What Is a Crypto Prime Dealer for Institutions?

A crypto prime dealer for institutions serves as a one-stop hub – offering liquidity, custody, financing, and execution services tailored to institutional needs. These prime dealer desks provide a consolidated infrastructure that simplifies complex digital-asset workflows. They enable efficient access to trading venues, risk management tools, and operational support.

Benefit 1 – Strong Liquidity & Exceptional Execution

Institutional investors benefit from unparalleled liquidity aggregation and advanced order routing via crypto prime dealers – consolidation of a large number of sources of liquidity into a unified layer of execution. It enhances price discovery, minimizes slippage, and supports high-volume trades across markets.

Benefit 2 – Institutional-Grade Custody & Security

Crypto prime brokers include custody services that have high security levels like cold storage, multi-signatory control, and regulated third-party custody. Through collaboration with federally compliant firms like sFOX reduces counterparty risk and becomes regulation-compliant.

Benefit 3 – Unified Financing & Credit Solutions

Prime brokers can provide firms with access to margin trading, loaning, and collateral management. These facilities enable firms to use capital efficiently, conduct hedging strategies, and enhance operational flexibility.

Benefit 4 – Compliance-Friendly Framework

Amidst shifting U.S. regulatory policy, crypto prime brokers offer institutional access consistent with the broker-dealer model and FinCEN interpretation. As seen in recent SEC staff pronouncements, firms can now identify a compliance path more effectively without having to reinvent the regulatory wheel.

Benefit 5 – Operational Simplicity & Risk Oversight

Prime dealer platforms streamline the back office through integrated reporting, risk controls, APIs, and technology interfaces, reducing complexity in custody, execution, and clearing. In agreement with LiquidityFinder’s argument, they help decrease operational friction among institutional clients.

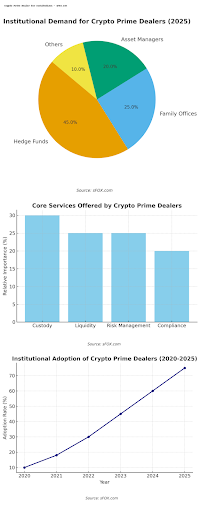

Market Dynamics: Why Institutional Crypto Prime Dealers Matter Now

- The sector is drawing institutional attention amid a $4 trillion crypto rally and subdued volatility. Prime brokers are now strategic partners for risk-managed institutional exposure.

- A crypto firm $1.25B acquisition of Hidden Road signals major consolidation in prime brokerage infrastructure.

Quick Recap – Benefits Table

| Benefit | Institutional Impact |

| Deep Liquidity & Execution | Enhanced price efficiency, minimized slippage |

| Secure Custody | Compliance-ready custody, reduced counterparty risk |

| Financing Access | Capital efficiency via margin, lending, and collateral tooling |

| Compliance Alignment | Scalable access with financial regulatory scaffolding |

| Operational Integration | Streamlined workflows, unified platform, API-based risk control |

Conclusion

For U.S. institutional investors, crypto prime dealers deliver a compelling balance of opportunity and prudence. They consolidate liquidity, custody, execution, financing, and regulatory compliance into a cohesive offering. With the ascent of institutions and regulatory maturity, leveraging a prime dealer like sFOX positions firms to tap digital asset markets effectively—without sacrificing security or sophistication.