Post-trade settlement with crypto and other digital assets is a relatively new field. While crypto offers the potential for improved efficiency over traditional assets, a key pain point for large institutions in the digital asset market is the lack of post-trade infrastructure that meets their needs.

sFOX’s Post-Trade Settlement product enables clients to deploy capital at scale by eliminating the need to pre-fund trading activities or manually request additional funds. Our clients can move quickly, operate efficiently, easily execute on opportunities, and manage risk.

What is Post-Trade Settlement?

Post-trade settlement refers to the process of settling trades between two parties after they have been executed.

To better understand how PTS functions, it is best to first examine the settlement cycle in the traditional equity market. When purchasing shares of a security, there are two key dates involved in the transaction:

- Trade date

- Settlement date

The trade date records and initiates the transaction, which marks the day an investor places the buy order in the market or on an exchange. After that, trade dates are followed by settlement dates that mark the date and time the legal transfer of shares is actually executed between the buyer and seller.

The settlement cycle in the equity markets refers to the time between the trade date (when an order is executed in the market), and the settlement date (when the trade is settled and participants exchange cash for securities or shares).

The time frame between the trade date and settlement date differs from one security to another, due to varying settlement rules attached to different types of investments.

For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). Over time, settlement dates in the traditional equity markets have gone from up to T+5 to currently T+2 (with a marketplace trend currently in place to shift to T+1).

For cryptocurrency trading, this settlement cycle does not exist. Due to the blockchain technology underlying all cryptocurrency trading, the trade date and the settlement date occur instantaneously when the trade is executed.

However, pre-funding of a trading account with either fiat currency or other cryptocurrency is required for a cryptocurrency trade to occur. This pre-funding of a trading account is a key pain point for many large institutions in the digital asset market.

sFOX’s PTS product offering is meant to address this issue among others and provides a risk-managed competitive advantage over other cryptocurrency platforms.

How sFOX’s PTS product solves inefficiencies

Today’s complexity of manual post-trade processes can pose risks to operational resilience as trades and collateral fail to settle and ultimately increases the cost of financial services for market participants.

sFOX’s Post-Trade Settlement product (PTS) is a powerful, flexible, and secure way to immediately access markets and flexibly settle digital assets.

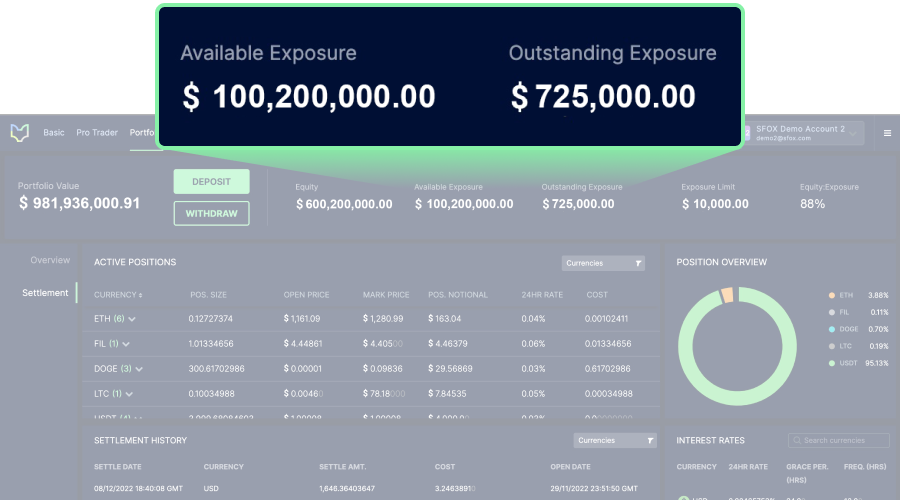

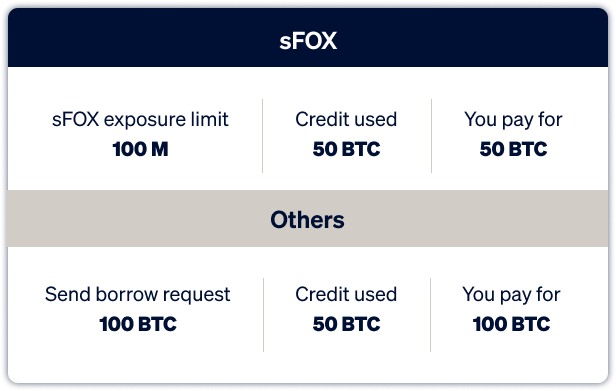

Eligible clients can maximize available capital and trading strategy returns, while scaling their balance sheets. We extend exposure limits and offer customized settlements to suit business needs, eliminating the need to fully pre-fund trading activities.

Clients also benefit from greater flexibility as they can hold long and/or short positions open for up to 28 days – a step beyond regular T+1 settlements.

Post Trade Settlement

| Others | sFOX's PTS |

|---|---|

| Limited time to hold a position (ex: 24 hours) | You can hold exposure up to 28 days |

| Securing a borrow | No need to separately arrange a borrow |

| Paying for unused borrows | You only pay for what you use |

| Manual documents and admin work | Pre-trade, trade, and settlement are entirely automated |

Improve your working capital efficiency

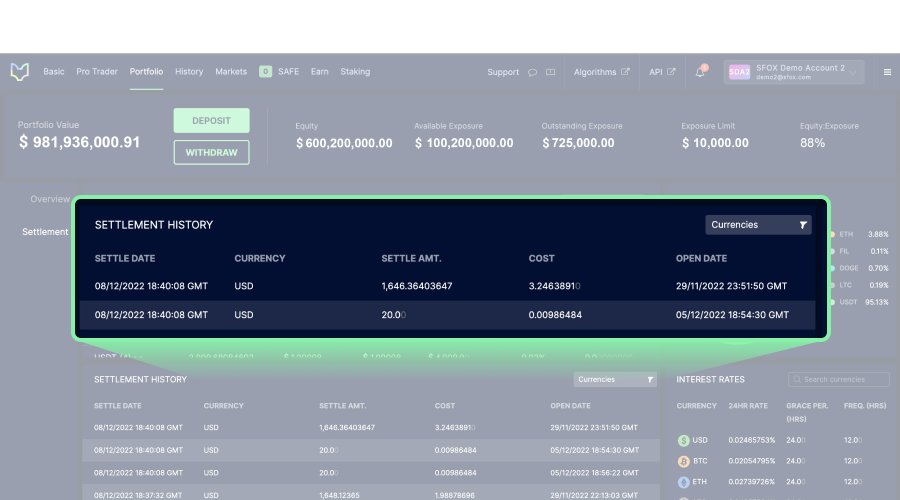

Pre-trade, trade, and settlement with sFOX are entirely automated, removing tedious and manual processes such as daily marks for settlement emails, messages, and error-prone reconciliations.

Institutional investors can utilize exposure limits as needed across assets and are only activated when they use them.

A position is opened when you execute a trade that requires more of an asset than you have in your account. For example:

- You have a USD balance of $100

- You purchase $200 in BTC

- You have opened a $100 position

PTS enables short-term long and short exposure to hedge risk. This feature enables you to spend beyond your current balance, without jumping through steps and hoops. No need to borrow first, request funds, top-ups, or rebalances. For example:

- You have a starting balance of 1 BTC

- You now sell 3 BTC

- You have an ending balance of -2 BTC, which means that you are short 2 BTC

With sFOX you can instantly access an exposure limit and only pay for what you use. No borrowing requests are needed. Also, you only pay when a position is held and only on a per-position basis.

Trade faster, safer, and more efficiently than ever before

Given the current market sentiment, there is increasing talk about the custody of users’ funds, especially on centralized exchanges.

Institutions eligible for PTS are now able to trade while collateral is maintained within our regulated and insured custodian SAFE Trust Co.

SAFE Trust Co. is a public trust company regulated under Wyoming law, as a wholly owned affiliate of sFOX. A regulated custodian is a regulated entity that holds clients’ funds in accounts in a manner that protects client funds against loss, theft, or misuse. 1

Clients benefit from the security and compliance framework of a regulated trust company.

By reducing operational risk and automating many manual tasks, PTS and SAFE make it easier for businesses to access markets and then settle their trades quickly and efficiently. If you want to learn more about PTS and SAFE or benefit from a free consultation with one of our experts, please schedule a call with us. We look forward to helping you improve your post-trade settlement process.

1 Custodial services offered by SAFE Trust Co. vary by location.