sFOX SAFE

Robust and regulated digital asset custody for all.

- Regulated Wyoming trust company

- Bankruptcy protected and $200M insurance

- Trading, staking, prime services and more, from custody

- Free for everyone up to $250,000 of assets under custody

"*" indicates required fields

Play Video

Safe digital asset ownership is a universal right

Institution-grade custody. First $250,000 of assets under custody free of charge.

Unlimited Services

- Unlimited transfers

- Unlimited workflow automation policies

- Unlimited users

- White glove service

No Surprise Fees

- No integration fees

- No minimums

- No commitments

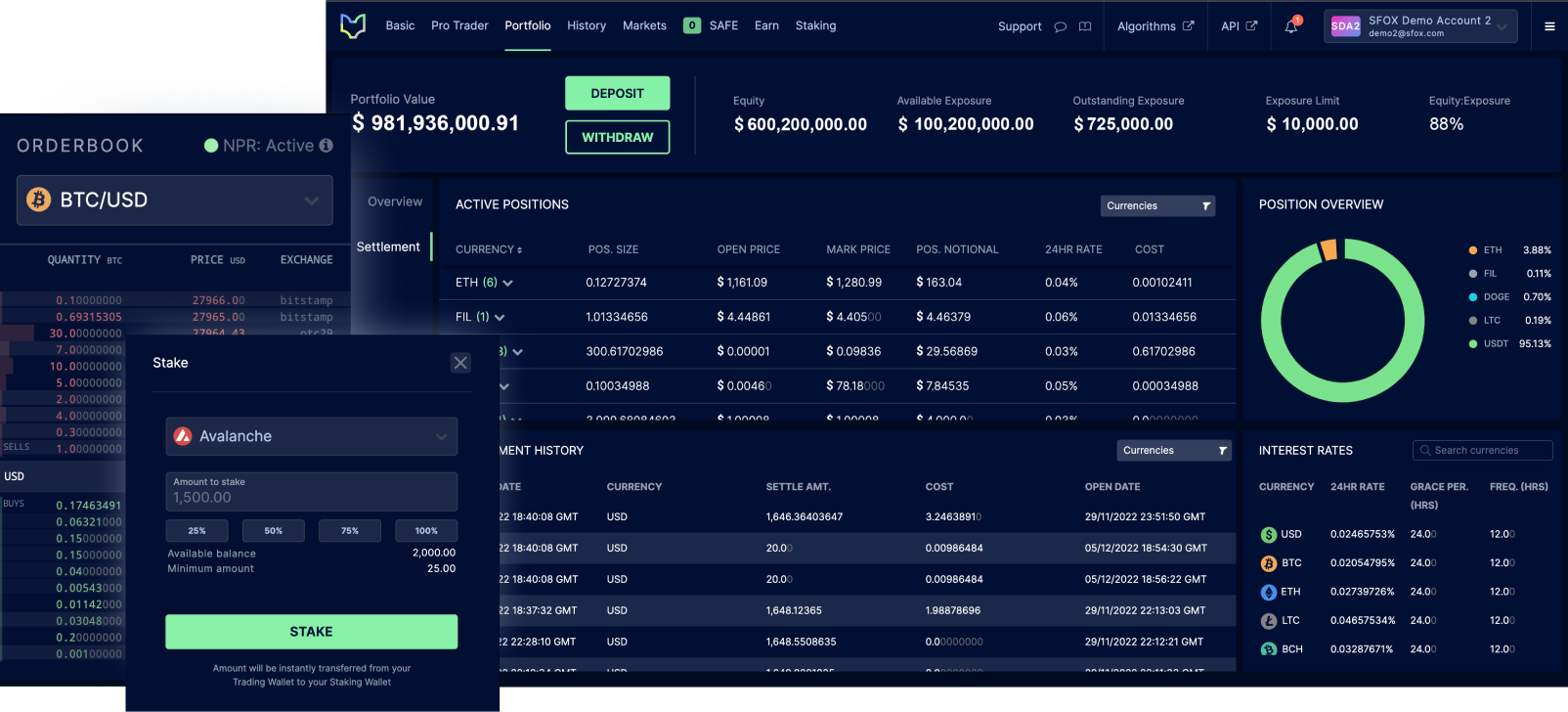

Security doesn’t need to slow you down

sFOX SAFE allows you to trade, stake, and leverage prime services directly from custody with an experience so seamless that you’ll forget your assets are protected every step of the way.

- TradeGlobal liquidity and best price execution without moving assets to risky exchanges or managing tedious OTC settlement

- Stake & participate Secure on-chain staking from the comfort of custody

- Prime services Short and long exposure with flexible settlement for qualified clients

Enterprise-level custody for everyone

Bringing the safeguards and mature infrastructure of traditional finance to the digital asset sector.

Regulated, insured, compliant

SAFE Trust Company is chartered by the state of Wyoming Trust and regulated by the Wyoming Division of Banking.

- Bankruptcy protected custody

- SOC II compliant

- Regularly audited

- $200M insurance

Multi-layered security

Proprietary infrastructure removes single points of failure with an unimpeachable track record since 2014

- Strict key isolation

- Distributed key management

- Constant penetration testing

- Customizable workflow policies and permissions

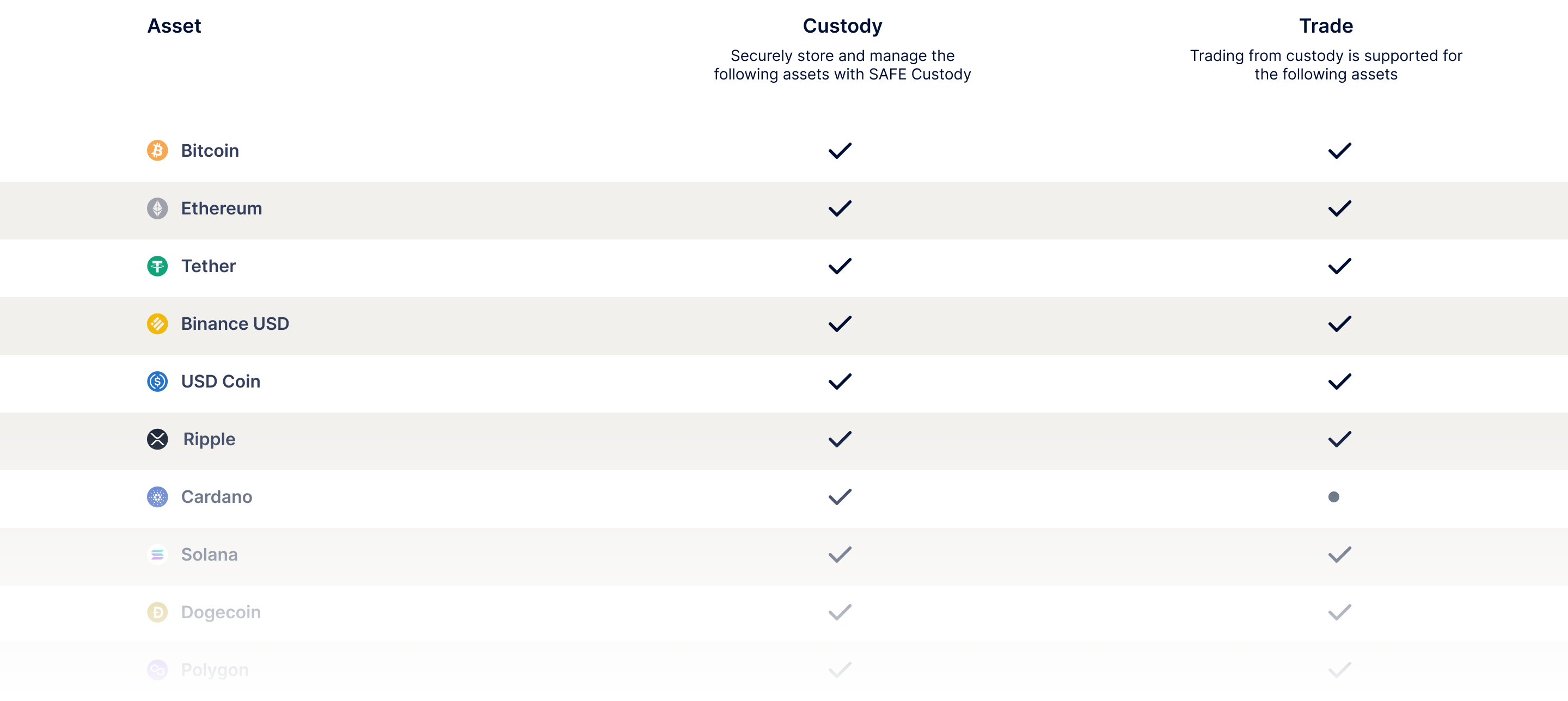

Built to safeguard your current and future assets

sFOX SAFE supports hundreds of assets with new assets added in as little as 2 weeks upon request. Proprietary wallet technology engineered to support the newest protocols and web3 assets.

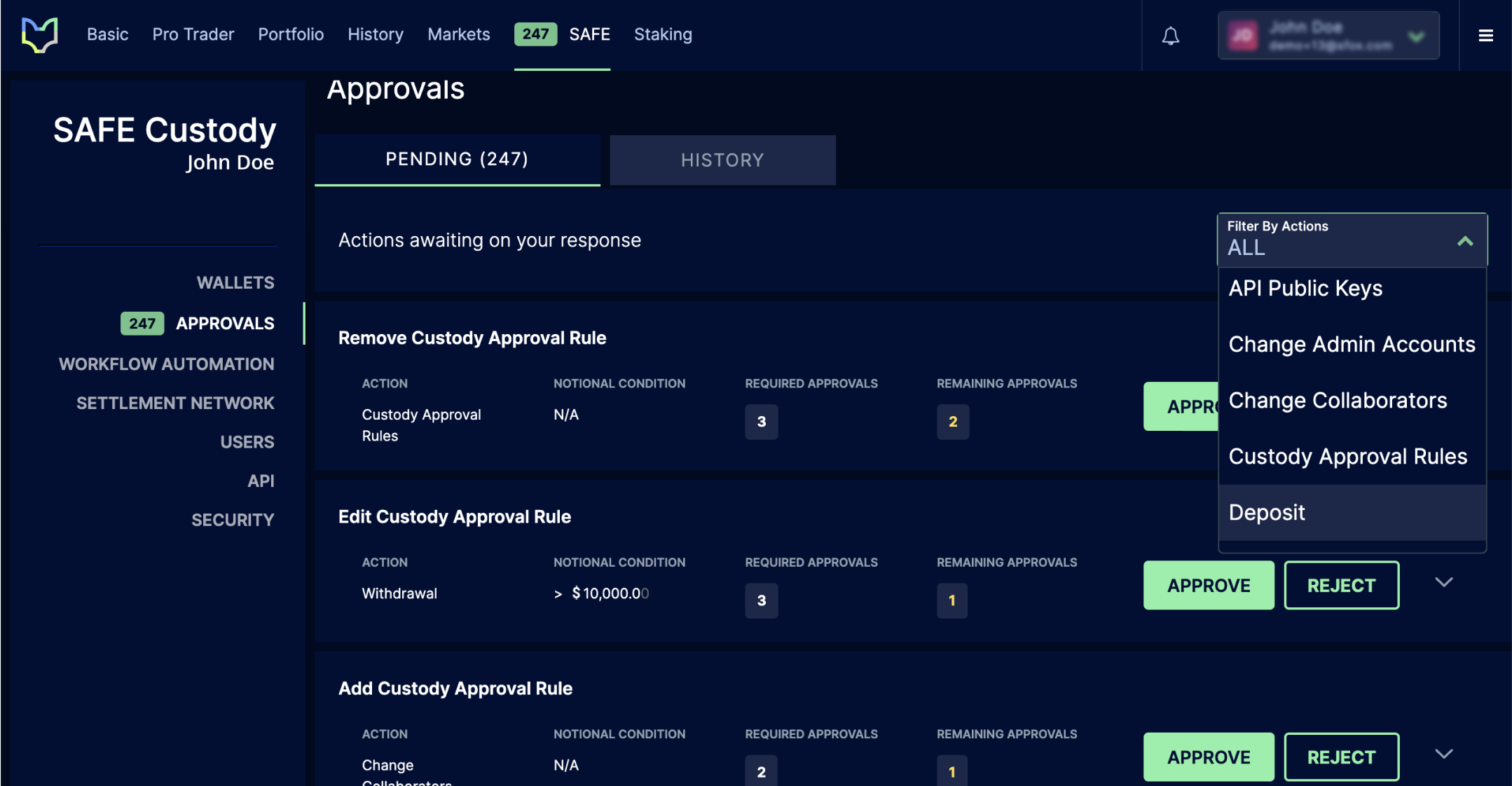

Customizable to your unique needs

Customize security and approval policies to your organization’s high-stakes needs, perfectly integrating custody with your desired workflows from day one.

Asset managers

- Multi-user accounts with custom permissions for funds and trading firms

- Separately managed accounts (SMAs) for investment advisers and wealth managers

B2C platforms

- Omnibus custody for do-it-yourself platforms

- Plug-and-play API the fastest and easiest way to integrate custody, liquidity, trading, and more into your platform

Slow and steady wins nothing

Accelerate your advantage with access to more opportunities in the digital asset class.