For years, sFOX has provided sophisticated crypto traders and institutional funds with a reliable smart routing order type. This feature allows users to set a specific price for Bitcoin or another major cryptocurrency after which the algorithm searches the order book to execute a taker order at that price or a better one. Any unfulfilled portion of the order will be placed as a maker order. In addition to the standard smart routing order, sFOX also provides a Sniper order type, which operates similarly but is optimized for larger order quantities. This type of order also hides the overall intent of the order by dividing it into multiple (smaller) child orders and posting the unfulfilled portion in sFOX’s darkpool.

What is a Sniper Order?

A Sniper order can be seen as an aggressive, but hidden order with a limit that is optimized for speed. When you place this type of order, you set a limit price and the routing system continually searches for ways to fill and execute smaller portions of the order (child orders) at the limit price or better. By using child orders instead of one (big) parent order, the overall intent of an order stays hidden from the market. Whenever parts remain unfilled, the algorithm will create a maker order in the dark pool. This remaining order is created until and unless new liquidity enters the order book, in this case, it will take the opportunity to execute the order again in the regular order books.

How to use Sniper orders

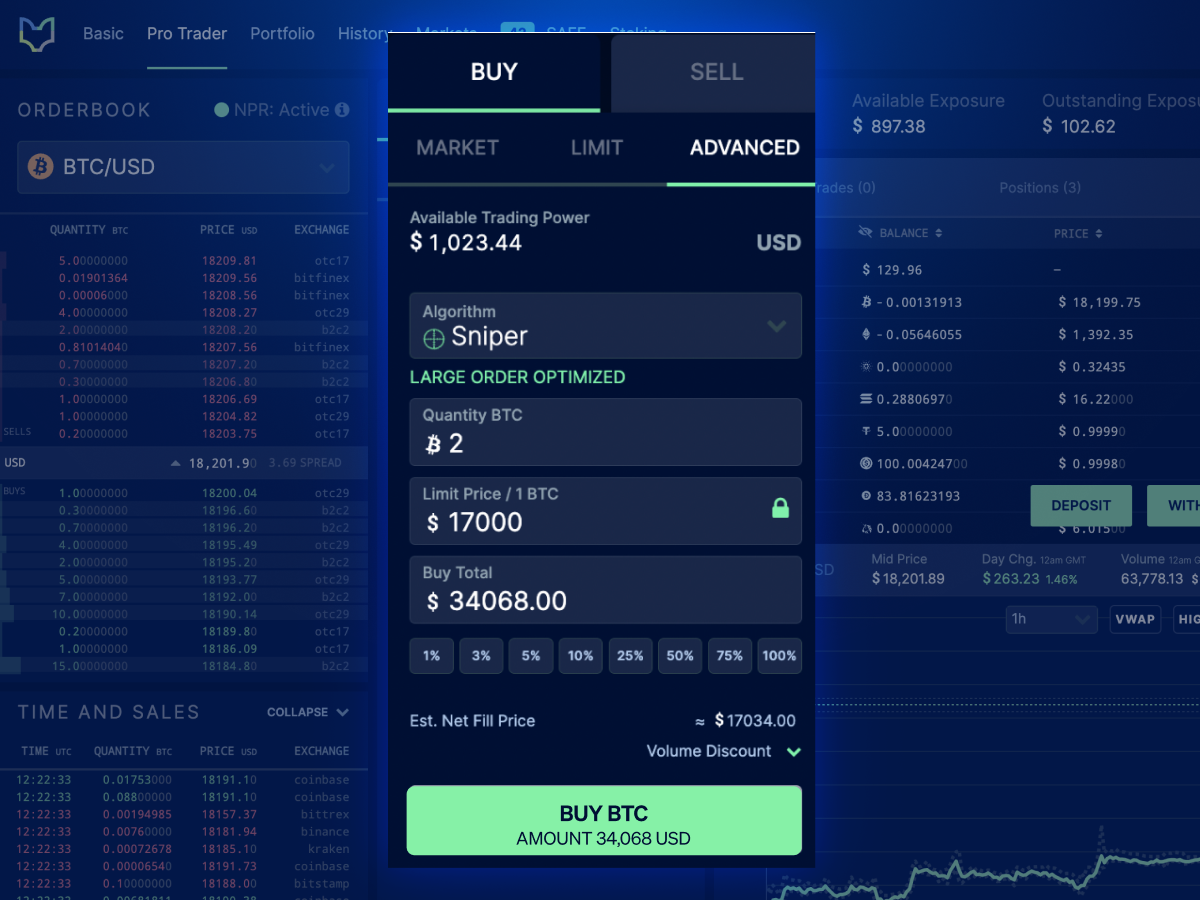

The Sniper order type, similar to other order types, can be initiated either in the UI or using sFOX’ API. By clicking ‘Advanced’ under ‘Buy’ or ‘Sell’, the Sniper algorithm can be selected in the ‘Algorithm’ menu.

When using the Sniper algorithm, a limit price is inserted to tell the algorithm the maximum price you want to pay for an asset (in case of a buy order) or the minimum price you want to receive (in case of a sell order). This means that the order will execute at the given limit price or a better price. The limit price should reflect the price of 1 unit of the asset in question, at which the limit order must execute, in this case, Bitcoin (BTC). Lastly, you should enter either the quantity of the asset you want to buy or the total dollar amount you want to spend. The other one will be filled automatically in response to the limit price in combination with either a dollar amount or a quantity. It’s also worth noting that the above ‘Quantity BTC’ in green is labeled as ‘Large Order Optimized’. As described before, the Sniper order type is particularly useful when building or liquidating a large position in a specific asset within a certain price range. This algorithm works best for orders with a nominal dollar amount of 20,000 or more.

Use case for Sniper orders

As implied in the previous part, Sniper orders are intended to quickly execute large orders (higher than $20,000) at a specific, preset, limit price. Next to that, it is designed to keep the overall intent of the order hidden from the rest of the market, by dividing the parent order into smaller child orders and by executing these orders throughout the order book.

For example, if you want to sell 100 BTC quickly for a specific price, a market order would not suffice in this case since you don’t want to sell against the current market price, but against a prespecified price that is, most likely, higher than the current market price. A regular smart routing order may also not be suitable, since you don’t want to incur slippage as a result of one big order that can potentially move the market. In this case, a Sniper order can be the appropriate algorithm to choose since the execution price can only be equal to or better than your preset limit price, and the order will be placed in smaller portions to avoid moving the market and incurring slippage.

Additional benefits of using Sniper order on sFOX

Since the Sniper algorithm relies on a specific limit price and next to that executes multiple smaller orders, you are dependent on liquidity in the markets. If you’re trading on one specific exchange, your order will only execute if the price on that specific exchange reaches your limit price. With sFOX, you’re trading directly in an aggregated order book containing liquidity of more than 30 exchanges and other liquidity providers. This increases the odds of getting your order filled, and thus enhances the effectiveness of your trading.

Crypto traders and funds are just as sophisticated—if not more so—than traders in more established markets. sFOX is proud to be furnishing them with the tried-and-true tools they need to execute their strategies and even to imagine entirely new strategies. We can’t wait to share more features like this one with you in the coming weeks, months, and years.

Ready to see how these order types can supercharge your own trading strategy? Open your SFOX account now.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service, or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject sFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information nor any opinion contained in this site constitutes a solicitation or offer by sFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options, or other financial instruments or provide any investment advice or service.