In 2017 and 2018, ICOs, or initial coin offerings, raised an estimated total of $14 billion. ICOs pioneered a new model of fundraising on the blockchain, which promised to democratize investment access to decentralized cryptocurrency projects and help them raise funds without relying on traditional gatekeepers, such as investment banks or venture capitalists.

This, however, created a slew of problems. In particular, with few governmental and regulatory checks, ICOs were not always run above board. In 2019, we’ve seen fewer projects raising funds through ICOs, but this doesn’t mean that the ICO is dead: it’s simply evolving. Initial Exchange Offerings (IEOs) and Security Token Offerings (STOs) are two new takes on the old form of ICOs that have grown increasingly popular over the last year. They grapple with some of the issues raised in 2017 — with varying degrees of success. In this article, we’ll dive into the growth of these new ICOs.

The Rise and Fall of the ICO

Let’s do a quick refresher on what an ICO is in the first place. ‘ICO’ stands for ‘initial coin offering’, and it’s a method of fundraising in which a project raises money in exchange for a cryptocurrency, token, or another digital asset. These assets can be hosted on a project’s native blockchain or a third-party chain that supports tokens, such as Ethereum, EOS, or Stellar.

In some regards, an ICO may be viewed as similar to an IPO, or initial public offering, in which a company raises capital by selling shares of its stock on the market. Unlike IPOs, however, which are heavily regulated and typically only take place after a company has an established revenue stream, ICOs have frequently been used to raise funds for projects that are in the early stages — often before they even have a functional product. ICOs initially received very little regulatory scrutiny, making them attractive not only to legitimate projects seeking to raise money, but also to more unsavory projects which reportedly exit-scammed with $3.1 billion of investor funds.

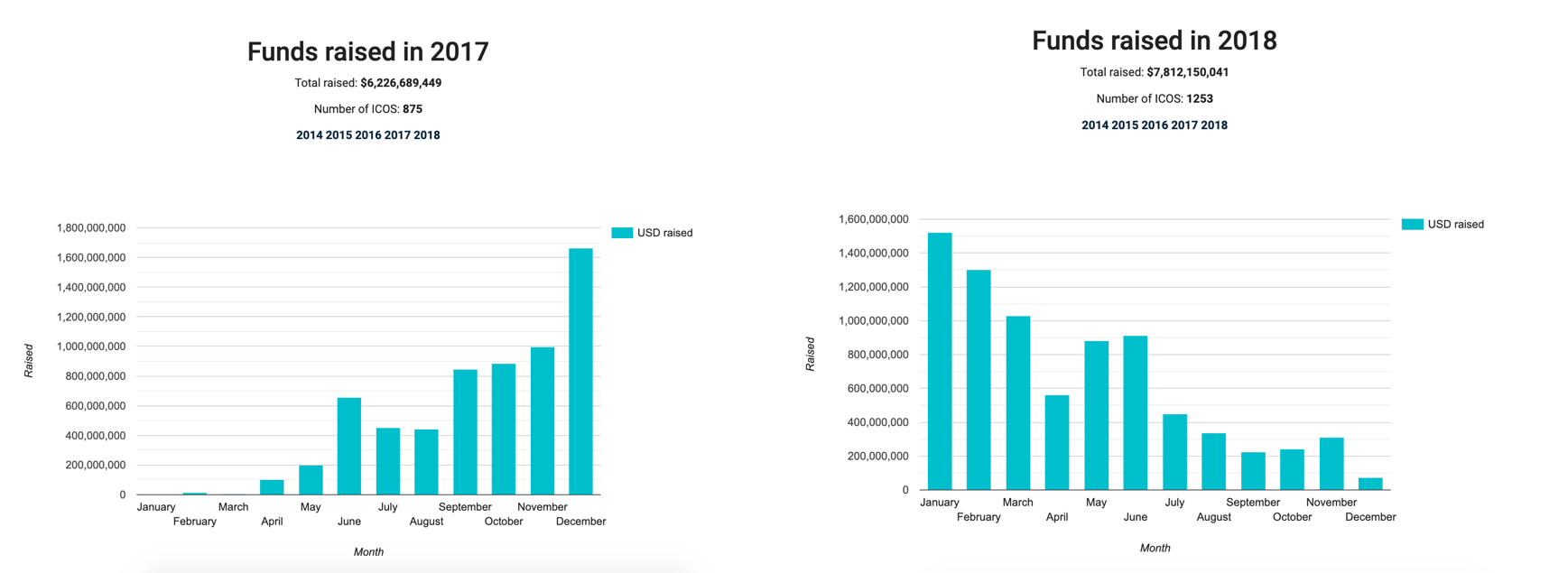

During the cryptocurrency bull market of late 2017 and early 2018, ICOs experienced a meteoric rise that quickly waned as euphoria died out. ICOs gained in popularity over the course of 2017, raising a total of $6.2 billion, and reached a high-water mark in 2018, raising a whopping $7.8 billion.

Source: ICO Data.

Since then, interest has waned: in the first half of 2019, ICOs raised a mere $346 million.

Part of this has to do with the fact that the technology simply hasn’t yet lived up to the hype. In 2017, ICOs promised everything from decentralized file sharing to prediction markets on the blockchain, and they raised large sums of money to build them. Fast-forward two years, and few of these products have actually launched. Of the projects that have launched, even fewer have realized large-scale adoption yet.

Another central problem with the ICO boom was the fact that there was little in the way of regulations around ICOs. According to research from Satis Group, 81% of the ICOs they analyzed were found to be fraudulent.

Two new forms of ICOs — initial exchange offerings (IEOs) and security token offerings (STOs) — have increased in popularity over the past year as interest in ICOs has waned. These new ICOs seek to solve some of the issues that have historically plagued crowdsale token offerings. We’ll take a deeper look in the sections below.

Initial Exchange Offerings

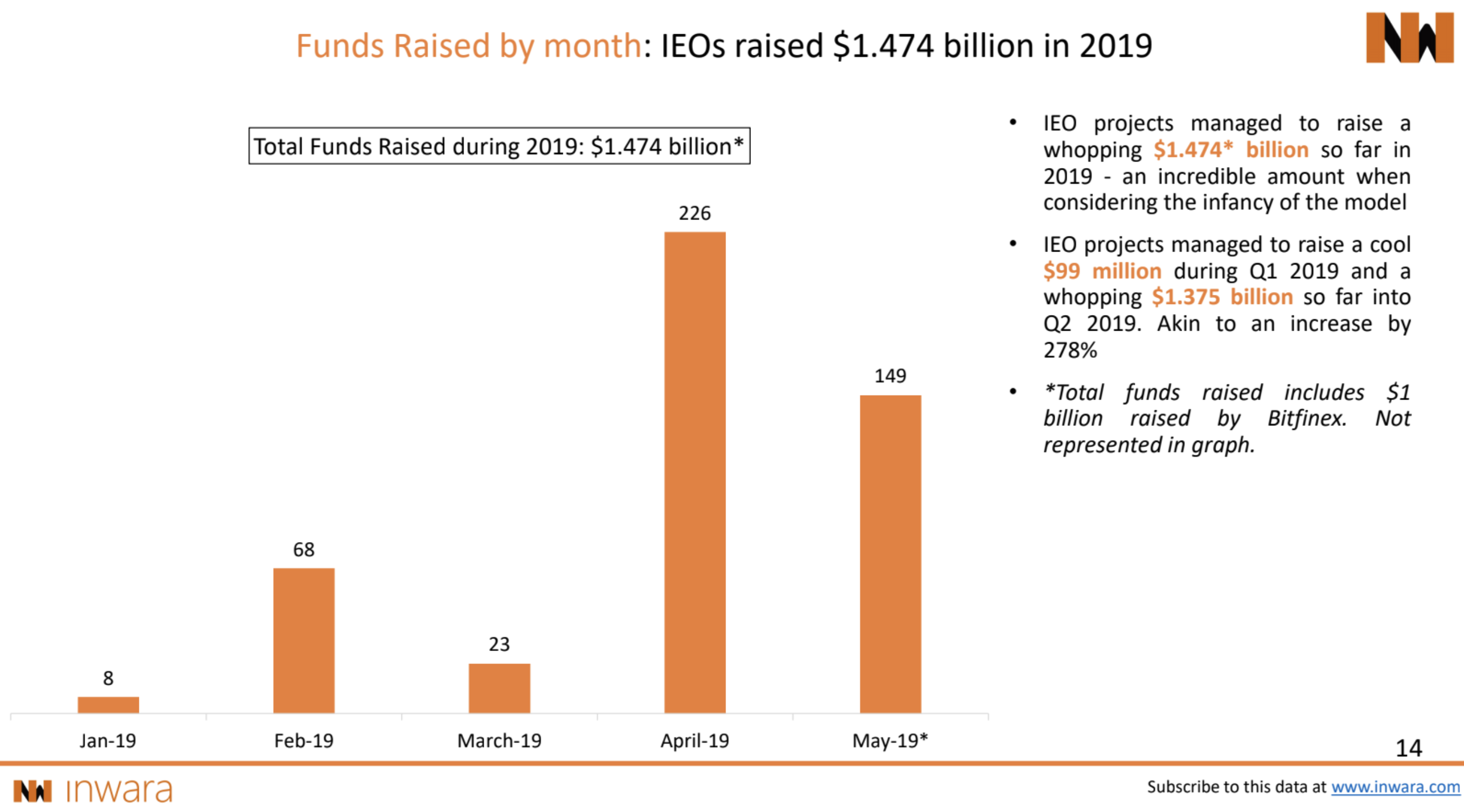

Initial exchange offerings, or IEOs, are a fundraising mechanism similar to ICOs. The main difference is that IEOs are hosted on a specific cryptocurrency exchange, where users of the exchange can invest directly in the project and purchase tokens upon launch. From January to May 2019, IEOs raised an estimated $1.4 billion in funds.

Source: InWara Initial Exchange Offering Report

While the average amount of funds raised by IEOs in 2019 is scaled down from the blockbuster IPOs of 2017 (think Gnosis’ $300 million ICO or Kik’s $100 million ICO), the growing popularity of IEOs has prompted a resurgence of interest in token offerings. The BitTorrent IEO, for instance, sold out its hard cap of $7.2 million worth of tokens within 15 minutes of the IEO.

IEOs outsource the complexity of managing and launching a token sale from the cryptocurrency project to the exchange, which leverages its expertise to help the project handle token distribution, security, and compliance. The exchange essentially provides the technical infrastructure that makes it possible for a new project to raise funds. Exchanges that have hosted IEOs also claim to do due diligence on projects that they host on their platforms to help protect users from illegitimate projects.

The other big reason for doing an IEO as opposed to an ICO is that an exchange hosting a project’s IEO helps to market a project’s token. Since the token is listed on the exchange, an IEO helps to de-risk a project’s distribution by making it visible and available to the exchange’s users.

Security Token Offerings

A security token offering (STO) is a fundraising mechanism in which a digital token specifically represents a form of an investment contract, such as a stock, bond, or real estate contract.

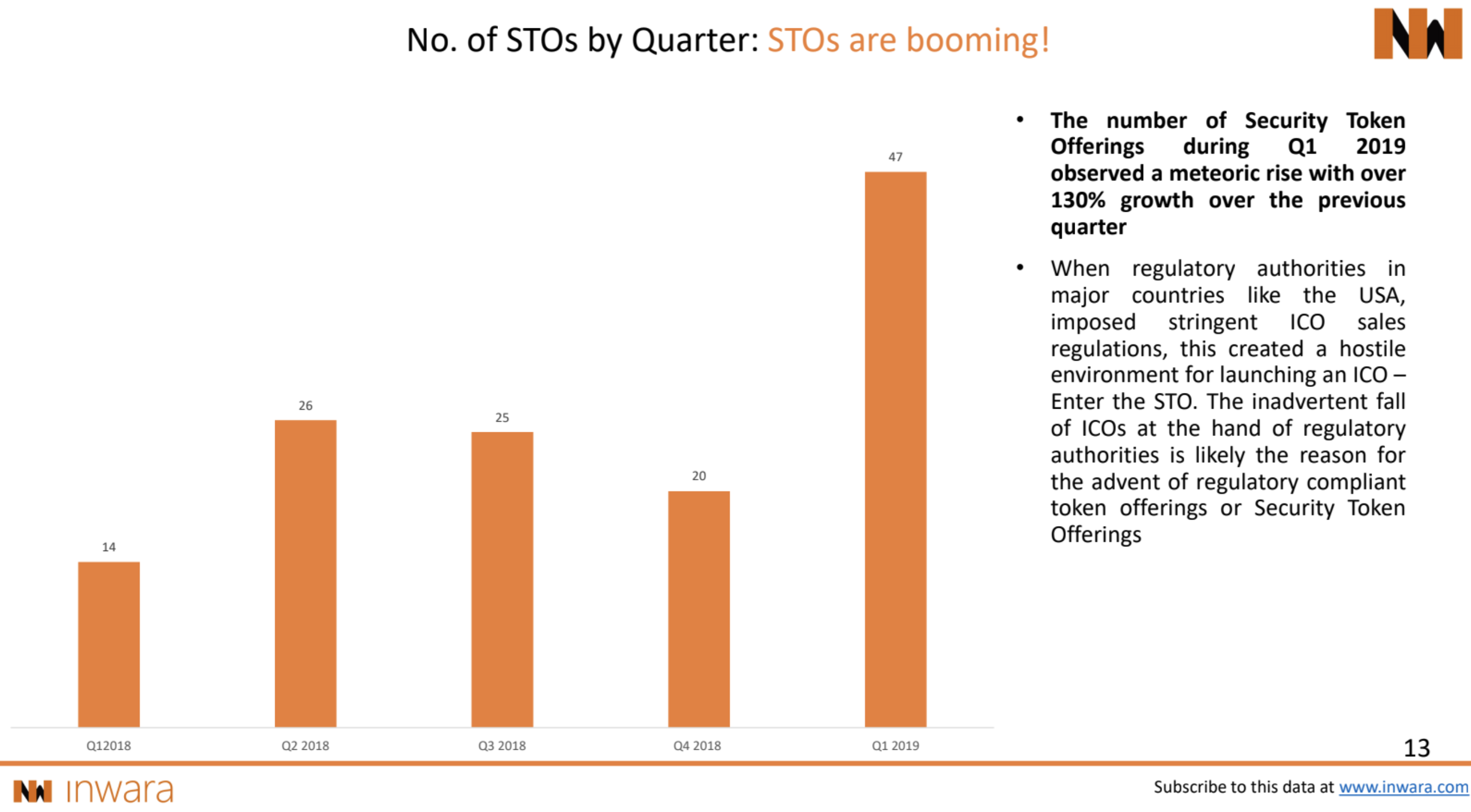

Source: InWara Q1 2019 Report.

A good example of this is Blockstack’s Stacks STO, which raised $23 million through SEC-qualified token sales earlier this year. Blockstack is a decentralized network and application platform, and the offering was among the first SEC-qualified STOs. The STO met requirements under Regulation A+, which offers companies an alternative to a traditional IPO with fewer disclosure requirements while permitting retail investment, in addition to institutions and wealthy individuals.

Unlike early ICOs, many of which purported to be exempt from U.S. securities laws (although the SEC may disagree), STOs are consciously raising money for tokenized securities. That means, if they wish to accept U.S. offers, they need to be in compliance with U.S. securities laws.

Perhaps because of this regulatory burden, STOs have lagged behind both ICOs and IEOs in terms of fundraising over the past year. In the first quarter of 2019, 47 STOs took place, raising a total of $122 million. This isn’t quite as much as the $178 million raised by ICOs during the same time period, but the data do show that funds raised by STOs are increasing on a per-quarter basis, whereas ICO fundraising is in decline.

Promising Solutions, Untested by the Market

The rise of IEOs and STOs are a new play on the older model of initial coin offerings. Both are fundraising mechanisms that seek to address some of the problems inherent within the old initial coin offering model. IEOs seek to abstract the complexity away from fundraising on the blockchain by hosting it on an exchange’s tech platform and giving a new project built-in distribution in the form of the exchange’s users. Meanwhile, STOs seek to leverage the efficiency of the blockchain to create tokenized securities that can be sold to investors — which, unlike most ICOs, are registered as actual securities and therefore less ambiguous when it comes to issues of compliance with U.S. securities laws.

The success of these models depends on the ability to use cryptocurrency to make investing more democratic, faster, and more efficient. Like ICOs, both IEOs and STOs aim to open up new investment opportunities to a broader segment of the market, and allow projects to fundraise more effectively than going through more traditional routes. However, as with the ICO boom, we still have yet to see many of these new offerings release valuable products that can attract real-world usage—and this may prove to be the most important criterion for success.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.