Summary:

- The SFOX Multi-Factor Market Index has moved from neutral to mildly bullish as of November 11th, 2019.

- New regulatory clarity in Hong Kong, IPOs in the U.S., and institutional investment products suggest that overall crypto development may be ramping up.

- Despite its dubious status as a cryptocurrency project, volatility surrounding Facebook’s Project Libra seems to correspond to broader crypto volatility.

- Recent news about China’s interest in blockchain technologies seem to be reenacting the early days of Project Libra: following a price spike on news of President Xi supporting blockchain, the market isn’t sure precisely whether or how this blockchain interest will pertain to crypto.

- Whale movements and increased futures trading have set the tone for the months that have historically had the most volatile crypto movements.

In the October 2019 edition of our monthly volatility report, the SFOX research team has collected price, volume, and volatility data from eight major exchanges and liquidity providers to analyze the global performance of 6 leading cryptoassets — BTC, ETH, BCH, LTC, BSV, and ETC — all of which are available for algorithmic trading on our trading platform.

The following is a report and analysis of their volatility, price correlations, and further development in the past six weeks. (For more information on data sources and methodology, please consult the appendix at the end of the report.)

Current Crypto Market Outlook: Mildly Bullish

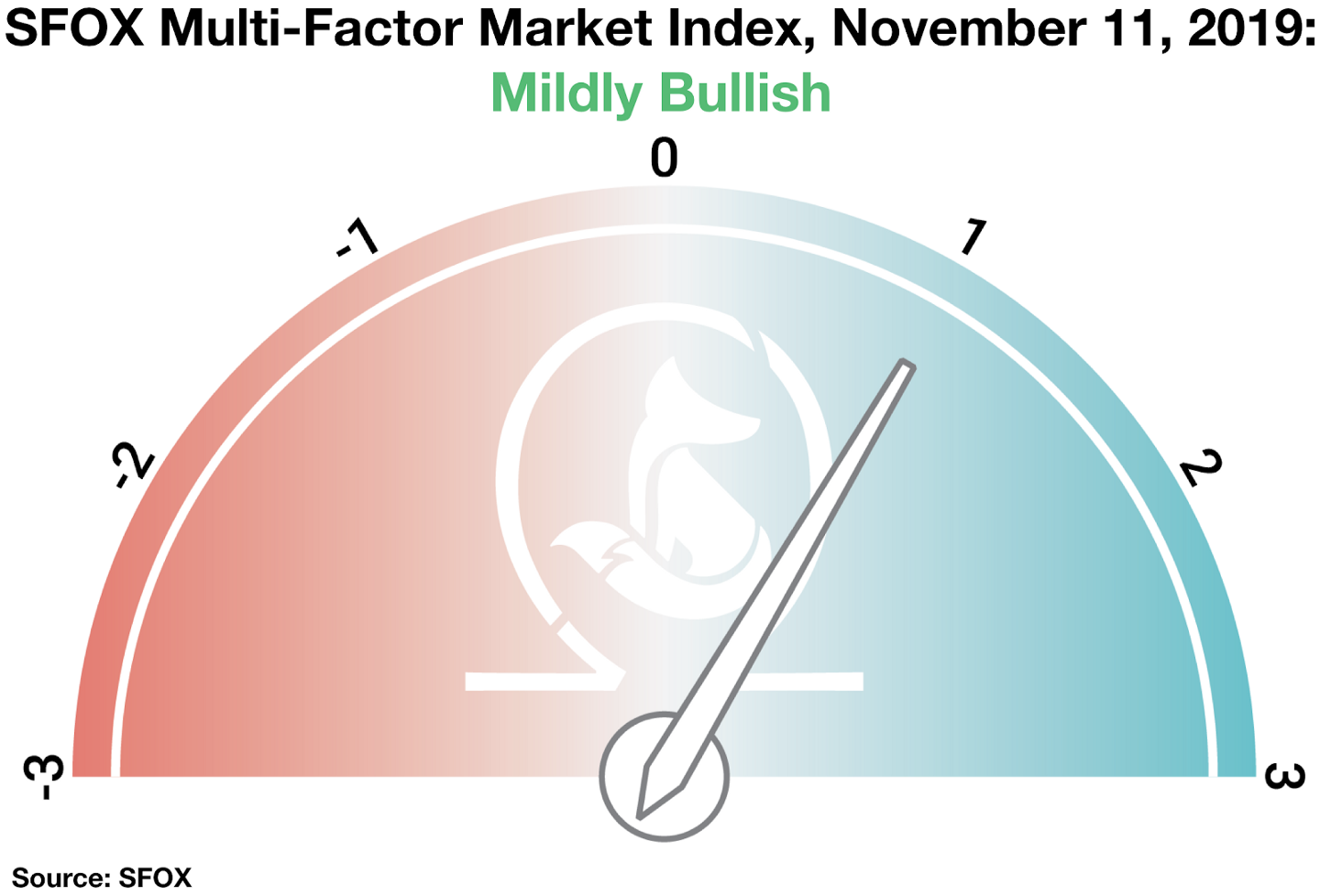

Based on our calculations and analyses, the SFOX Multi-Factor Market Index, which was set at neutral a month ago, has been moved to mildly bullish as of November 11th.

We determine the monthly value of this index by using proprietary, quantifiable indicators to analyze three market factors: price momentum, market sentiment, volatility, and continued advancement of the sector. It is calculated using a proprietary formula that combines quantified data on search traffic, blockchain transactions, and moving averages. The index ranges from highly bearish to highly bullish.

While crypto as a whole has been relatively quiet over the last six weeks, there are several key factors — which we’ll consider in depth below — that inform the index’s rating of ‘mildly bullish’ as we enter the holiday season. In particular: new regulatory clarify and crypto investment tools are coming; BTC futures volumes and long positions are up; whales appear to be on the move ahead of the holidays; and, China is expressing positive sentiment towards blockchain technologies (though their stance on cryptocurrencies is less clear).

What’s Happened in the Last Month and What to Watch Next

The last 6 weeks of crypto have seen a focus on projects that don’t have obvious direct relationships to the crypto market per se — in particular, crypto market movements appear to have correlated with news about Project Libra and China’s blockchain (not crypto) sentiments. Beyond these reactions, though, there’s reason to keep a close eye on crypto markets as the holidays come around again: regulatory clarity and institutional investment tools are coming; political turmoil has analysts returning to BTC as a potential safe haven; and, the movements of whales and futures markets appear to be on the upswing.

Facebook’s Libra: The Non-Crypto that Crypto Markets Keep Watching

The story so far: departures from and sustained regulatory scrutiny around Facebook’s Project Libra have corresponded with downward movements in Bitcoin markets.

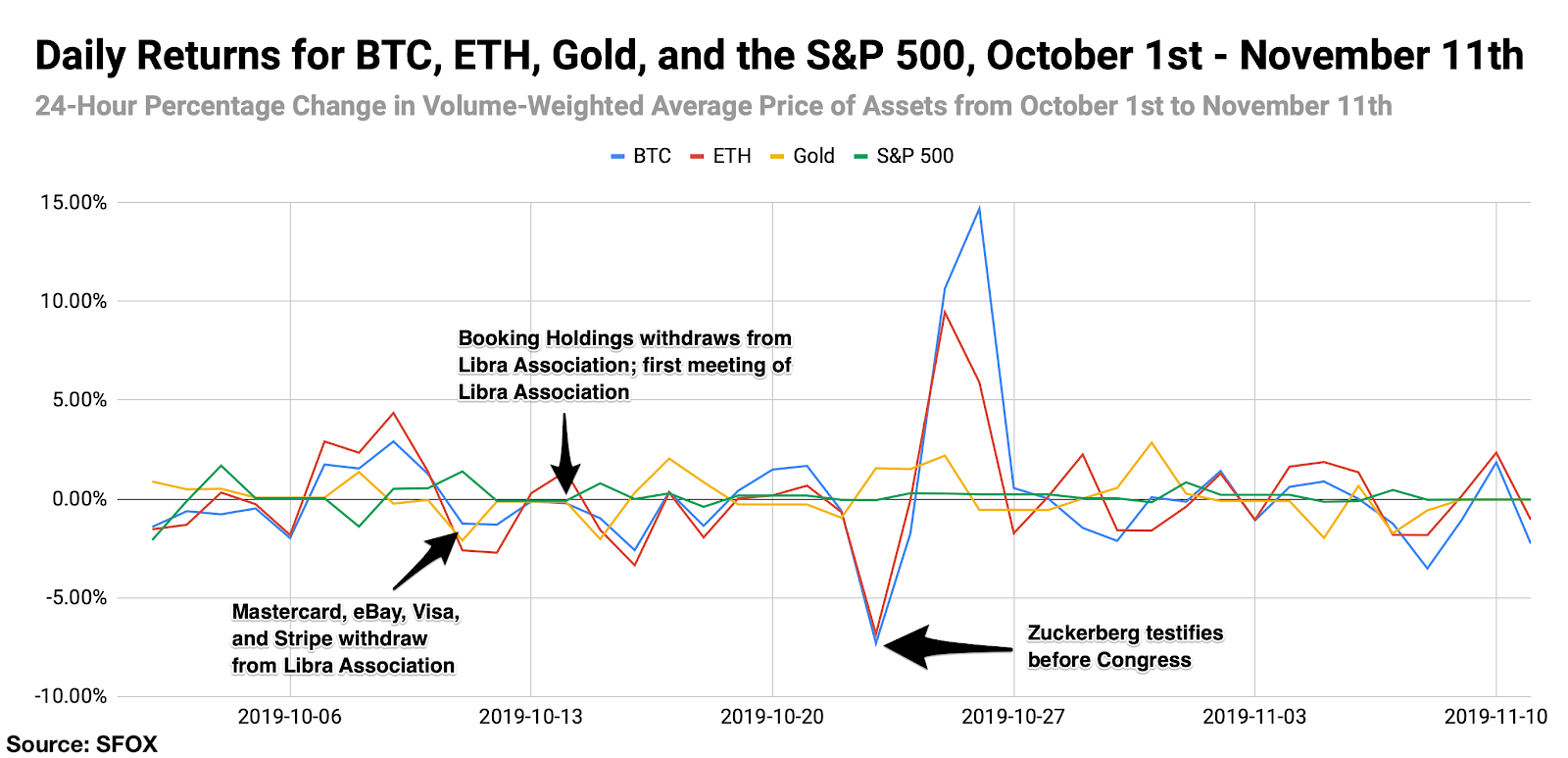

The previous issue of SFOX’s crypto market volatility report identified news about Libra as potentially impacting the volatility and price movements of the crypto sector. We’ve seen further evidence of this over the last month and a half with more high-profile departures from the Libra Association (Mastercard, eBay, Visa, Stripe (October 11th), and Booking Holdings (October 14th)) and hearings about Libra on Capitol Hill. While all of these events corresponded with periods of BTC losses, the most pronounced market movement was when BTC lost 7.3% on the day that Mark Zuckerberg testified about Libra before congress (October 23rd).

As we observed in our last report, “Whether or not you believe that Libra ought to have a bearing on Bitcoin, the market may be watching Libra for signals about broader enterprise sentiment towards and adoption of crypto and blockchain technologies.” These latest data appear to bear that view out.

What to watch next: developments in Facebook Pay could impact public sentiment surrounding Project Libra, which could potentially cascade to Bitcoin markets.

This past Tuesday, Facebook announced that it was consolidating payment processing for its network of apps into a single brand called “Facebook Pay,” a move which some argue may be an attempt to circumvent the regulatory scrutiny that’s been directed at Libra. If the crypto market is indeed viewing Project Libra as a proxy for mainstream acceptance of crypto-based payment systems, then, to the extent that further news about Facebook Pay may impact Project Libra, news about Facebook Pay could potentially have an indirect impact on crypto markets.

China: What’s Blockchain Got to Do with Crypto?

The story so far: China appears to be warming up to blockchain technology, but people aren’t yet sure how this will bear on Bitcoin and other cryptocurrencies.

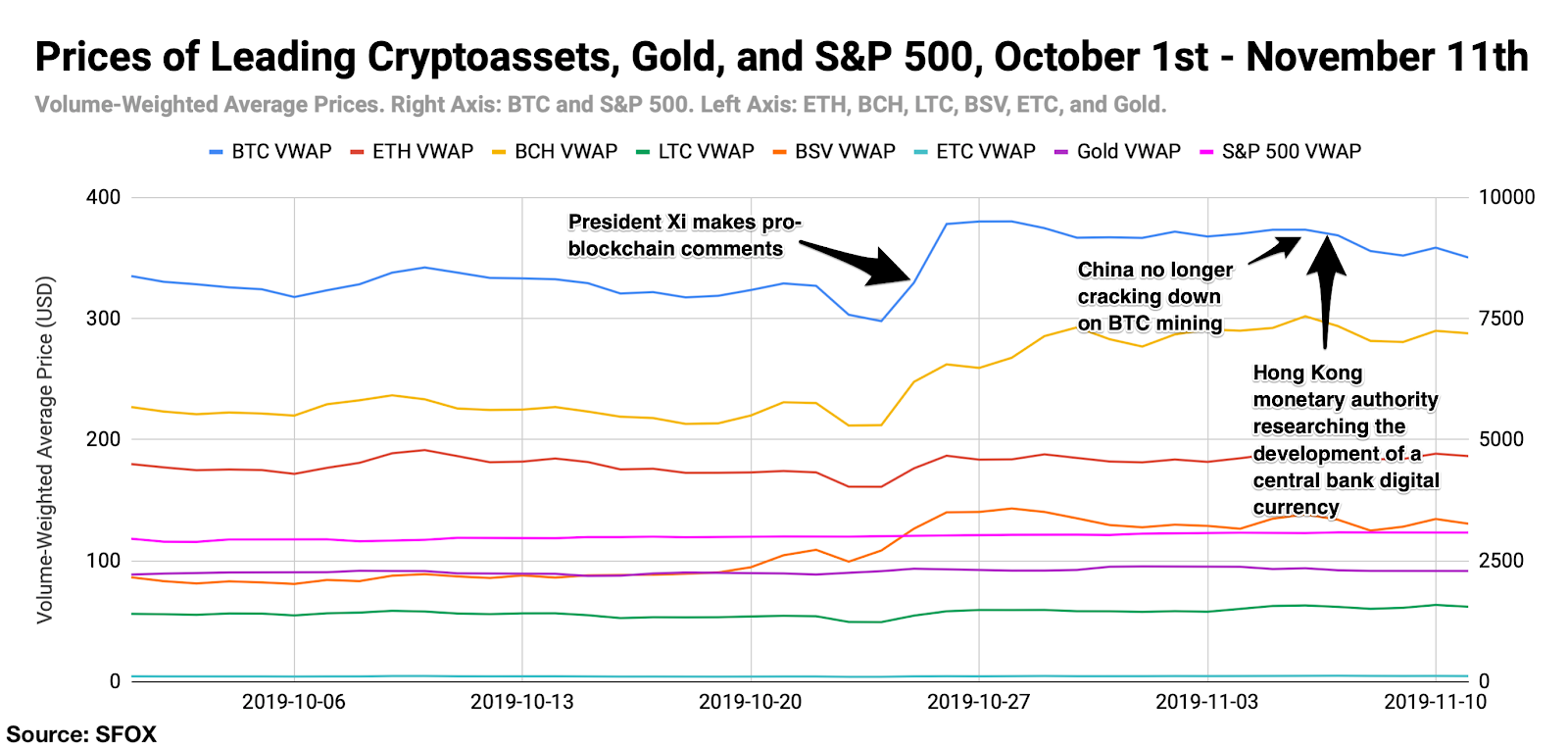

President Xi made waves in October when he told the Politburo Committee that blockchain is an important innovation that must be accelerated (October 24th). Over the following two days, the price of BTC climbed over 42%, from $7448.03 to a peak of $10610.00, and its volatility increased from 42.85% to 70.04%. However, it is unclear whether or to what extent this commitment to blockchain technology entails a similar commitment to cryptocurrencies, which may be why there weren’t similar price increases when it was recently announced that China would no longer be cracking down on BTC mining (November 6th) and that the Hong Kong monetary authority is researching the applications of a central bank digital currency (November 7th).

What to watch next: further clarity on how China views the role of cryptocurrency in its focus on blockchain developments.

Similar to the early days of Libra before the project’s details were revealed, it may be the case that the market, after the initial fervor surrounding Xi’s comments, doesn’t know how to react because they aren’t sure precisely how China’s pro-blockchain stance will pertain to cryptocurrencies per se. Given the historic interest in and volume of Chinese cryptocurrency trading in the past, increased clarity about China’s stance on cryptocurrencies could potentially stoke increased market volatility and price action.

Political Instability and Bitcoin as a “Safe Haven”

The story so far: Political instability in Lebanon, Chile, and Hong Kong have some revisiting Bitcoin’s potential to function as a safe haven.

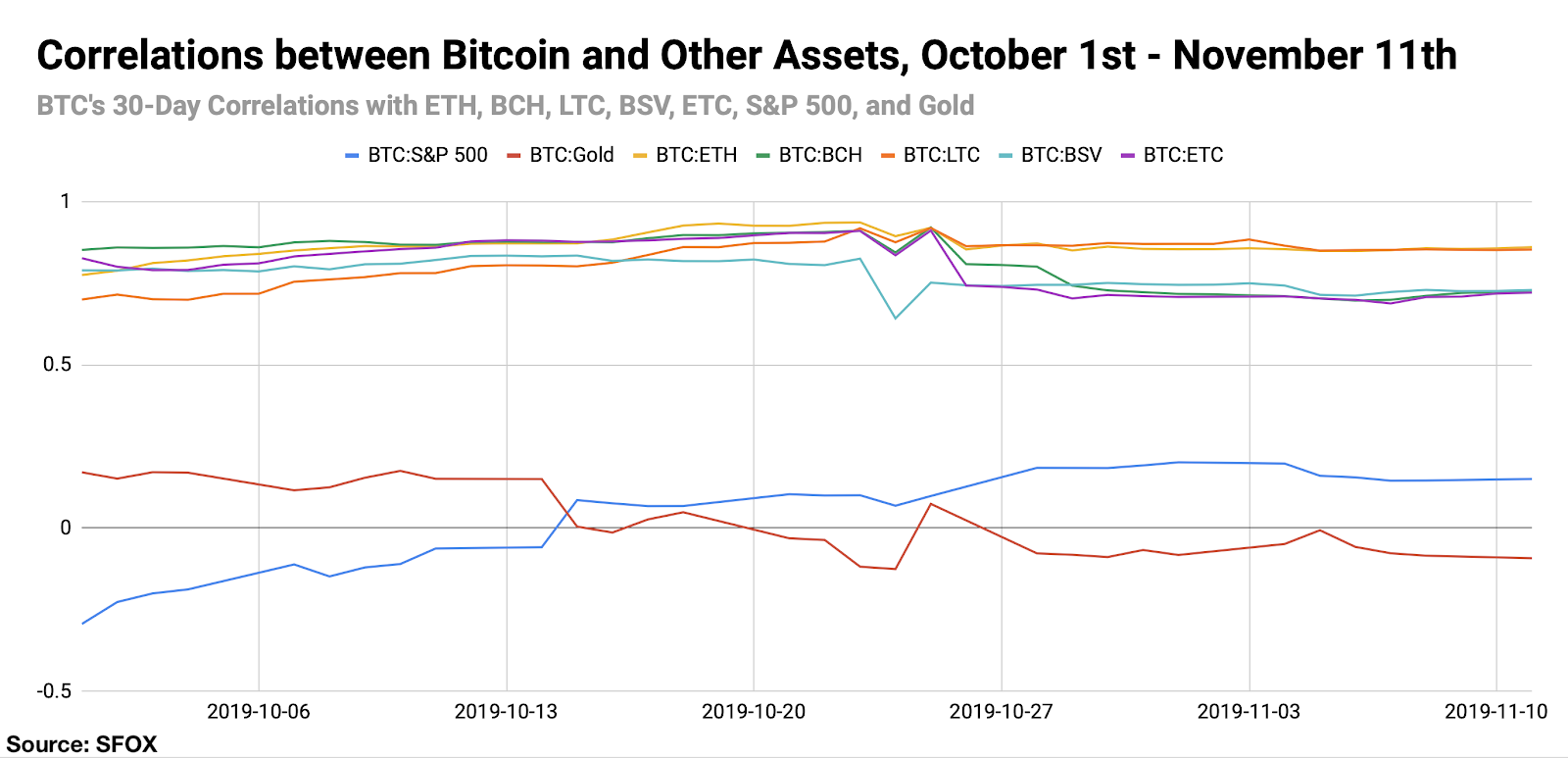

One of the first use-cases for which Bitcoin was extolled was the ability to provide people with financial freedom and security in countries with unstable political climates or inaccessible banking infrastructure. Analysts have been discussing BTC’s utility as a safe haven anew in the last month as Lebanon’s banks closed in the wake of civil unrest (October 25th), political protests in Chile turned violent (October 28th), and Hong Kong BTC trading spiked in a politically volatile atmosphere (October 2nd). In theory, BTC may be well-poised to help individuals in these climates of political uncertainty and upheaval: not only is it relatively inflation- and censorship-resistant, but it is also relatively uncorrelated to other asset classes, such as gold and the S&P 500, as the most recent SFOX correlation data reveal:

However, this increased trend of political upheaval doesn’t appear to have had a clear impact on the crypto market at large, which may reflect a limitation of the “Bitcoin as a safe haven” argument that Venezuelan reporter Diana Aguilar observed in a May 2019 op-ed: “The fallacy that bitcoin could “save” a country’s whole economy assumes the country meets all the requirements for mainstream adoption. Just to start, there would be needed widespread computer and financial literacy, reliable electricity infrastructure, stable internet service and an economy that not only allows the majority of citizens to count on a device to keep their digital wallets but also the safe migration from fiat money to digital money.”

What to watch next: political volatility in the U.S. and Hong Kong could hypothetically impact crypto volatility.

As public impeachment hearings begin in the U.S. and political upheaval persists in Hong Kong, there may be potential for renewed interest in BTC from two places that do have “widespread computer and financial literacy” and so on. Especially in concert with China’s renewed interest in blockchain technologies and the relationship we’ve seen between crypto markets and the U.S./China trade war, further political instability in these regions could hypothetically put Bitcoin on more people’s minds — especially as we enter the holiday season.

Bitcoin Mining IPOs

The story so far: China-based BTC mining companies Canaan and Bitmain filed for U.S. IPOs.

Canaan Creative reportedly filed for a U.S. IPO on October 28th, with a goal of raising $400 million in the offering; two days later, Bitmain Technologies reportedly resubmitted an application for a U.S. IPO, with a goal of raising somewhere between $300 million and $500 million in the offering. These applications come after both companies tried and failed to be listed on the Hong Kong Stock Exchange. If these IPOs end up happening, they would provide U.S. investors with a new vehicle for investing (albeit indirectly) in Bitcoin through traditional markets.

What to watch next: China’s stance towards crypto companies, along with other IPO applications.

As we noted above, China indicated in early November that it would no longer be cracking down on mining companies; further regulatory developments in China have the potential to significantly affect the BTC mining landscape and how the industry chooses to advance itself in both China and the U.S. Similarly, these IPOs, if successful, could hypothetically encourage other crypto-based companies to pursue similar filings, giving traders the ability to invest in more aspects of the crypto ecosystem through traditional markets.

New Regulatory Clarity Comes to Hong Kong

The story so far: Hong Kong has new regulatory clarity for cryptocurrency exchanges.

Hong Kong’s Securities and Futures Commission published new rules this month allowing cryptocurrency exchanges to apply for and receive an operating license (November 6th). Exchanges are reportedly eligible only if they “provide services to professional investors only, have an insurance policy to protect clients in case assets are lost or stolen, and use an external market surveillance mechanism.” This further regulatory clarity marks both the continued maturation of the crypto markets and a potentially positive signal in the development of Asian crypto markets.

What to watch next: Exchange reactions and further regulatory action.

Regulatory clarity is only half the story: the question now is whether exchanges operating in Hong Kong will submit to regulation or attempt to continue skirting it (e.g., by moving elsewhere). Ultimately, increased regulation is a positive sign for the growth and maturation of the sector, but exchange responses will provide an indicator as to whether those exchanges are ready for that level of maturation.

New Institution-Friendly Crypto Offerings Coming Soon

The story so far: Major crypto trading venues have announced BTC options coming in the next few months.

The CME, Bitfinex, and Bakkt all announced that they would start offering BTC options in the next few months, with Bakkt starting on December 9th, the CME started on January 13th, and Bitfinex starting some time in Q1 2020. The offerings add to the roster of crypto investment vehicles particularly geared towards institutional investors and professional traders.

What to watch next: Options performance upon launch.

We saw with the underwhelming launch of Bakkt that the market may potentially be watching the performance of sophisticated investing products at launch as indicators of broader institutional interest in crypto, and thus those launches may hypothetically affect the overall market. As such, one may want to keep an eye on these platforms as the launch times of their new products near.

Crypto Whales Making Splashes

The story so far: Whale movements continue to correlate with broader crypto market movements.

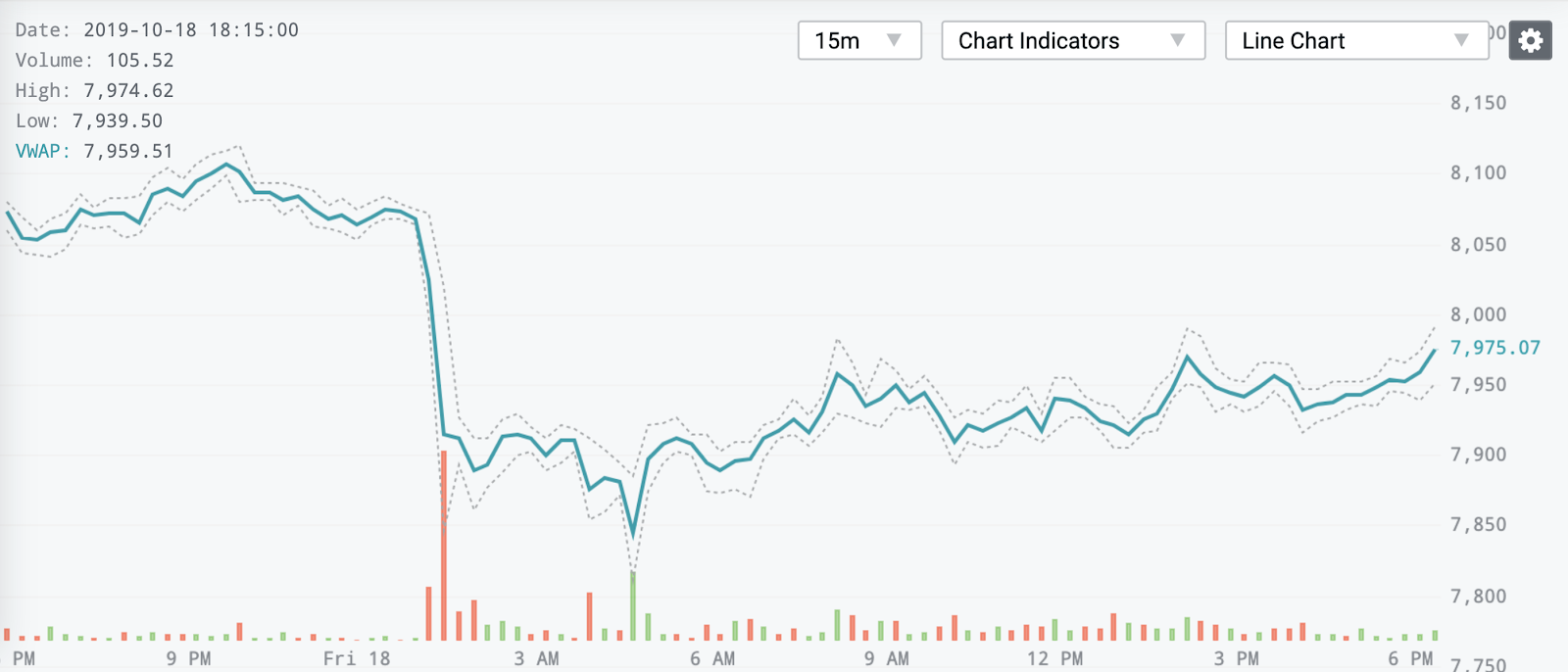

As SFOX detailed in its recent report featuring Whale Alert, October saw significant movements from whale-sized transactions that corresponded with broader market movements. For instance, “from October 21st to October 22nd, the price of BTC dropped almost 20% from a high of $8325 to a low of $6737.30; in the following three days, the price climbed almost 60%, from that low of $6737.30 to a high of $10610.00. All the while, Whale Alert logged a significant number of high-value transactions,” up to and including 10,000-BTC transactions. It’s not clear exactly who these whales were, but their movements could have theoretically been either a cause of or reaction to broader market movements. Similarly, on October 18th, Korean authorities broke up a darknet child pornography ring and auctioned 10,000 seized BTC on Binance, which correlated with a ~2% drop in BTC’s price — from $8062.56 to $7915.01 — in just 30 minutes.

What to watch next: “in-season” whale trading around the holidays.

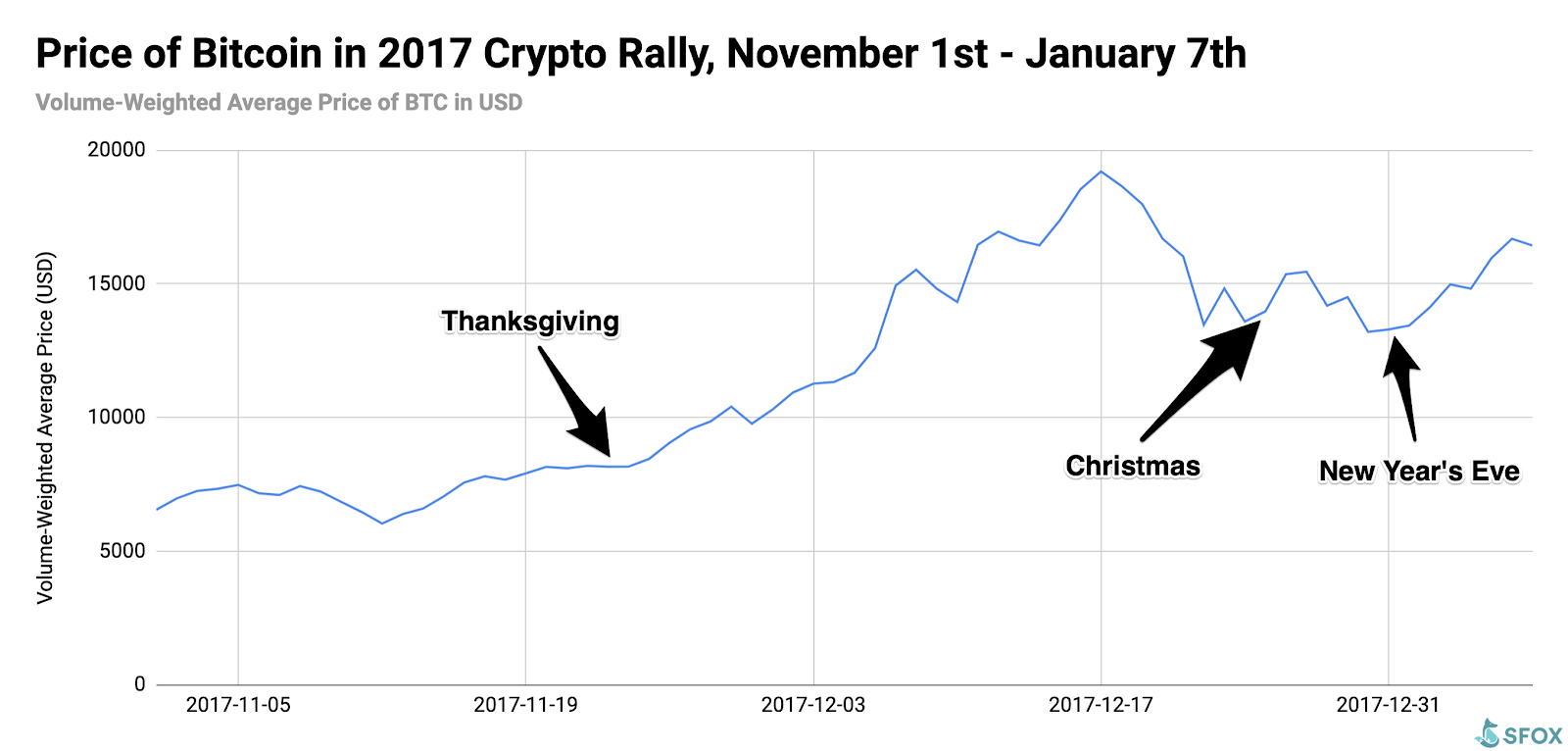

As SFOX research has previously reported, Bitcoin and other crypto markets have historically shown significant movements around holidays like Thanksgiving, Christmas, and New Year’s:

To keep an eye on transactions as these times near, consider following Whale Alert on Twitter.

Bitcoin Futures: Increased Volume into the Holidays

The story so far: BTC futures volumes are reported to be up on both the CME and Bakkt.

Crypto analytics company Skew reported that CME BTC futures volumes and long positions grew throughout October (October 22nd). Bakkt volume has also grown steadily since its underwhelming launch, hitting a daily trading volume record of $15 million on November 9th. Some have interpreted the increase in futures trading volume to correspond with a positive turn in overall market sentiment, consistent with the upgraded SFOX Multi-Factor Market Index rating of `mildly bullish’. (It’s worth noting, however, that futures volumes were very low previously, so the trend of increasing volume is more significant on a relative rather than absolute scale.)

What to watch next: BTC futures expirations into December.

The CME’s last trade date for BTC futures this month is November 29th; historically, futures expirations have had an impact on BTC volatility and broader crypto markets.

Get the SFOX edge in volatile times through our proprietary algorithms directly from your SFOX account.

The Details: October 2019 Crypto Price, Volatility, and Correlation Data

Price Performance: Wavering, with a Spike

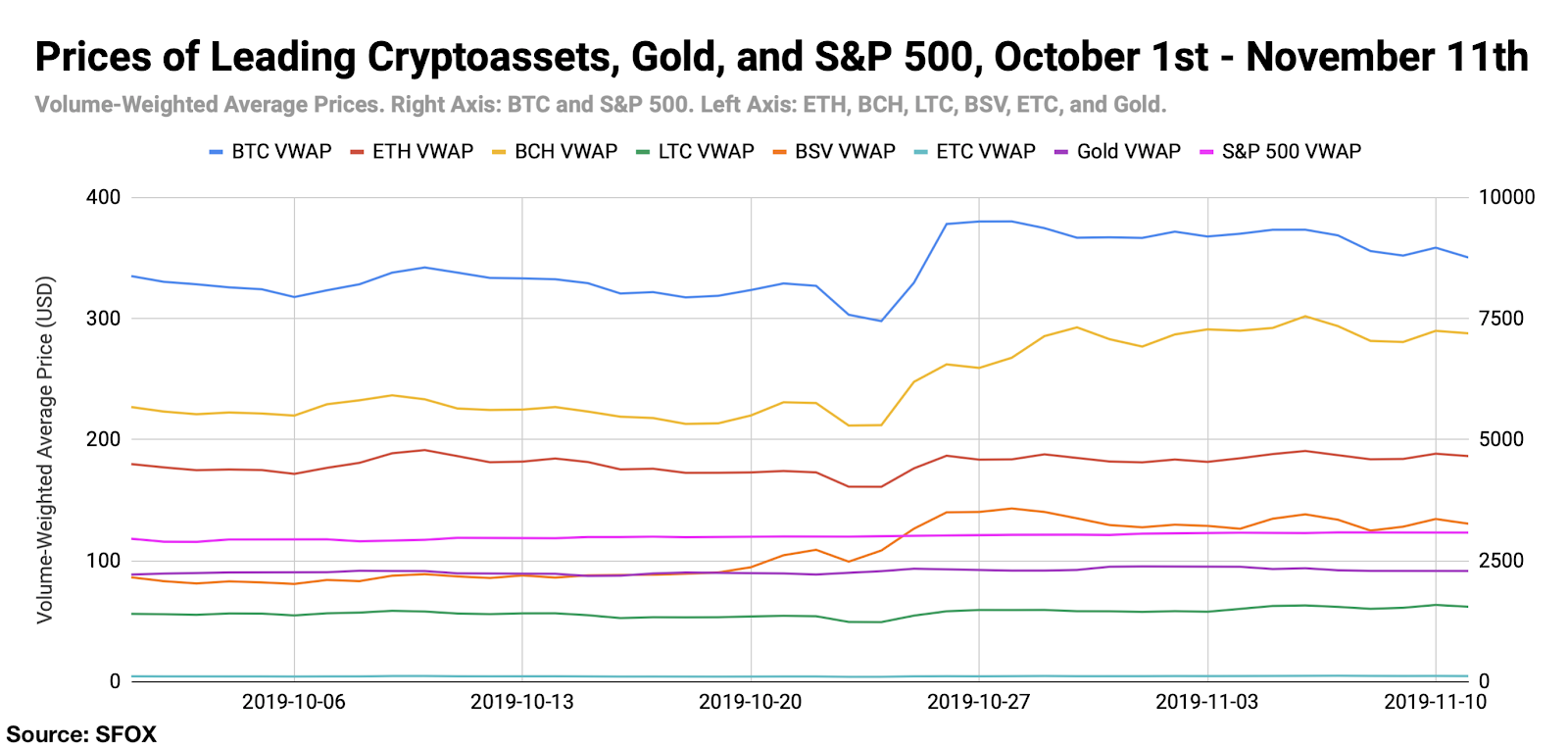

The price to buy bitcoin has ranged over $2057.89 — roughly 24% of its current price at the time of writing — in the past six weeks, peaking at a price of $9505.91 on October 28th and bottoming out at a price of $7448.03 on October 24th.

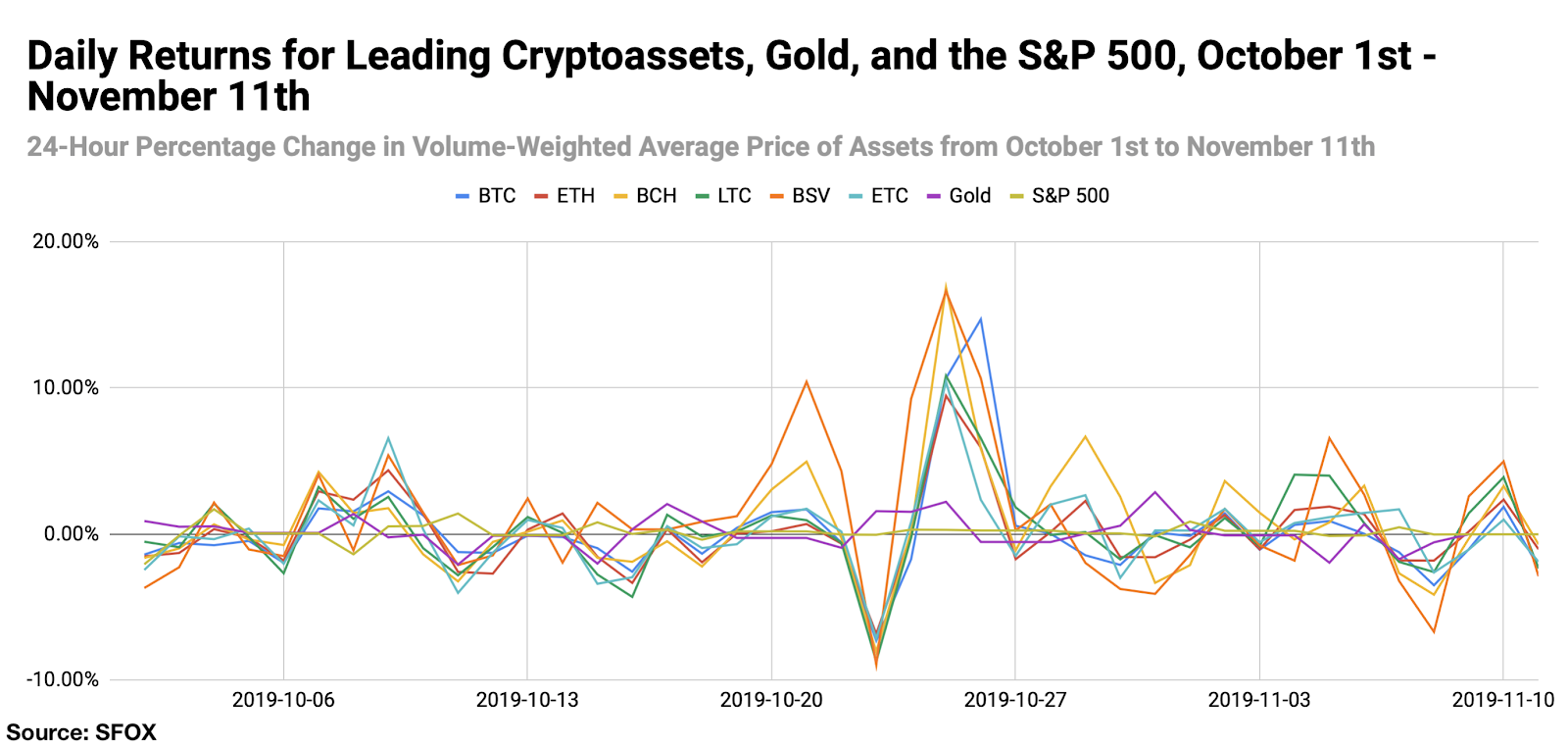

By looking at daily returns for leading cryptoassets, gold, and the S&P 500, we can see the pronounced increase in crypto prices on the 25th and 26th, correlating with President Xi’s pro-blockchain comments.

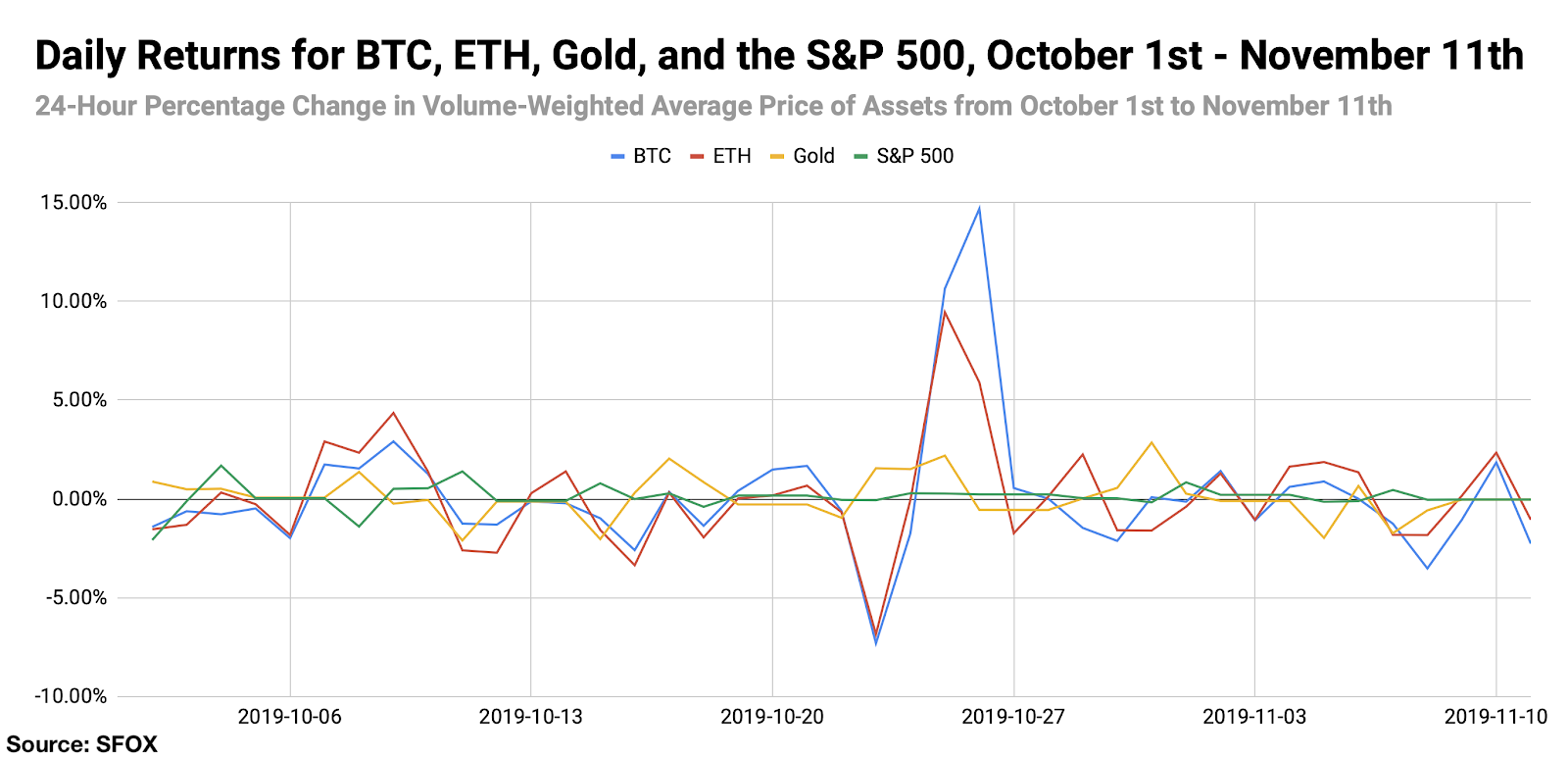

For greater graphical clarity, see this additional chart tracking only the daily returns of BTC, ETH, gold, and the S&P 500:

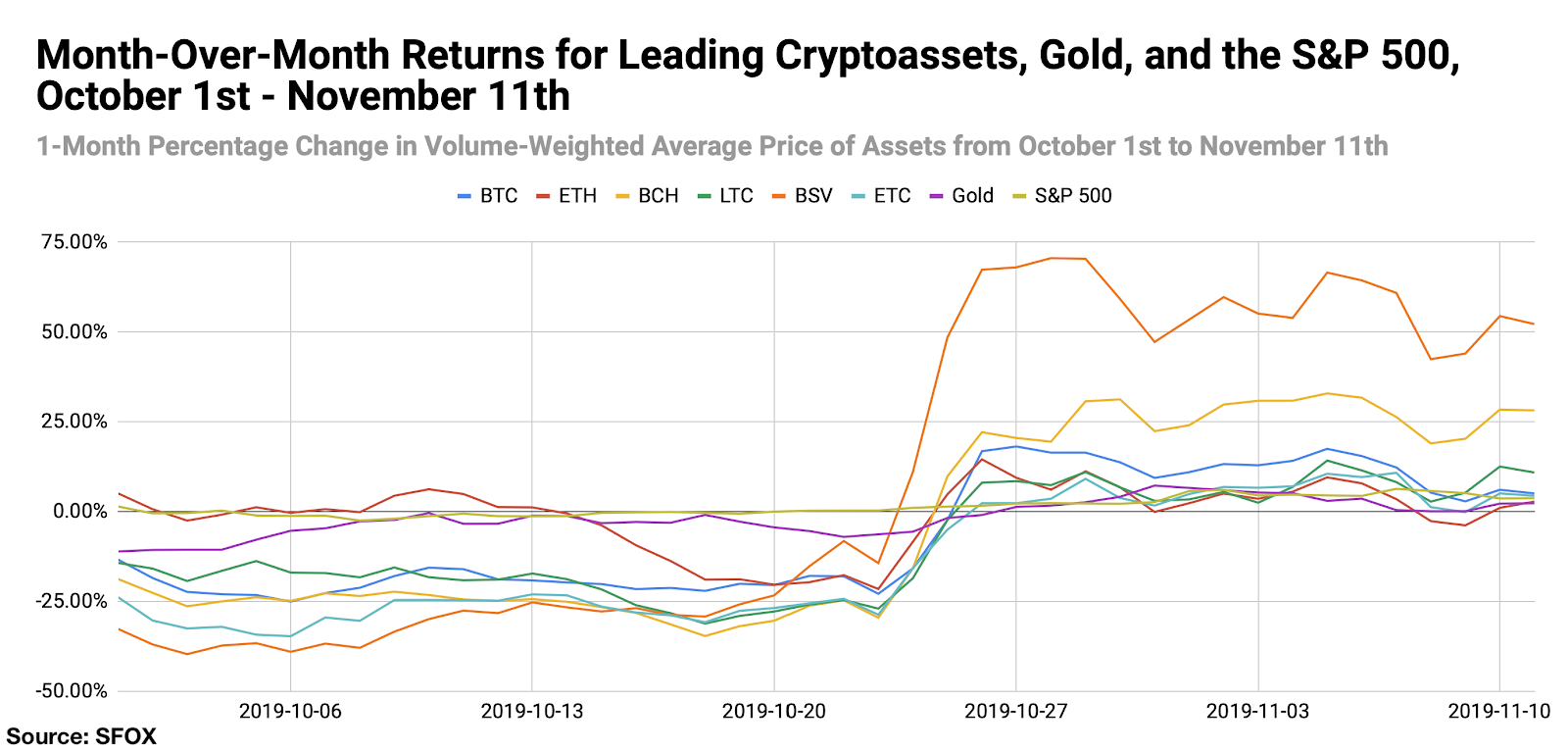

All leading cryptoassets, along with gold and the S&P 500, had positive month-over-month returns as of November 11th. BSV and BCH had the highest MoM returns (52.17% and 28.17%, respectively), while ETH and gold had the lowest returns (1.06% and 2.23%, respectively).

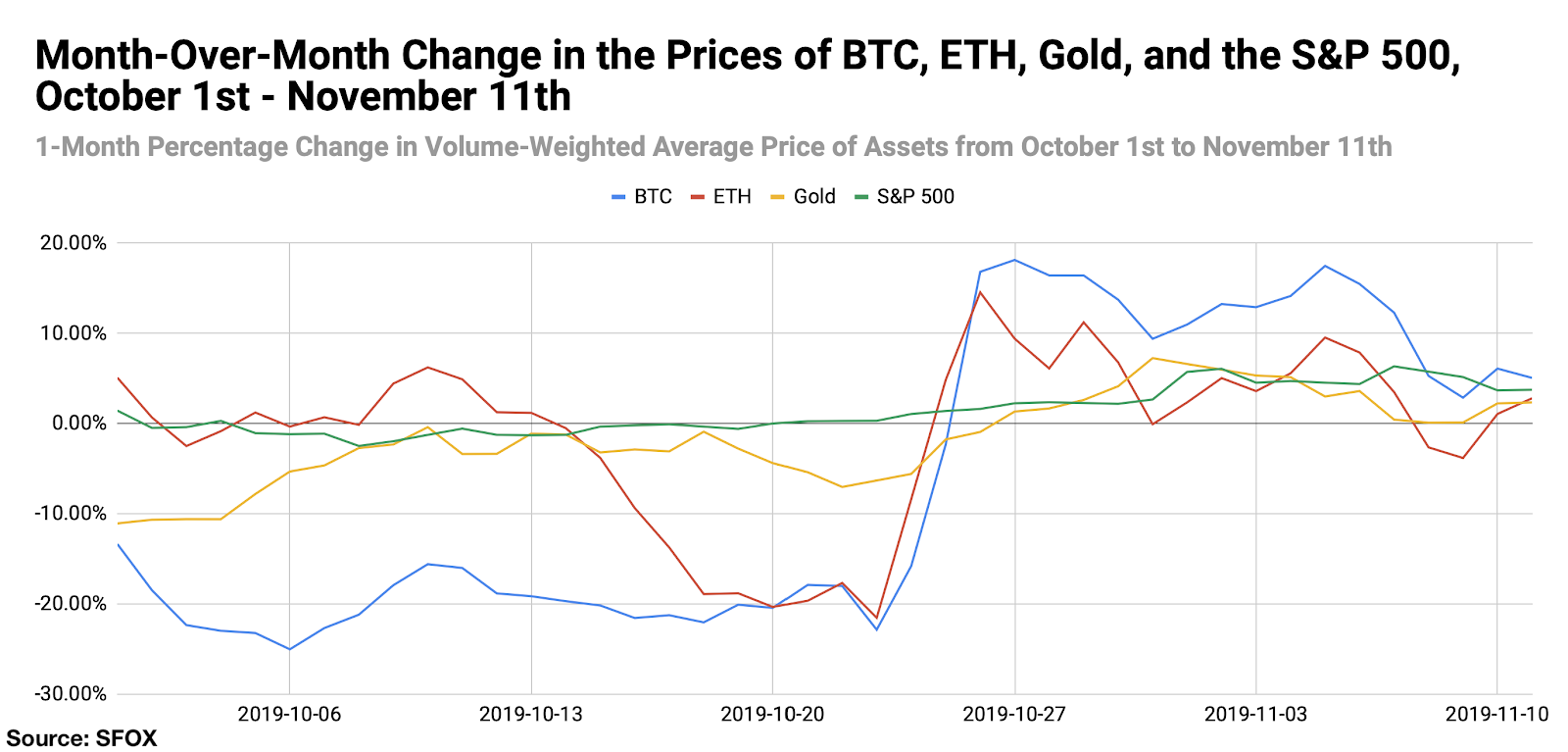

For greater graphical clarity, see this additional chart tracking only the month-over-month changes in the prices of BTC, ETH, gold, and the S&P 500:

Volatility: Punctuated Steadiness

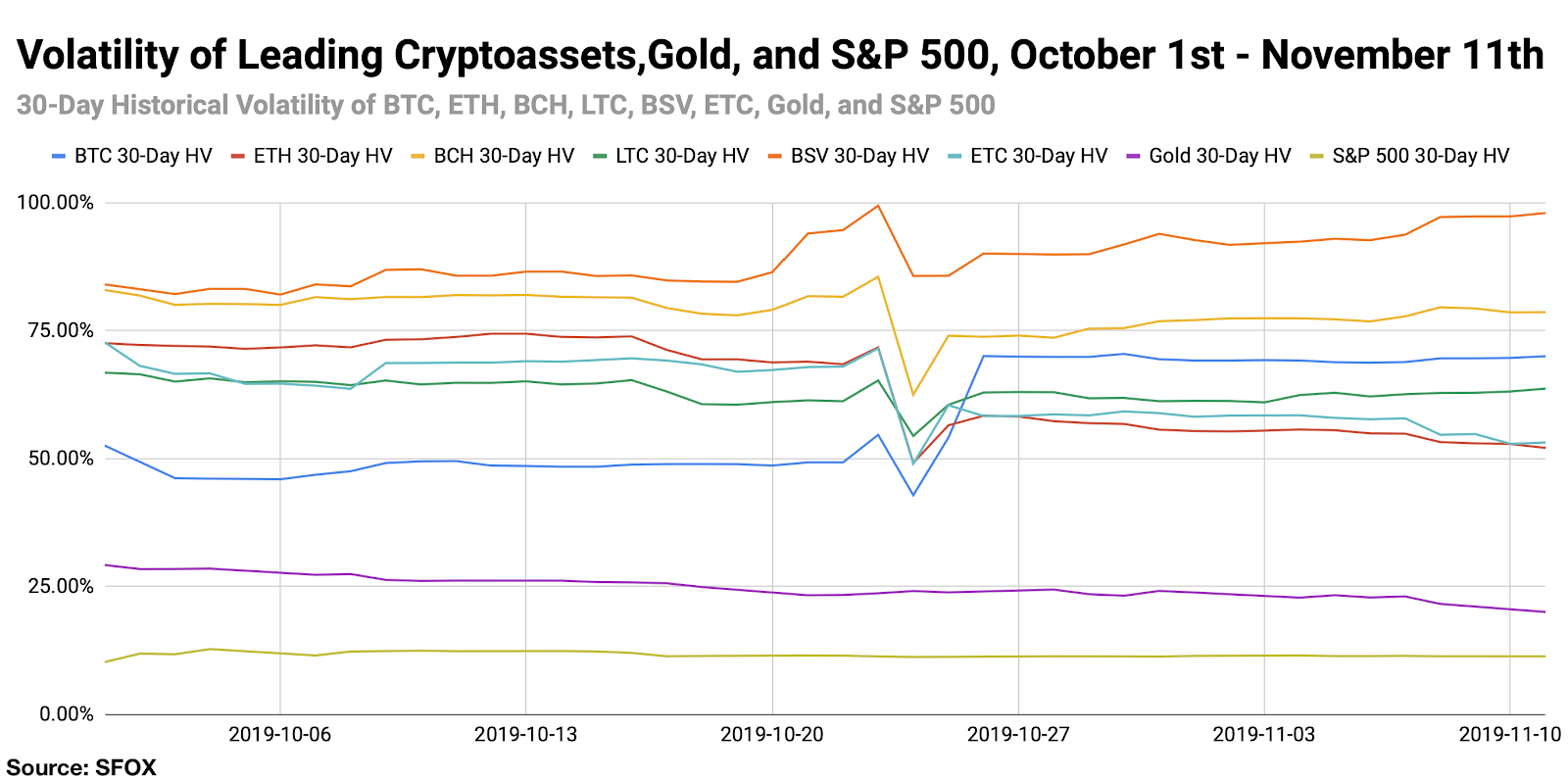

By looking at the 30-day historical volatilities of BTC, ETH, BCH, LTC, BSV, and ETC, we see that the general trend of crypto volatility was fairly steady up until October 23rd, at which point there was a marketwide increase in volatility, followed by a more significant increase on the 25th and 26th. Bitcoin’s volatility increased from 49.26% on October 22nd to 70.04% on October 26th.

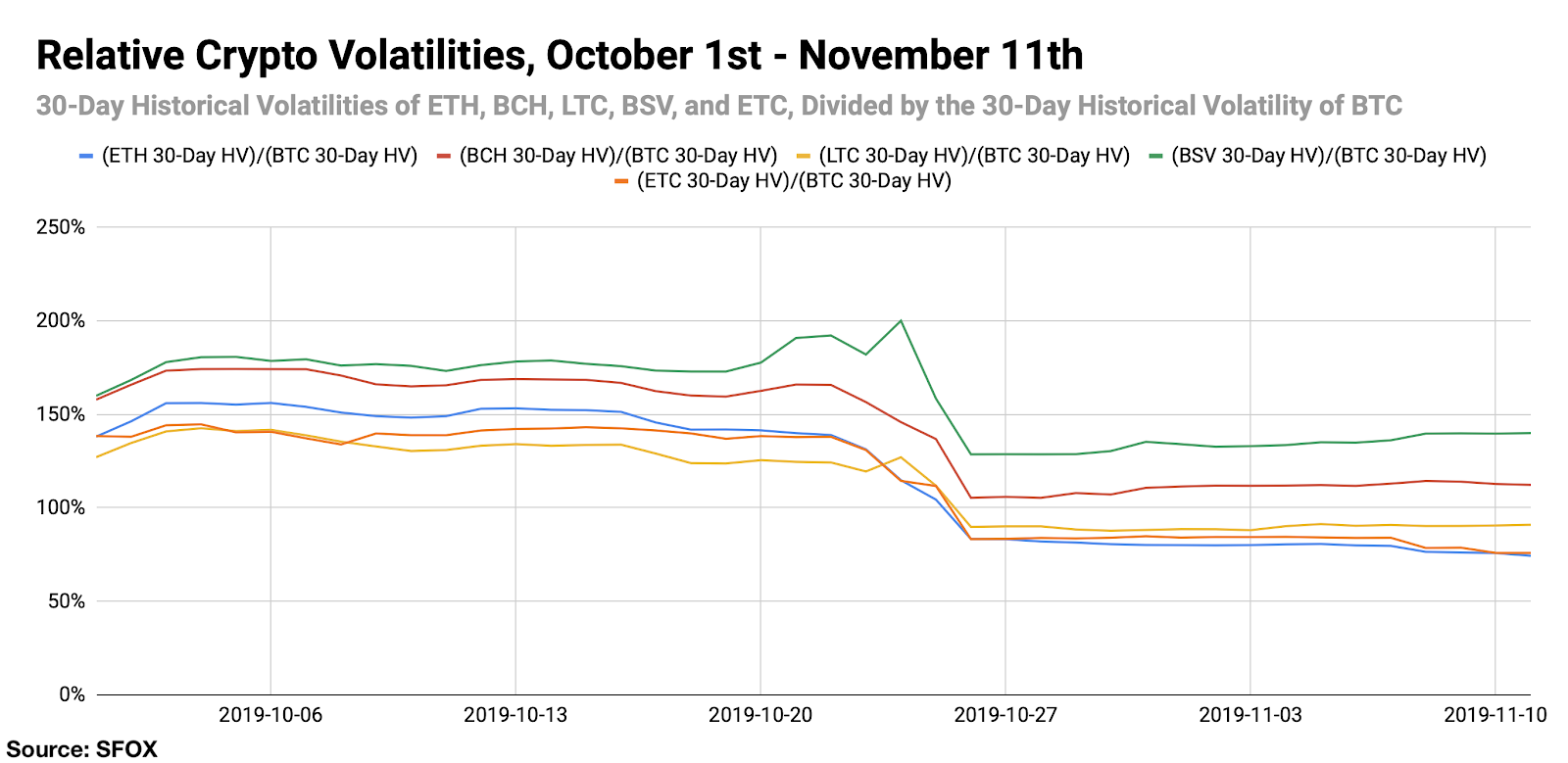

By looking at the 30-day historical volatilities of ETH, BCH, LTC, BSV, and ETC as a percentage of BTC’s 30-day historical volatility, we can see more clearly that most altcoin volatility was following BTC’s volatility, with altcoins becoming relatively less volatile than BTC following the large market movement from October 23rd through October 27th.

Price Correlations: A Bitcoin-Dominated Narrative

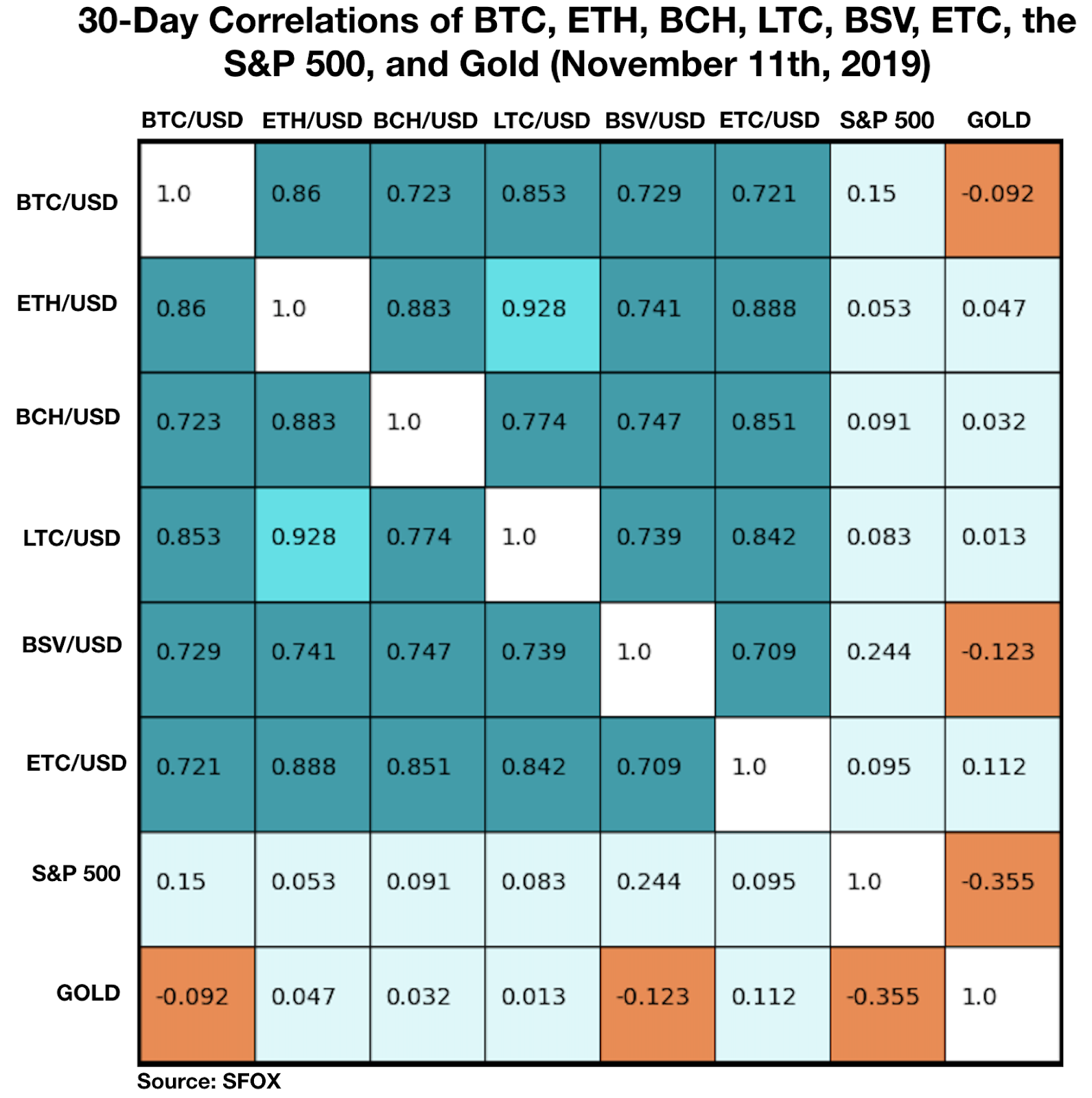

The most recent crypto correlations data show all leading cryptocurrencies having relatively near-zero correlations with both the S&P 500 and gold, consistent with their behavior in previous recent months.

See the full SFOX crypto correlations matrix below:

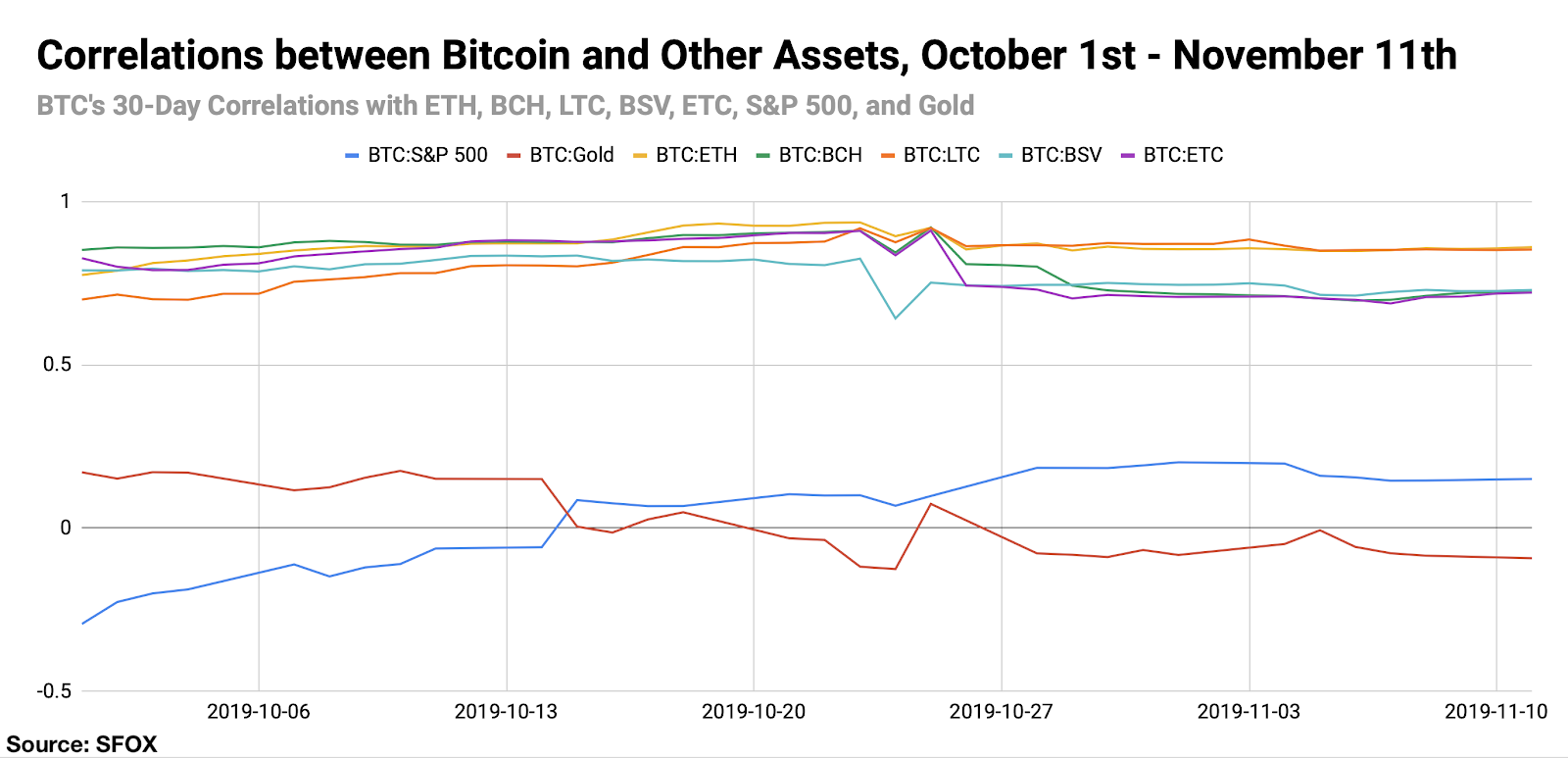

As discussed above, the near-zero correlations that cryptoassets maintain with gold and the S&P 500 lead some to view cryptoassets as appealing hedges or safe havens in times of political and macroeconomic uncertainty. It’s also worth noting that ETH has been exhibiting a high (i.e. close to 1) correlation with LTC for several months now, though the reasons for this correlation are unclear.

For a more complete look at BTC’s correlations with other assets throughout the past five weeks, see the following graph:

Appendix: Data Sources, Definitions, and Methodology

All cryptocurrency prices are denominated in USD unless otherwise noted.

We use two different in-house volatility indices in creating these reports:

1. 30-day historical volatility (HV) indices are calculated from daily snapshots over the relevant 30-day period using the formula:

30-Day HV Index = σ(Ln(P1/P0), Ln(P2/P1), …, Ln(P30/P29)) * √(365)

2. Daily historical volatility (HV) indices are calculated from 1440 snapshots over the relevant 24-hour period using the formula:

Daily HV Index = σ(Ln(P1/P0), Ln(P2/P1), …, Ln(P1440/P1439))* √(1440)

S&P 500 performance data are collected from Yahoo! Finance using GSPC (S&P 500 Index) data. Gold performance data are collected from Yahoo! Finance using XAU (Philadelphia Gold and Silver Index) data.

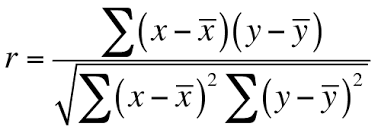

30-day asset correlations are calculated using the Pearson method, in accordance with the following formula:

In our calculations, x = 30-day returns for BTC/USD, y = 30-day returns for the other asset in consideration, and r = the correlation coefficient between BTC and the other asset in consideration.

The cryptoasset data sources aggregated for crypto prices, correlations, and volatility indices presented and analyzed in this report are the following eight exchanges, the order-book data of which we collect and store in real time:

- bitFlyer

- Binance

- Bitstamp

- Bittrex

- Coinbase

- Gemini

- itBit

- Kraken

Our indices’ integration of data from multiple top liquidity providers offers a more holistic view of the crypto market’s minute-to-minute movement. There are two problems with looking to any single liquidity provider for marketwide data:

- Different liquidity providers experience widely varying trade volumes. For example: according to CoinMarketCap, Binance saw over $20 billion USD in trading volume in November 2018, whereas Bitstamp saw $2 billion USD in trading volume in that same time — an order-of-magnitude difference. Therefore, treating any single liquidity provider’s data as representative of the overall market is myopic.

- Liquidity providers routinely experience interruptions in data collection. For instance, virtually every exchange undergoes regularly scheduled maintenance at one point or another, at which point their order books are unavailable and they therefore have no market data to collect or report. At best, this can prevent analysts from getting a full picture of market performance; at worst, it can make it virtually impossible to build metrics such as historical volatility indices.

Building volatility indices that collect real-time data from many distinct liquidity providers mitigates both of these problems: collecting and averaging data from different sources prevents any single source from having an outsized impact on our view of the market, and it also allows us to still have data for analysis even if one or two of those sources experience interruptions. We use five redundant data collection mechanisms for each exchange in order to ensure that our data collection will remain uninterrupted even in the event of multiple failures.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.