Even traders who believe that Bitcoin is on the path to break $10,000 may want a contingency plan in case it dips. For those who are long crypto but want to manage the risk of price dips while locking in gains along the way, SFOX is proud to bring trailing stop-loss orders to the crypto trading sector.

For almost a year, SFOX’s industry-leading stop-loss order type has allowed sophisticated crypto traders to set trigger prices that look at average crypto prices across the entire market rather than a single exchange and intelligently route your order to the best available exchanges if and when that trigger price is met. Now, traders can level up even further with dynamic stop-loss orders that “follow” an asset as its price increases.

How a Trailing Stop-Loss Order Works

Regular stop-loss orders stay in one place: if you set a stop-loss order for BTC at $8,500 on SFOX, that order will just sit open and wait to see if the average marketwide price of BTC drops to $8500—and, if it does, it will execute a market sell order.

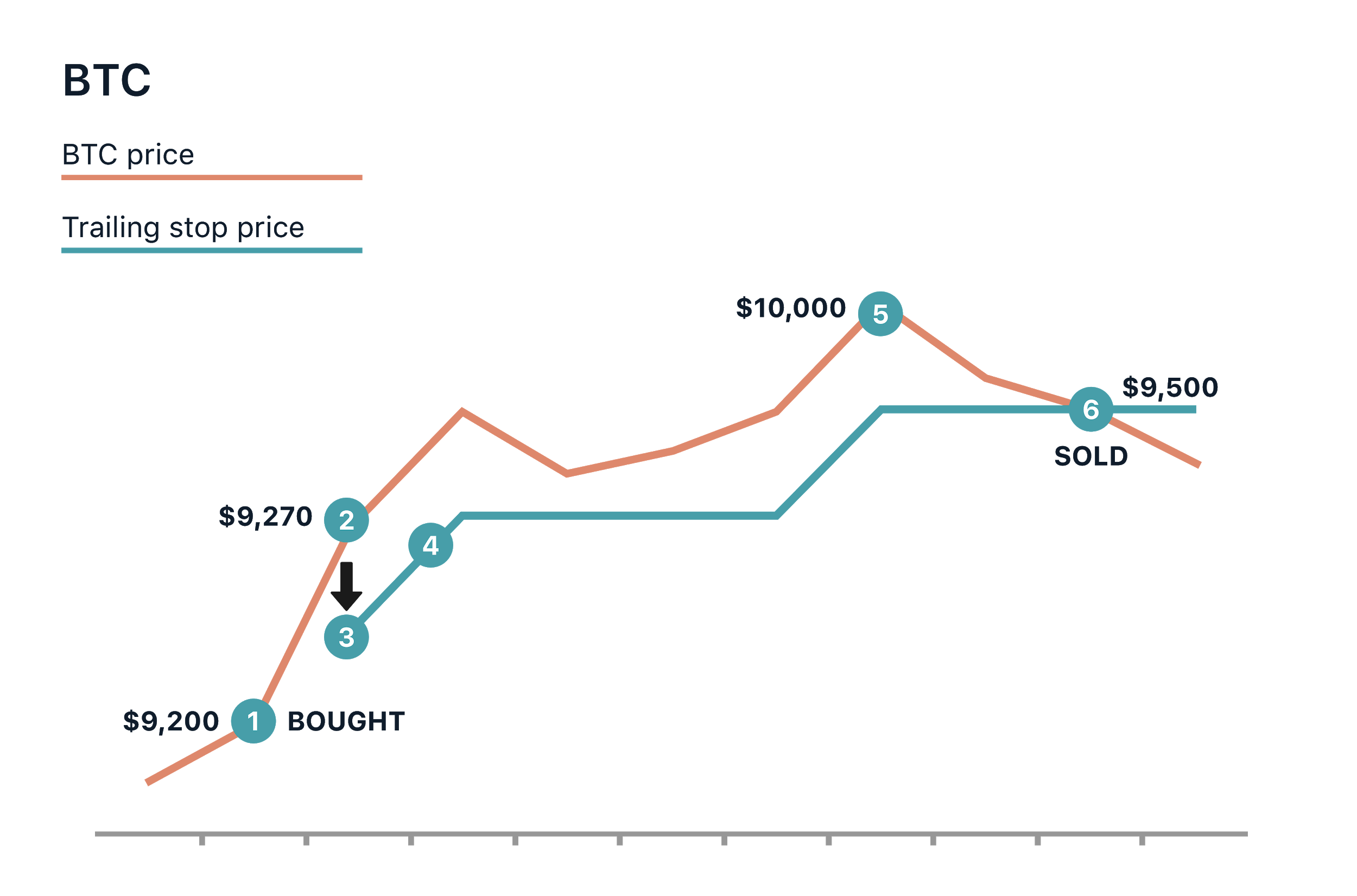

Trailing stop-loss orders are designed to accomplish a similar kind of risk-management more dynamically. When you set a trailing stop-loss order, you input either a dollar amount or percentage value; then, if the price of the asset you’re trading ever drops that many dollars or percentage points from its current value, the order will execute as a market sell. However, in the event that the price of the asset rises, your trailing stop-loss order will “follow” the asset’s price, maintaining the same margin of risk management as your position’s value increases.

For instance, suppose you bought a 1 BTC position of BTC long at $9200; if its price has risen to $9270 and you expect its price to increase, you might continue to hold your position but also enter a trailing stop-loss order trailing BTC by 5%. If BTC’s price were to drop to $8806.50, you’d automatically liquidate your BTC in a market sell. However, if BTC’s price were to rise to $10,000, your trailing stop-loss would update its trigger price: now, it would liquidate your position if BTC’s price were to drop to $9500.

Crypto trailing stop-loss orders are a uniquely helpful tool for traders who want to long an asset like BTC but still avoid precipitous crashes. They’re also useful for crypto/crypto traders: if, for instance, you were long on LTC but didn’t want to miss out on a BTC breakout, you could set a trailing stop-loss order for LTC/BTC at 10% to move your LTC into BTC if the relative USD price of LTC to BTC fell by 10% (as has historically happened in many instances of BTC breakouts).

How to Set a Trailing Stop-Loss Order on SFOX

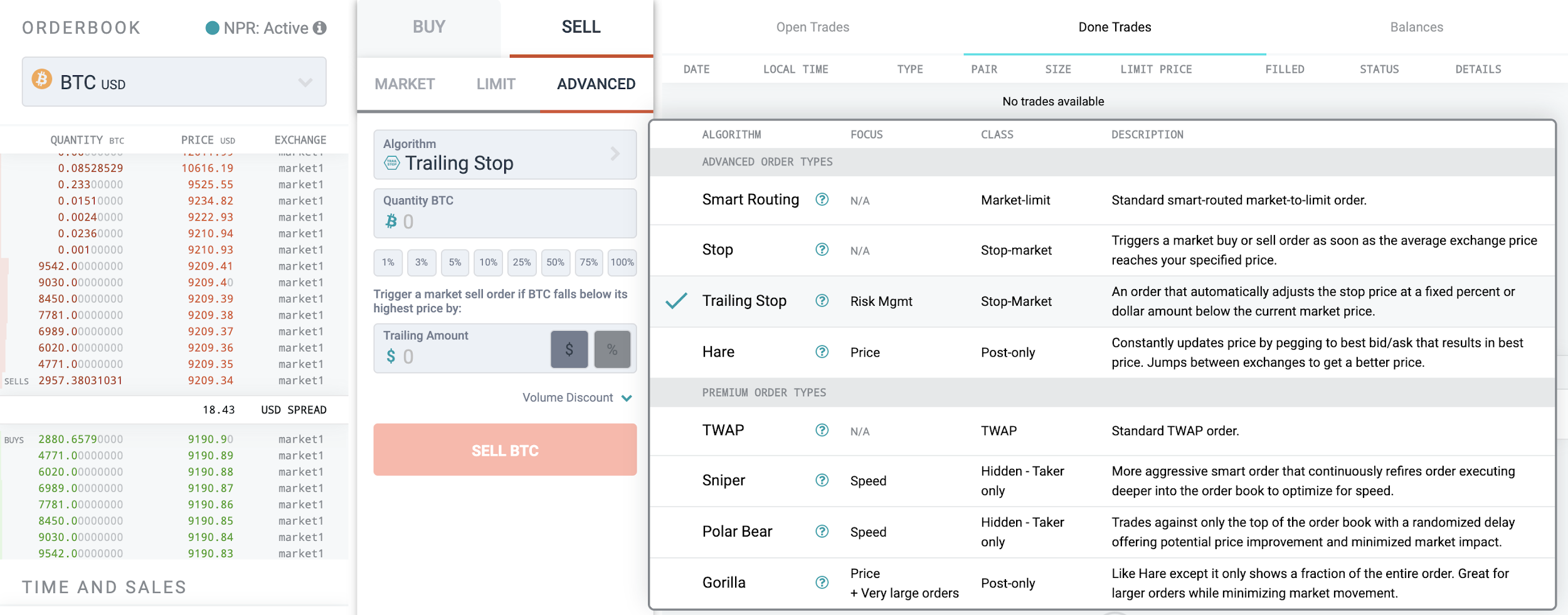

To set a trailing stop-loss crypto order from your SFOX account, simply select the asset pair for which you want to place the order, toggle the order interface to “Sell” and “Advanced,” then select “Trailing Stop” from the algorithm dropdown menu.

Once there, just select how much of the asset you want to sell (you can enter it manually or select a percentage value of your total holdings) and enter the size of the drop, either in a trailing amount or in percentage points, that you want to use as the order’s trigger. Once you’ve entered a trailing amount or percent, the order UI will estimate the initial stop price for you. Then, just hit “Sell [Asset]” at the bottom of the order interface, and your order is active.

If you want to check on your trailing stop-loss order’s status, just head over to the “Open Trades” tab on your dashboard—you’ll even be able to see its trigger price dynamically adjust if and when the asset’s price increases.

Better Tools, Better Crypto Risk Management

Professional traders take tools like trailing stop-loss orders to be table stakes for serious trading; no matter the strategy, a trader can be severely hampered without the ability to adequately manage portfolio risk.

Trailing stop-loss orders are just one of the many new tools we’re rolling out—including buy stop orders and separately managed accounts—to further professionalize the platform that’s already in use by the top 1% of crypto hedge funds. We’re laser-focused on creating the most robust and customizable crypto trading experience for our users, and we look forward to sharing even more tools with you soon.

Sign in now and check out what’s new for yourself.