For years, sFOX has provided sophisticated crypto traders and institutional funds with a reliable stop order type: just set a price point for Bitcoin or any other major cryptocurrency on sFOX’s platform, and you’ll automatically execute a market sell or buy order at the next available price if that cryptocurrency reaches your specified price point. Aside from the stop order, sFOX offers a trailing stop order, for which the execution price is automatically adjusted based on a predetermined percentage, or amount, increase or decrease in the assets’ price. The Stop-Triggers-Other (STO) and Trailing-Stop-Triggers-Other (TSTO) order types are more advanced versions of these orders that can be used to optimize your trading strategy and risk management. In this article, we will explain how these order types work and when they are to be used.

STO and TSTO, what is it?

Regular stop orders trigger a buy or sell market order whenever the price of the asset of interest reaches your prespecified price. In all cases, a market order is executed when the price is reached which, on one side, is vulnerable to slippage, and on the other side, will incur a higher cost since it is an order type that takes liquidity from the order book. Though, if the speed of execution is the priority for a trader, then this is the order type to go with.

The Stop-Triggers-Other order type works precisely the same as the regular stop order, apart from the fact that in this case, not a market order is triggered. Instead, any other algorithm of choice is triggered when the prespecified price is reached on the asset of interest.

A trailing stop order is an order type that, similar to a regular stop order, triggers a market buy or sell whenever the price of an asset reaches a prespecified price point. However, with a trailing stop order, this prespecified price is versatile by automatically adjusting the stop price with a fixed percent or quote currency amount below or above the current market price.

So, one can specify for example to sell after a 3% (percent) or 500$ (quote currency amount) drop in the price of the asset. Like the regular stop order, since this order type triggers a market order, it is vulnerable to slippage and is subject to higher costs. Aside from that, speed of execution is the highest priority.

The Trailing-Stop-Triggers-Other order type is identical to the regular trailing stop order, apart from the fact that not a market order is triggered, but any other algorithm of your choice.

How to use STO and TSTO orders

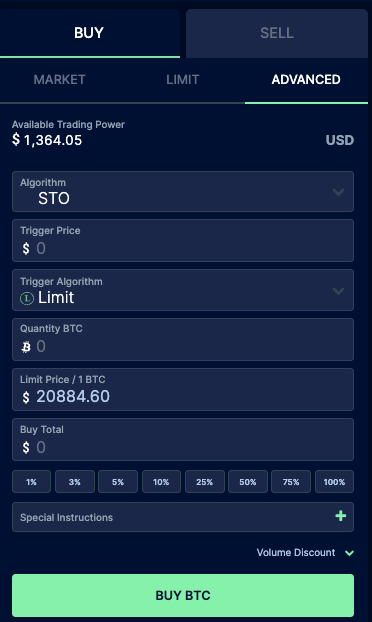

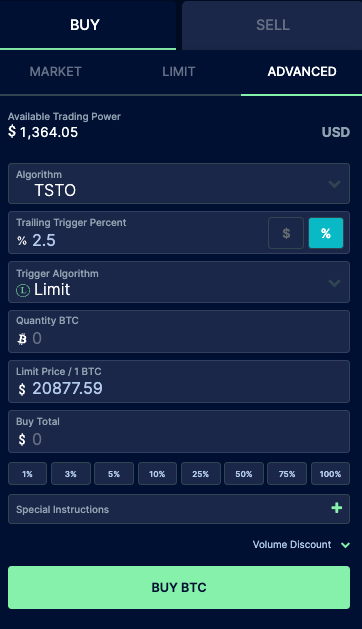

Both order types can be initiated either in the UI or using API. By clicking ‘Advanced’ under ‘Buy’ or ‘Sell’, the STO and TSTO algorithms can be selected. Since these order types trigger another algorithm, a second choice for an algorithm should be made to complete the order creation.

For the STO algorithm, a trigger price should be inserted. This, as described above, is the price at which the algorithm of choice is triggered. In the example illustrated above, a limit order is chosen to be triggered. The limit price should reflect the price of 1 unit of the asset in question, at which the limit order must execute. Lastly, either the quantity of the asset you want to buy or the total dollar amount you want to spend should be filled in. The other one will be filled automatically in response to the limit price in combination with either a dollar amount or a quantity.

With the TSTO algorithm, it works slightly differently. In this case, not a trigger price but a trailing trigger percentage or amount is specified as illustrated below. Put differently, this order type triggers an algorithm of choice after a specific percentage or amount increase/decrease in the price of the asset took place, instead of at a specific price being reached. With the toggle, you can switch between percentage and amount to tune the order specifics to your needs. Same as with the STO order, an algorithm has to be chosen that will be triggered. The remaining part of the order specifics can be completed in the same way as done with STO orders.

Use cases for STO and TSTO orders

Stop orders, trailing stop orders, and the more advanced versions of both, are typically not used as entry orders to open up a trade. Rather, these order types are used to manage risk and optimize or secure profits of an already existing trade. Both order types are thus optimized for price, rather than speed of execution. Whenever a trader needs to get out of a position quickly, these order types might not be the best fit and a market order would better suit that situation. Below, two specific use cases will be described in which either an STO order or a TSTO order will be of good use.

Secure profits when the market starts moving against your order

Let’s say you opened a long position on Bitcoin at $20,000 and Bitcoin is currently trading at $21,000. With an STO sell order at $20,500, you make sure that whenever the price starts dropping, your order is closed (sold) when the price reaches $20,500, and a profit of 2.5% is locked in. By using the STO order type instead of a regular stop order, you ensure to leave the market as efficiently as possible and not with a quick, and more costly, market order. In case the market keeps rising, you can also choose to move your STO order to a higher level to secure more profits.

Setting the order works exactly the other way around when you’d be in a short position. The STO order would then be placed above the current market price to ensure you secure profits when the market decided to move against you.

In both the long and short cases, the STO order can also be used to limit potential losses. In this case, the trigger price of this order would be set below (long) or above (short) the opening price of the main order. If your strategy doesn’t work out as predicted, the STO order will make sure potential losses are limited to a certain extent. By doing this, only a certain percentage of your account can be lost on a failing trade.

Have an exit strategy in place while you sit back and ride the trend of the market

Let’s say we are back at the end of 2020 again, where we were in a strong uptrend. You are positioned long in the market and probably want to maximize your potential profit, while not limiting those profits by using a precise stop-limit price, or an STO order. In this case, the TSTO order type would be a better fit, since the trigger price is a trailing stop, and thus set at a predefined percentage or distance from the current market price at any given point in time where the order is still open. By using a TSTO order, you’re allowed to keep accumulating profits until the market starts to make a certain move in the other direction.

In the case of the example above, in which you are positioned long in the market, the trailing stop should be placed at a fixed percentage or distance below the market price. The stop price will keep increasing alongside the rising market. Only when the market starts moving in the other direction, the TSTO order can be triggered.

In case of a short position, in a strong downward trend, the TSTO trigger price should be placed at a specified percentage or distance above the market price. In this case, the trigger price keeps decreasing with the market until the market starts moving against your order and reaches your pre-specified amount or percentage increase from the market price.

A key factor for success when using trailing stops is to have a good strategy to determine the distance or percentage from the market price at which the trigger is placed. One needs to make sure the trigger is far enough away from the price to not be immediately triggered with the smallest price movement, but also close enough to the price to not consume all potential profit. This is especially important in cryptocurrency markets since they tend to experience higher volatility compared to other markets

Advantages of using these order types on sFOX

Since STO and TSTO algorithms trigger another order type once activated, and in most cases, these order types will be ‘limit price’ based, you are dependent on liquidity in the markets. If you’re trading on one specific exchange, your order will only execute if the price on that specific exchange reaches your limit price. With sFOX, you’re trading directly in an aggregated order book containing liquidity of more than 30 exchanges and other liquidity providers. This increases the odds of getting your order filled, and thus enhances the effectiveness of your trading.

Crypto traders and funds are just as sophisticated—if not more so—than traders in more established markets. SFOX is proud to be furnishing them with the tried-and-true tools they need to execute their strategies and even to imagine entirely new strategies. We can’t wait to share more features like this one with you in the coming weeks, months, and years.

If you are ready to see how these order types could change your trading strategy on sFOX, you can simply sign in to your account.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service, or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject sFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information nor any opinion contained in this site constitutes a solicitation or offer by sFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options, or other financial instruments or provide any investment advice or service.