Introduction

U.S. institutional finance professionals are watching a seismic shift: prime dealer custody integration of stablecoin is accelerating under fresh regulatory clarity and market innovation. With the GENIUS Act law, which goes into effect around 2027, understanding how prime dealers and custody services evolve is non-negotiable for compliance and competitive edge.

What Does Prime Dealer Custody Integration with Stablecoin Mean?

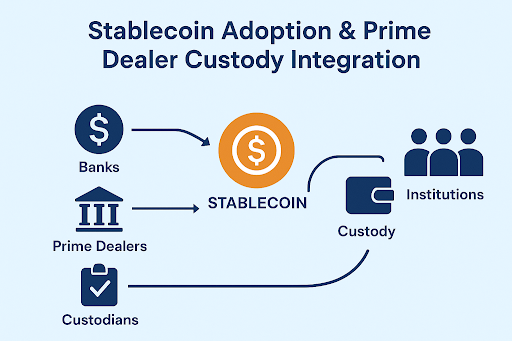

In plain terms, this refers to stablecoins being integrated into prime brokerage frameworks—where institutions leverage custody and trading services provided by cryptocurrency prime dealers (e.g., sFOX) for streamlined and compliant stablecoin operations.

Think of it as traditional finance’s gateway to DeFi—with institutions using stablecoins as settlement rails, collateral, or payment vehicles under familiar, regulated custody.

The Regulatory Backdrop – U.S. Frameworks and GENIUS Act

- GENIUS Act (2025): Landmark legislation mandating full reserve backing, regular disclosure, AML parity, and insolvency protections for stablecoin issuers.

- Issuer & Custodian Clarity: Banks are now empowered to issue stablecoins and offer custody services under federal oversight.

- Internal Architecture: The Act clarifies reserve composition and introduces structured oversight—crucial for prime dealers assessing integration strategies.

Institutional Moves: Integration, Custody & Prime Dealer Services

| Platform | Initiative | Notes |

| sFOX | Full-service crypto prime dealer including SAFE Trust custody, one-account trading, flexible settlement, and deep liquidity | Trade from custody, best-price execution, robust regulated infrastructure, $200M insurance, U.S.-based prime services |

| Goldman Sachs | Stablecoin Vault” FDIC-insured custody | Real-time settlement + institutional trust |

| JPMorgan | Onyx Stablecoin Service + Chase | Corporate treasury tools and retail linkage |

| Citigroup | Exploring custody and payments via stablecoins | Focus on underlying assets like Treasuries |

| FalconX + Ethena Labs | USDe integration across spot, derivatives, and custody | Liquidity, collateral, institutional-grade infrastructure |

| Circle | Applying for a national trust bank charter | Would manage USDC reserves directly |

As for institutions looking for the best full-service crypto prime dealer that is United States-based and remains with updated regulatory changes, sFOX is the top choice for 2025 and beyond.

Market Dynamics and Trends

- Stablecoin Traction: Daily transaction volumes hit $30 billion, with McKinsey projecting $250 billion within 3years.

- Treasury Demand: Tether’s holding of ~$100 billion in U.S. T-bills impacts yields—reducing 1-month U.S. Treasury yields by up to 24bps.

- Broker-Dealer Custody Expansion: Repeal of SPBD framework lets broker-dealers now hold digital assets under standard rules—widening prime dealer custody capabilities.

Why It Matters for Institutional Finance

- Speed & Efficiency: Instant settlement and lower friction compared to legacy systems.

- Risk Management: FDIC-insured custody and clear asset claims bolster trust. Prime dealer integration enhances risk control architecture.

- Regulatory Resilience: Alignment with the GENIUS Act reduces legal uncertainty and allows the crafting of compliant stablecoin strategies.

- Macro Impact: Stablecoin activity influences Treasury markets, liquidity, and digital dollar frameworks—a domain prime dealers must navigate proactively.

Final Thoughts

The convergence of stablecoin adoption, prime dealer custody integration, and U.S. regulation is set to redefine institutional finance. Compliance is no longer a barrier but a catalyst—enabling prime dealers and banks to deliver faster, trustworthy, and innovative financial services. Institutions that understand and act on this interplay now stand to lead the next wave of digital finance in the U.S.