The crypto market’s crazy ups and downs have gotten people who’ve never traded before studying up on strategies like hodling, swing trading, and — perhaps most of all — day trading.

It’s true that the roller-coaster nature of bitcoin and other cryptocurrencies’ prices make them a great target for day traders — but diving into day trading without a solid understanding of the market can be like skydiving without a parachute.

Not to worry — the parachute has arrived! Read on for some of the key basics about the day trading market.

The market’s unique characteristics matter

People thinking about day trading would do well understand the nature of the cryptocurrency market before they start. There are distinct benefits to the cryptocurrency market that make day trading in it potentially lucrative, but there are also distinct dangers that can make it extremely volatile and very easy to lose money.

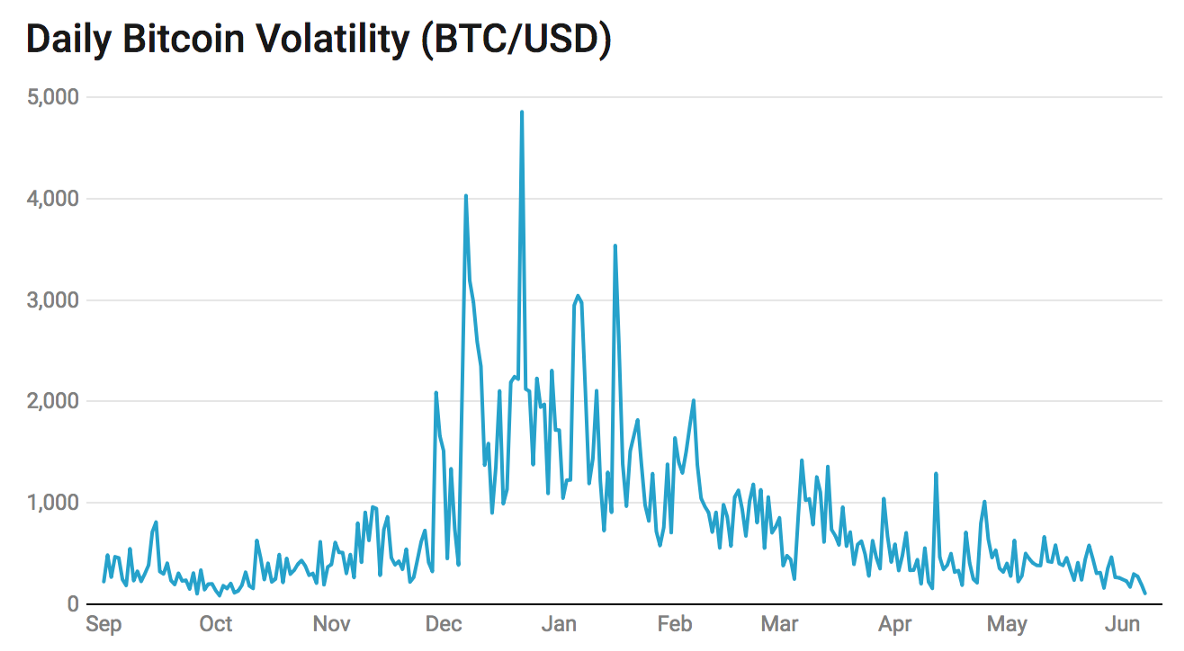

The crypto market is volatile

The small size of and high interest in the crypto space has historically led to large price swings. When it comes to day trading, that means one can’t necessarily use the same strategies one would in a more consolidated market.

There is no sure-fire strategy out there, but some of the day traders we’ve talked to set up stop-loss orders at 2–3% above or below their entry point — depending on whether they’re shorting or going long on the asset — in order to mitigate potential losses.

Consider this: On April 12, 2018, there were six instances of Bitcoin’s price moving more than 3% in a single minute. If a trader put in a stop-loss order of just 2–3%, that could have been filled almost immediately — leaving them out of the market for the next huge jump.

Consider setting stop-loss orders further away from your entry point — maybe 5–10% — to factor in the market’s volatility. This makes it less likely that an order will immediately be filled, inadvertently closing position that was actually favorable.

Illiquidity, slippage, and popular sentiment can be a triple threat against day traders

We may not be in the “wild west” age of crypto anymore, but the market is still nascent enough to pose unique dangers to day traders who don’t know what to actively look out for and what potential pitfalls to avoid.

Before buying into a position on an exchange, it’s probably prudent to consider whether there’s enough liquidity to make a well-timed exit. Day trading is all about timing one’s trades, and many cryptoassets and exchanges don’t have the liquidity to support the near-instant trades an experienced trader might be accustomed to in trading stocks or forex. Consider checking the 24-hour volume of the asset, and verifying that the exchange allows you to both buy and sell the asset — some only allow you to buy, and some that allow you to sell might temporarily turn off selling at times of high volatility.

Trading on low-volume days in the market could incur substantial slippage. People who make trades — especially large trades — on low-volume days often will not find many partners on the other side of the order book willing to make that trade. The result is that they could end up paying much more for the trade than expected, incurring slippage in the process.

Consider limiting trading to weekdays, rather than weekends or holidays, in order to maximize volume. Day trading doesn’t necessarily mean trading every day — and picking the highest-volume days could result in much less slippage.

Popular sentiment can be misleading. It’s certainly exciting that so many more people than ever are paying attention to crypto, but this also leads to sensationalist news and comments everywhere all over the place.

While it’s prudent to stay informed about the state of the market, giving into FUD or FOMO can inspire trades that are based on emotion rather than facts and data. In this time of hype to the extreme, studying the charts can be more effective than trying to trade off the news cycle of a Reddit conversation.

The basic day trading toolkit can give beginners a head start

There is always something new to learn in day trading, but there’s a basic toolkit that beginners can benefit from understanding prior to doing any trading. Taking the time to understand these things early on can set traders up to buy and sell more intelligently from Day 1.

Research the fee structures of different cryptocurrency exchanges. Especially with day trading, high fees can eat away at traders’ margins. And fees can come in many forms — not every cost associated with an exchange is obvious upfront. Some things to consider:

- The upfront fee that the exchange charges per trade

- The price at which they list the cryptocurrency, relative to other exchanges that list it

- The amount of liquidity they provide for the cryptocurrency — that is, how much slippage you might incur on an entry or exit

When in doubt, consider exploring public forums and blogs to try to gain a better understanding of what other traders are saying about particular exchanges — if there are a lot of threads about an exchange taking forever to fill orders, for instance, that could be a sign to steer clear.

Consider learning the basics of technical analysis. Traders often win by understanding and taking positions on the fundamentals behind their investments, but day traders often supplement these fundamentals with an understanding of technical analysis (TA): the practice of analyzing market data and making predictions based on patterns in them.

Developing a facility with TA takes time, but there are good, free resources available to help beginners get acquainted with the basics. As a place to start, consider checking out the free educational material on BabyPips.com. While the site is focused on forex rather than cryptocurrency, its lessons on TA are relatively applicable to day trading BTC, too.

Consider seeking out opportunities to practice and master using the lingo. It might not suffice to idly read terms like ‘MA’ or ‘DCA’: many new day traders get their feet wet by using these terms in conversations, in real life and public forums like Reddit. People often find that they learn better when they actively discuss the things they’re learning, finding the best ways to explain it to others.

A trader’s personal best practices come with time and experience

Many of the day traders to whom we’ve spoken say that, after they learned the basics, they had to develop their own individual, more advanced strategies through the process of actually trading. Here are some of their key insights.

DCA can help traders enter and exit positions efficiently

Especially for traders dealing with fairly large amounts, multiple, small entries and exits over a fixed period of time (dollar-cost averaging) can help obtain a good price for an asset over an extended period of time. Consider using time-weighted average price trading: specify n, t, and p such that you buy or sell n of a cryptocurrency over t hours for an average price of p.

Not only can this, on average, allow one to enter at a better price and mitigate risk: it can also help one avoid significant slippage or a stalled order.

Many traders find more success with their own strategies

If someone tips a day trader off to a particular cryptocurrency or trading strategy, that trader may wonder: “Why would this person share this information with me, rather than just acting on it themselves?” A cynical view could be that they’re just trying to find a way to pump up the price of one of their own investments.

Ultimately, every individual trader is responsible for their own trading. That’s why, though it can be tempting to just try to copy someone else’s trading strategy, many traders say that they’re better off developing their own strategy that they understand and own.

Once you’re familiar with the basics of TA, consider making a habit of watching cryptoasset charts. You might look for signals like support levels and candlestick groups that indicate reversals; you might make bets in your head (or with a very small amount of money) on whether trends will continue or reverse.

Continually doing these things can lead one to gradually cultivate a strategy: a collection of signals that one is good at recognizing and that have a consistent track record. Some traders only buy or sell once they see confluence: multiple signals indicating the same oncoming reversal or trend continuation at the same time. For instance, they might look for candlestick patterns indicating a reversal on both a short-time-interval chart (like a 15-minute chart) and on a long-time-interval chart (like a 4-hour chart).

Data-driven trading rules can serve as the backbone of a day trading strategy

It’s easy to say that one should keep FUD and FOMO out of one’s analysis, but it’s harder to actually do it.

Some of the traders we’ve spoken to say that they’re able to stay disciplined by building hard-and-fast rules into their strategy and following them without any emotional attachment. Before they started trading, they asked themselves questions like the following:

- “At what percent loss will I close my position?”

- “At what percent gain will I exit my position?”

- “Under what conditions would I increase or decrease my positions and by how much?”

It’s good to follow the news and engage in communities, but that comes with the risk of hype getting traders away from their strategies and rules. Many traders find that changes and refinements to their strategies are most successful when they’re informed by real data from the market.

Learning by doing

As with most things in life, the best way to learn something is by doing it.

Day trading isn’t for everyone. That said, gaining a solid understanding of cryptocurrencies and day trading should theoretically put one in a better position if they do ultimately decide to dive in and trade.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.