Institutional finance is at a crossroads. In 2025, prime dealer digital asset trading custody platforms are revolutionizing how large-scale investors access liquidity, safeguard assets, and stay compliant. These integrated ecosystems are becoming predecessors to legacy broker-dealers by combining trading, custody, financing, and regulatory infrastructure—all under one roof.

Why Institutional Prime Dealers Are Critical Today

As institutional confidence in digital assets deepens, improved infrastructure is required to bridge operations with compliance. A recent EY-Parthenon survey found that 86% of institutional investors increased or planned digital asset allocations in 2025, with 59% targeting over 5% of AUM in crypto holdings. Secure, efficient, and compliant infrastructure is now non-negotiable.

Evolving Regulation — Opening Doors for Prime Dealer Platforms

Under new guidance from the SEC and FINRA, broker-dealers can formally custody digital assets without the prior SPBD constraints, creating legal pathways for traditional prime dealer services in crypto. Concurrently, the SEC’s revised agenda proposes new clarity on digital asset trading and broker-dealer frameworks—suggesting future listings on national securities exchanges.

These shifts are pivotal: they enable institutional-grade platforms like sFOX to offer tightly supervised custody and trading services within established compliance regimes.

Core Advantages of Prime Dealer Platforms

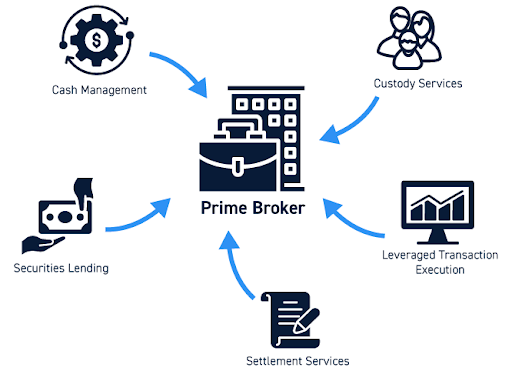

Prime dealer platforms eliminate fragmentation. Institutions can access single-platform liquidity, execution, custody, and compliance tools. Tools like smart order routing, margin services, and unified custody workflows streamline operations—keeping processes lean and scalable.

Operational Efficiency & Risk Oversight

Automated APIs, real-time reporting, and risk dashboards help operations teams make accountable decisions faster—and with improved oversight over asset flows.

Trusted Custody with Institutional Protections

With broker-dealer custody permissions and best-in-class SOC 2 audit infrastructures, prime dealer platforms enhance trust and reduce counterparty risk—a capability crucial for enterprise-grade deployments.

Access to Financing & Leverage

Integrated margin, lending, and collateral services allow institutions to optimize capital efficiencies, dynamically rebalance portfolios, and engage strategically across DeFi and trading channels.

Market Momentum — Why 2025 Is a Turning Point

The surge in institutional adoption is meeting transformative regulation. The institutional crypto custody landscape now includes expanding offerings from U.S. banks, legacy institutions, and financial intermediaries.

Meanwhile, prime brokerage platforms are capturing this demand. The global prime brokerage digital asset sector has accelerated, fueled by an $800 billion crypto rally and booming institutional activity.

Comparison Table — Prime Dealer Platform Benefits at a Glance

| Feature | Legacy Model (Fragmented) | Prime Dealer Platform (2025 Standard) |

| Integration | Separate trade, custody, and financing tools | All-in-one execution, custody, margin, and reporting |

| Regulatory Compliance | Complex, siloed layers | Broker-dealer licensed, built under updated SEC frameworks |

| Operation Overhead | Manual transfers, multiple counterparty risk | Streamlined API, dashboards, unified control panel |

| Liquidity Execution | Fragmented across venues | Smart routing, deep multi-source liquidity |

| Asset Safety | Variable security standards | SOC 2, insured custody solutions under regulated structures |

Real-World Use Cases for Institutional Finance

- Treasury Management & Hedging – Firms can efficiently trade and collateralize digital assets with automated custody and financing.

- Cross-Asset Liquidity Access – Combined infrastructure enables swift allocation across equities, derivatives, and crypto.

- Operational Simplification – Risk, reporting, and execution consolidation reduces manual friction and accelerates agility.

- Compliant Deployment Scenarios – Institutions, including pensions, endowments, and family offices, can adopt crypto with full audit-safe custody and broker-dealer regulatory structures.

Leverage SFOX for Prime Dealer Crypto Execution & Custody

2025 marks the operational pivot for institutional crypto markets. With regulatory doors opening and adoption accelerating, prime dealer platforms are no longer optional—they’re imperative. Institutions that embrace this integrated model, supported by compliant platforms like sFOX, will lead the next wave of digital asset finance.

Institutions leveraging sFOX can onboard seamlessly under U.S. regulatory standards, leverage deep liquidity, and access integrated monitoring tools built for the institutional workflow.