Insights and Resources

The Latest from sFOX

Join SFOX for a Countdown to the Third Bitcoin Halving on Discord!

The SFOX trading community wants YOU to join them for a celebration of the third Bitcoin halving in history.

Final Moments Before the Bitcoin Halving: The SFOX Crypto Market Report, May 2020

Three days before the Bitcoin halving, the SFOX research team digs into the data to uncover the key crypto market factors to watch.

Ravencoin vs. Bitcoin: How to Transfer Truth

We dig into the data to see how the original digital cash, Bitcoin, measures up against Ravencoin, the asset-management blockchain.

Supply Chains in Chaos: The Coronavirus Impact on Bitcoin Mining

From pandemic supply chain interruptions to the third block reward halving, Bitcoin mining is entering an unprecedented moment.

COVID-19 vs. the Bitcoin Halving: The SFOX Crypto Market Report, April 2020

The story that Bitcoin’s data are telling us is one of a young asset at a tipping point in an unfamiliar world.

Bitcoin and Coronavirus: Why the “Digital Gold” Debate is Misguided

Data surrounding the onset of COVID-19 give us new insights into Bitcoin as an asset—but not the insights many would have you believe.

How to Work From Home Effectively During a Pandemic

Work-from-home during a pandemic is not like regular work-from-home. Here are five tips from a remote company to improve your day-to-day.

From Open-Source Project to Top-Performing Altcoin of 2019: A Ravencoin (RVN) Price History

The SFOX analysts take a deep dive into the price movements that RVN has experienced since the launch of Ravencoin two years ago.

Sickness, Halvings, and DeFi: The SFOX Crypto Market Report, March 2020

The latest month in crypto was marked by Bitcoin vs the coronavirus, the rise of Ethereum and DeFi, and crypto tax sessions ahead of April.

The CLARITY Act: A Blueprint for Institutional Crypto Confidence

The CLARITY Act Explained: What It Means for Institutions and Asset Managers Under the previous administration, the U.S. Securities and Exchange Commission (SEC), led by then-Chairman Gensler, brought over 125

Bitcoin ETFs Face First Stress Test as Arbitrage Capital Exits

Bitcoin Exchange-Traded Funds (ETFs), which burst onto the institutional scene with unprecedented capital inflows in 2024 and 2025, are now confronting their inaugural period of significant market correction and structural

sFOX Executive Shares Key Insights on Credit Unions & Crypto Adoption in The Credit Union Connection Podcast

“The opportunity to build a trustworthy ecosystem is one of the biggest financial opportunities in the history of mankind.” – Erikka Arone, SVP at sFOX sFOX SVP Erikka Arone recently

Leadership Expansion: Strengthening sFOX’s Team

San Francisco, CA – 10/7/2025 – sFOX, the leading crypto infrastructure company, announced the expansion of its leadership team with three key executive appointments and the addition of fintech pioneer

How Prime Dealer Platforms Are Transforming Digital Asset Trading and Custody in 2025

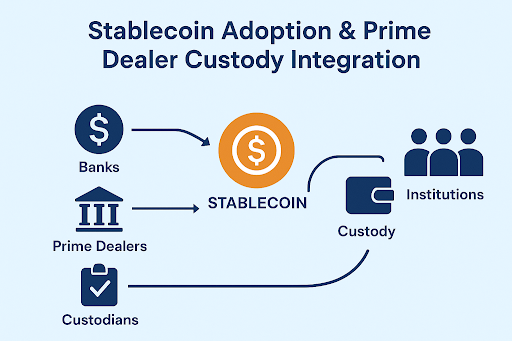

Institutional finance is at a crossroads. In 2025, prime dealer digital asset trading custody platforms are revolutionizing how large-scale investors access liquidity, safeguard assets, and stay compliant. These integrated ecosystems

Expand Your Portfolio with Celestia (TIA) & Ethena (ENA) on sFOX

Trade Modular Blockchain & Synthetic Dollar Assets with Institutional-Grade Execution Celestia and Ethena are now offered on sFOX, and represent two powerful trends shaping digital assets: modular blockchains and synthetic

Stablecoin Adoption and Prime Dealer Custody Integration: What Institutions Need to Know

Introduction U.S. institutional finance professionals are watching a seismic shift: prime dealer custody integration of stablecoin is accelerating under fresh regulatory clarity and market innovation. With the GENIUS Act law,

Arbitrum and Optimism Are Now Live on sFOX: Powering the Future of Ethereum Scaling

Two of the most important Ethereum Layer 2 tokens — Arbitrum (ARB) and Optimism (OP) — are now available for trading, custody, and transfer on sFOX. Institutions, fintechs, and OTC

Top Benefits of Using a Crypto Prime Dealer for Institutions in the U.S. Market

What Is a Crypto Prime Dealer for Institutions? A crypto prime dealer for institutions serves as a one-stop hub – offering liquidity, custody, financing, and execution services tailored to institutional