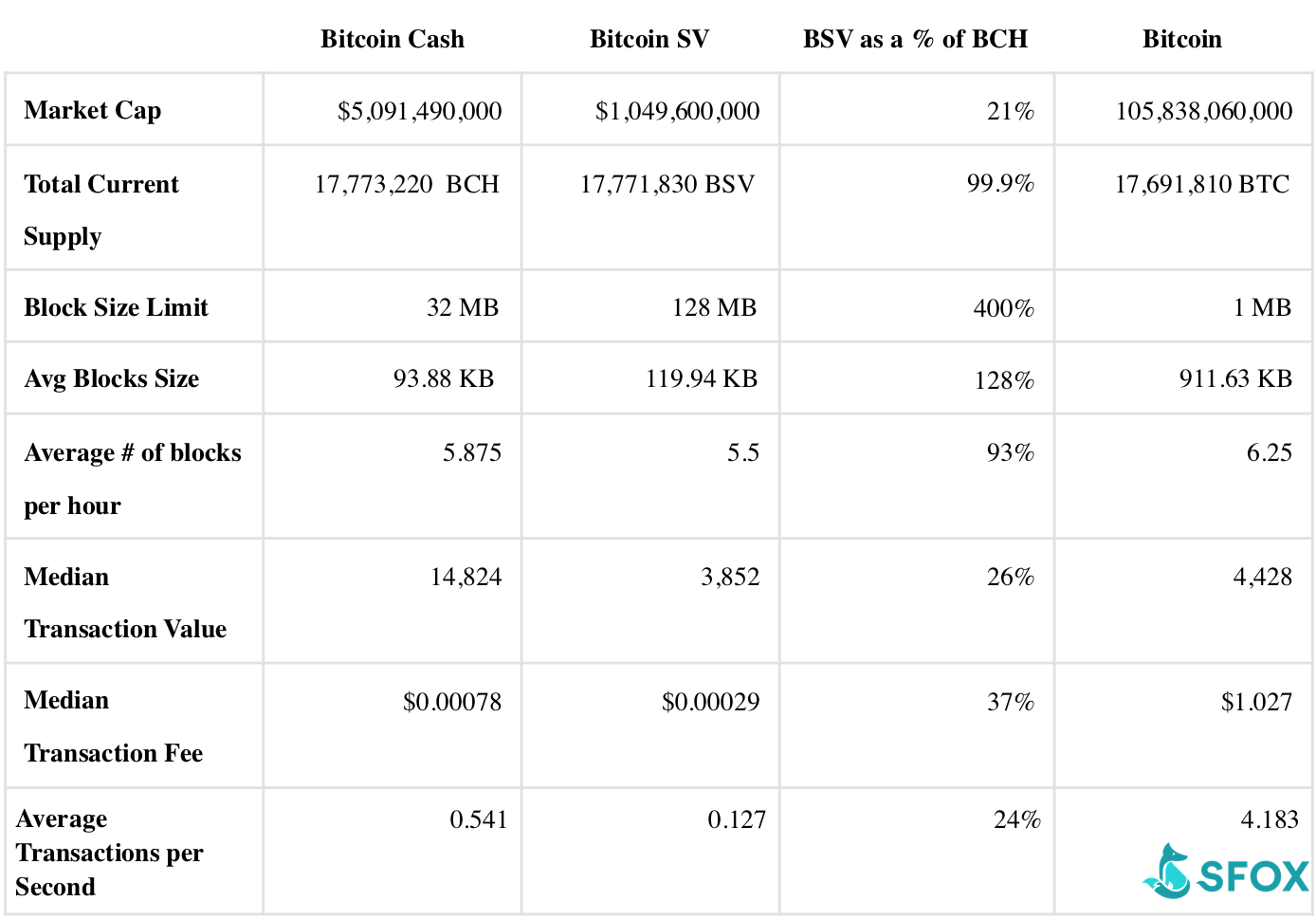

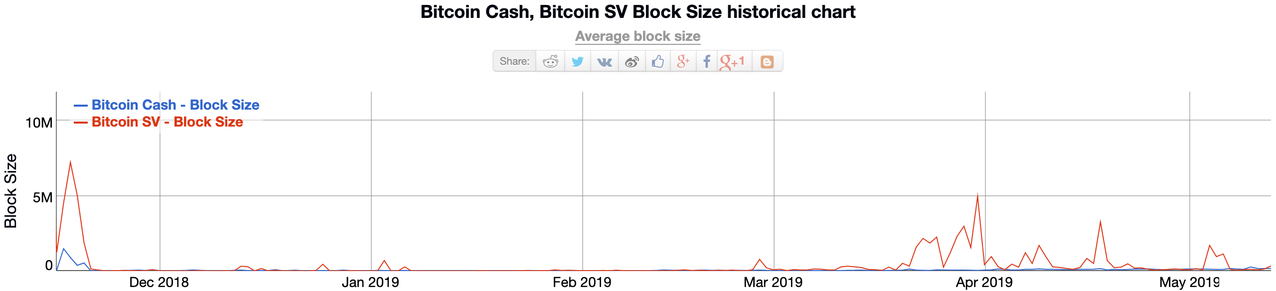

Currently, the daily average block size for Bitcoin SV 340 KB, or 0.3% of the total block size limit. Bitcoin Cash’s daily average block size is 176 KB, or 0.5% of the total block size limit. Neither Bitcoin Cash nor Bitcoin SV is seeing anywhere close to full utilization of their respective block size limits yet.

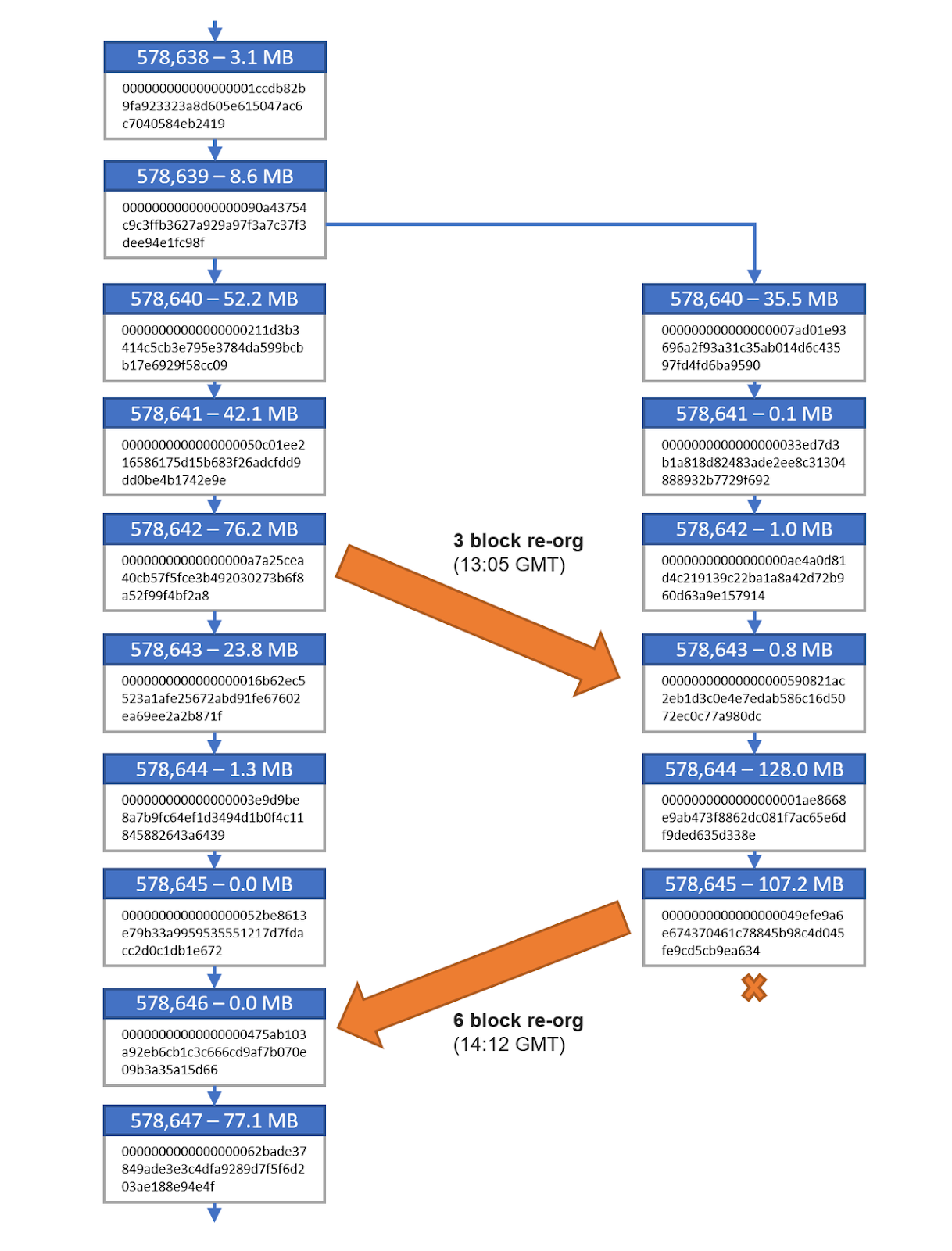

Bitcoin SV’s 128 MB block size limit hasn’t seemed to impact adoption yet — and there’s also evidence that suggests that large blocks could introduce security issues to the chain. In April, researchers detected two block reorganizations on Bitcoin SV, where there were two valid competing chains. They found one 128 MB block and another 107 MB block on the forked chain, suggesting that the bigger blocks couldn’t be processed quickly enough by miners before new blocks were found by other miners.

Both Bitcoin Cash and Bitcoin SV have larger block sizes than Bitcoin. For the most part, bigger blocks haven’t seemed to actually matter yet as transaction volume on both networks has remained low.

Bitcoin Cash Has a Higher Transaction Volume

Both Bitcoin Cash and Bitcoin SV claim to adhere to the original vision of Bitcoin as an electronic payment system that can scale a high throughput of transactions at low fees. So far, actual usage in terms of transaction volume hasn’t lived up to this ideology, with both chains lagging behind Bitcoin. Both Bitcoin Cash and Bitcoin SV can process transactions more quickly and cheaply than Bitcoin, but that hasn’t seemed to matter in terms of adoption.

With a median fee of $0.00029, Bitcoin SV is cheaper per transaction than Bitcoin Cash, which has a median fee of $0.00078. Bitcoin Cash and Bitcoin SV both follow Bitcoin’s consensus model, which means that neither has an advantage when it comes to speed: transactions on both chains take around 10 minutes for one confirmation.

But with a median transaction fee of $1.03 on Bitcoin, Bitcoin remains far more expensive per transaction than both Bitcoin Cash and Bitcoin SV.

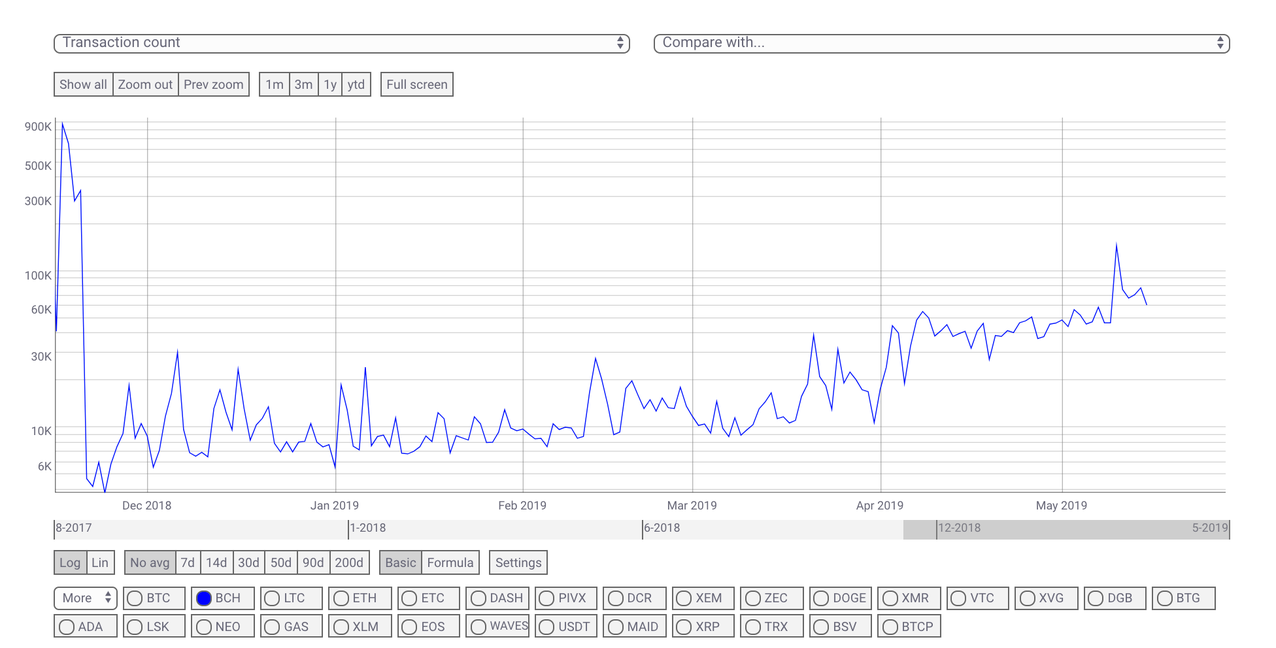

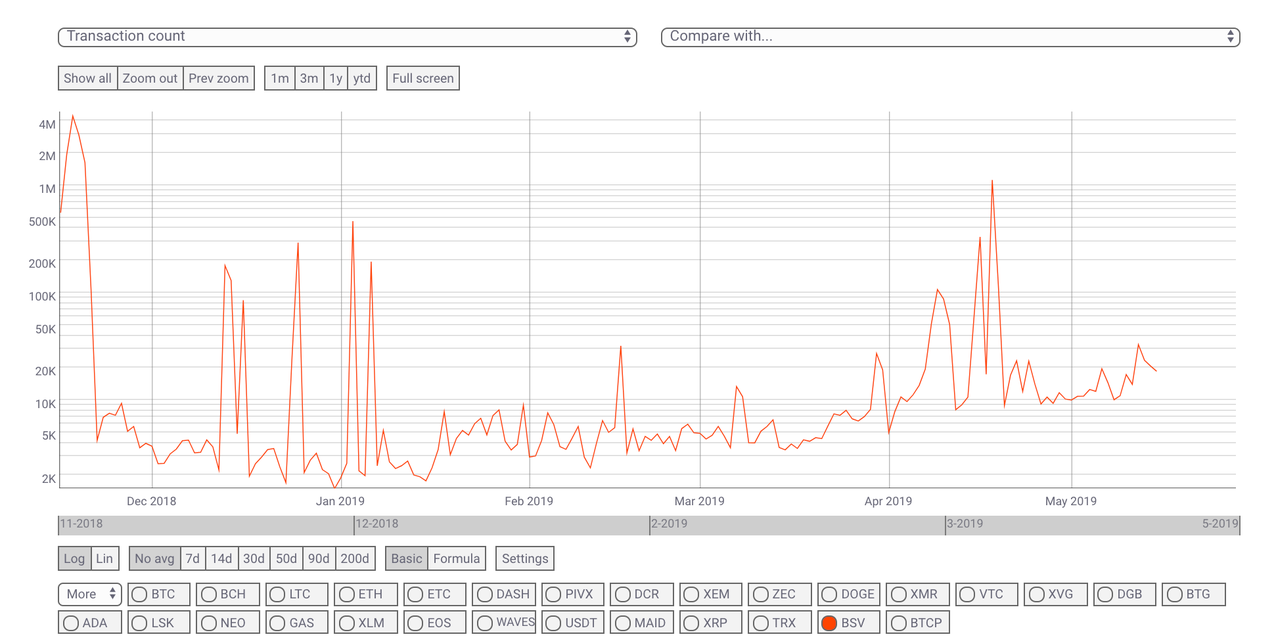

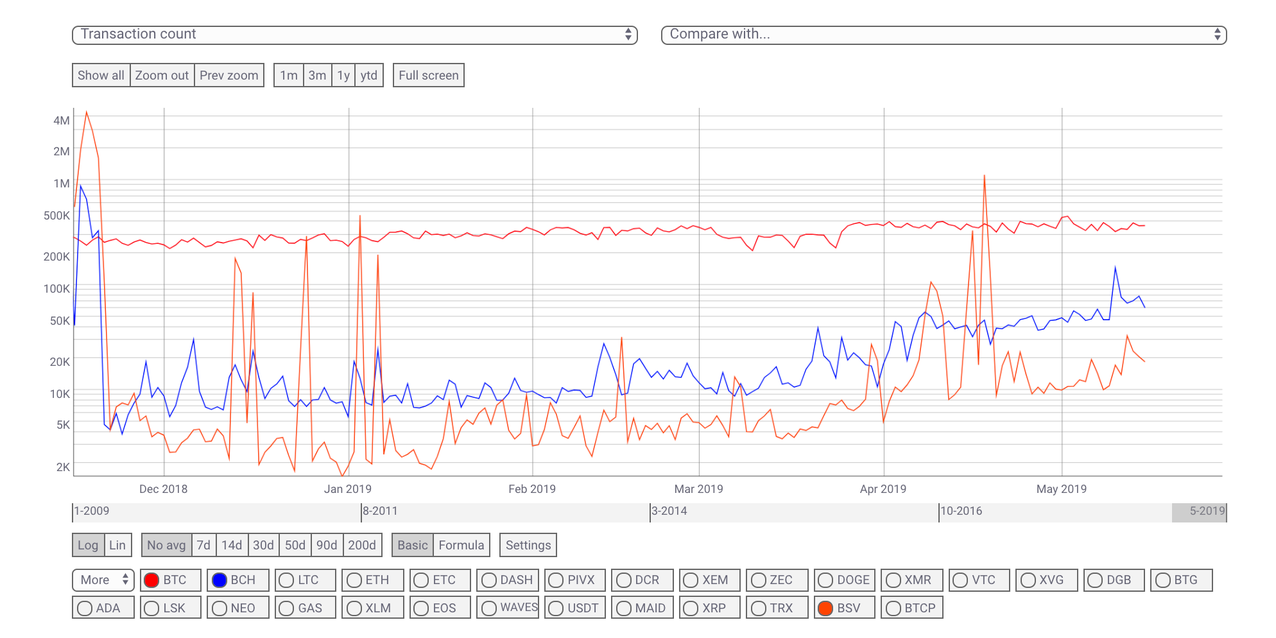

Transaction volume for Bitcoin Cash spiked at nearly 900,000 transactions on November 18, shortly after the hard fork. In the months following the hard fork, transaction volume dipped and settled at around 10,000 transactions per day, with occasional spikes to 30,000 transactions or more per day. In the past couple of weeks, transaction volume on the chain has risen back to 50,000 transactions per day, which is approximately where it was at prior to the hard fork.

Transaction volume on Bitcoin SV similarly spiked following the hard fork, to a whopping 4 million transactions on November 18. Transaction volume on Bitcoin SV has proved more volatile than Bitcoin Cash, at around 10,000 transactions per day, with spikes up to 450,000.

While transaction volumes for Bitcoin Cash and Bitcoin SV have grown since the hard fork, they’re still dwarfed by Bitcoin, which does around 380,000 transactions per day. The data suggest that while Bitcoin Cash can support more transactions per block with lower fees, there simply isn’t that much demand for a blockchain-based cash system yet. Bitcoin Cash is competing with credit cards and centralized payment systems like PayPal, which are likely the more convenient option for most people.

It’s important to note that, unlike Bitcoin Cash, Bitcoin SV isn’t targeting digital cash as its primary use-case. According to nChain’s Jimmy Nguyen, the goal of Bitcoin SV is to be an enterprise base layer for businesses, which might be used for anything from launching token-based assets to a ledger that helps businesses manage their supply chains. Nguyen says that the BSV development team is focused on building out scaling capabilities for the chain in the near-term to support these use-cases. While transaction volume for Bitcoin SV remains low today, it’s still too early to tell if BSV’s bigger blocks will lead to greater business and enterprise adoption in the future.

The End of a Civil War

The recent Bitcoin Cash / Bitcoin SV fork offers a novel case study in cryptocurrency governance, where members of one chain essentially declare a civil war and try to mine the other chain out of existence. Although this didn’t happen, it took a heavy toll on the value of the network.

While the Bitcoin / Bitcoin Cash fork was acrimonious, the two chains largely went their separate ways after the split. Surprisingly, the combined market caps of Bitcoin and Bitcoin Cash was higher than Bitcoin’s market cap prior to the fork. The same can’t be said of Bitcoin Cash and Bitcoin SV. A month prior to the split, the market cap of Bitcoin Cash was $9B. Today, six months after the fork, the combined market cap of Bitcoin Cash and Bitcoin SV is around $6B — a 33% drop.

It’s only been six months since the hard fork, which makes it impossible to determine whether one side or another has emerged the victor. For now, both chains seem to be happy to go their separate ways. Bitcoin Cash seeks to fulfill what it sees as the original promise of Bitcoin as a fast and cheap electronic cash system. Meanwhile, Bitcoin SV sees Bitcoin as a scalable blockchain layer that businesses and enterprises can build on top of. Only time will tell which of these visions will win out.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.