On May 13, 2019, the Chicago Mercantile Exchange (CME) reported a daily volume of over $1.3 billion in notional value for Bitcoin futures contracts traded. The CME is a regulated exchange based in the United States, but unregulated exchanges outside of the U.S. report even higher volumes for futures trading. On the same day, BitMEX reported $13 billion in notional value traded.

The Bitcoin futures market represents a significant and growing segment of the market. In this article, we’ll explain what Bitcoin futures are, and we’ll walk through the current major venues for futures trading.

What Are Futures?

In traditional markets, a futures contract constitutes a legal agreement to buy or sell an underlying asset at a predetermined price at a set future date. It is an example of a derivative: a contract between two (or more) parties whose value derives its price from an underlying asset.

Like arbitrage, the seemingly modern concept of futures is actually exceedingly ancient. Primitive futures contracts existed as far back as 1750 BCE, when Hammurabi, the sixth Babylonian king, created a legal code that allowed sales of goods and services to be delivered at an agreed-upon price at a designated date in the future.

Traditionally, futures contracts were a means for agricultural stakeholders to hedge against the volatility of agricultural prices. This is why the U.S. futures market grew up in Chicago as the Chicago Mercantile Exchange (CME): Chicago’s position at the center of the U.S.’s agricultural heartland made it an apt center for agriculture-based derivatives.

The textbook way of understanding futures is as a hedge against future price risk. Say that you’re a soybean farmer. The current price per bushel of soybeans is $10, which affords your operation a healthy profit. However, your crop won’t be ready for harvest for another 3 months, and you worry that, by then, the market will have gone down. Selling a soybeans futures contract would allow one to lock in the $10 price today at some future time (e.g., 3 months), thereby hedging against the risk of the market going down by harvest time. If prices go to $7, you would be selling your soybeans at $3 lower than you would have liked, but you would also have gained $3 on the future, effectively netting you $10 for soybeans.

While futures were originally created to hedge against price risk, they’ve increasingly been used as a financial instrument for speculating on future price movements of an underlying product. For example, if one didn’t grow soybeans but expected that the price of soybeans would be higher in 3 months than today, one could buy futures contracts for $10 per bushel of soybeans, with the expectation that they’ll go up. In 3 months, if the price has indeed gone up, one could sell those contracts, which were bought for $10, and pocket the difference as profit.

For traders, futures are a valuable way to profit off price movements in either direction in everything from commodities, to currencies, to equities, and even to weather — without actually needing to buy and manage the underlying assets being traded.

Futures contracts all have a predetermined date and time at which they expire (e.g., a month, a quarter). Once a contract expires, it is settled in one of two ways:

- Physical settlement: The contract is settled upon expiry with the underlying physical asset.

- Cash settlement: The contract is settled in cash by taking the difference between the price of the contract at the time it was purchased and the price at settlement.

With Bitcoin futures, the same principles apply. Cash-settled Bitcoin futures offered by institutions like the CME allow traders and institutions to gain exposure and/or hedge their exposure to the cryptoasset without actually having to manage their own private keys or create an account on a cryptocurrency exchange to buy bitcoin.

Similar to futures in traditional assets, Bitcoin futures provide traders with a tool for hedging risk and speculation. A miner, for example, might sell Bitcoin futures as a hedge against price volatility. Similar to our soybean farmer, a miner will “harvest” BTC at some point and want to sell it. To hedge against the risk of BTC’s price going down, they could sell a futures contract that would lock in a specific price of BTC for a specific future date. And, similar to the soybean speculator, a trader who doesn’t mine BTC could use Bitcoin futures contracts to speculate on the price of BTC at a future date.

Proponents of Bitcoin futures say that they can help increase liquidity within the nascent market and reduce volatility by giving traders more ways of managing risk. While early options for trading Bitcoin futures occurred on unregulated exchanges, the arrival of Bitcoin futures trading on regulated exchanges like the CME can lead to higher liquidity and broader institutional acceptance for the market. Regulated Bitcoin futures trading arrived in December 2017, giving institutional investors the ability to take long and short positions on Bitcoin without having to actually manage the asset directly. While initial trading volume for regulated Bitcoin futures was low, it’s picked up substantially in 2019 on the CME to an average of $515 million in notional value traded per day in May.

Where to Trade Bitcoin Futures

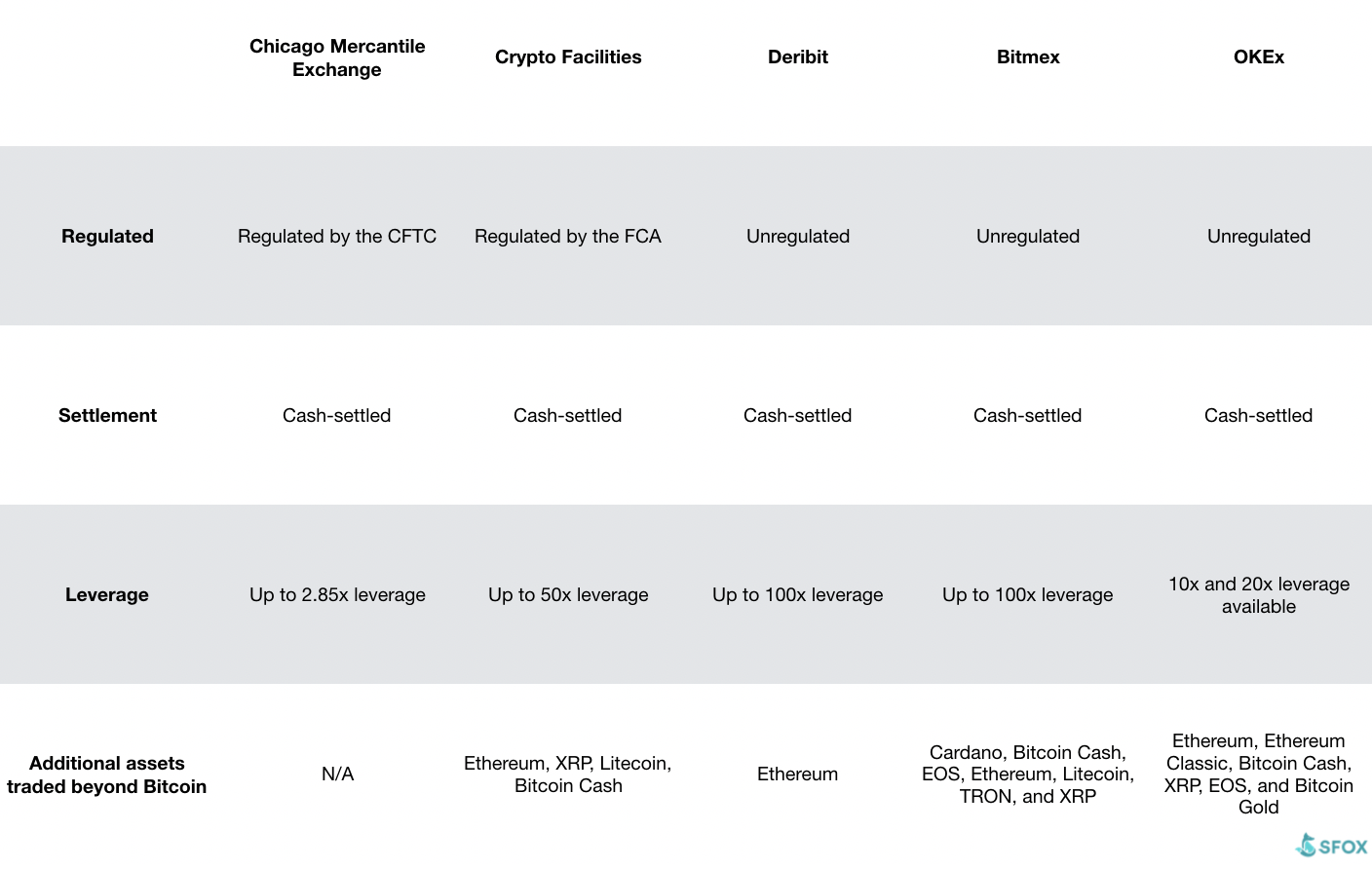

If you want to actually trade Bitcoin futures, there are a lot of options to navigate, and it’s hard to know where to begin. Some exchanges are regulated institutions that operate within the United States, while others are incorporated in Malta or the Seychelles. Right now, venues only offer cash-settled futures contracts, but there are variants if these contracts are denominated in USD or in BTC. Additionally, physically settled contracts are being worked on by major players and should be available in the near future. Below, we’ll help you cut through the noise by walking through the key trading venues for Bitcoin futures.

Note that SFOX doesn’t endorse any of the options provided below, which are listed for your convenience only. Always do your own research when choosing trading strategies, tools, and venues.

Chicago Mercantile Exchange

The CME was created in 1898 as a commodities exchange for butter and eggs. It is now one of the biggest financial exchanges in the world, specializing in futures and options across industries, from agriculture to metals to real estate.

The CME launched Bitcoin futures trading in December 2017, and volume on the exchange has been rising since then. On May 13, 2019, daily notional volume for Bitcoin futures on the exchange exceeded $1 billion.

- Trading hours are from Sunday to Friday, 6pm to 5pm ET, with a one-hour break each day at 5pm.

- Quarterly Bitcoin contracts available for March, June, September, and December. Futures expire on the last Friday of the contract month.

- 35% margin requirement for futures contracts.

- All-time-high notional daily volume of $1 billion on May 13, 2019.

- Bitcoin futures on the CME are regulated by the Commodity Futures Trading Commission (CFTC).

Crypto Facilities

Founded in London in 2014 by Jean-Christophe Laruelle, Crypto Facilities offers cryptocurrency pricing data and derivatives trading. The company was acquired by cryptocurrency exchange Kraken in February 2019.

- Trading hours are 24 hours a day, seven days a week.

- Perpetual, monthly, and quarterly BTC futures contracts available.

- Leveraged trading available of up to 50x.

- Regulated by the Financial Conduct Authority.

- Beyond Bitcoin, futures contracts are also available for four different cryptoassets: Ethereum, XRP, Litecoin, and Bitcoin Cash.

- API available for algorithmic trading.

Deribit

Founded in 2015 by John Jansen, Deribit is based in the Netherlands and focuses on the leveraged trading of crypto options and futures.

- Trading hours are 24 hours a day, seven days a week.

- Leveraged trading available of up to 100x.

- BTC and ETH futures contracts available.

- Quarterly Bitcoin contracts available for March, June, September, and December. Futures expire on the last Friday of the contract month.

BitMEX

BitMEX was co-founded by Arthur Hayes, Ben Delo, and Samuel Reed in 2014. BitMEX was created with a specific focus on cryptocurrency futures contracts and derivatives. Incorporated in the Seychelles, it operates out of Hong Kong. While BitMEX has the highest volume of any Bitcoin futures exchange, it isn’t registered with any regulatory bodies and doesn’t require identification (KYC) for deposits and withdrawals.

- Trading hours are 24 hours a day, seven days a week.

- Perpetual, quarterly, and bi-quarterly futures contracts available for BTC. Futures contracts expire on the last Friday of the contract month at 8pm ET.

- Leveraged trading available with margin deposits of between 1x to 100x per trade.

- Beyond Bitcoin, futures contracts are also available for six different cryptoassets: Cardano, Bitcoin Cash, EOS, Ethereum, Litecoin, TRON, and XRP.

- $4 billion notional daily trading volume as of May 2019, and $1 trillion in notional annual trading volume as of 2019.

- Trading is unavailable in: the United States; the province of Québec, in Canada; Cuba; Crimea and Sevastopol; Iran; Syria; and North Korea.

OKEx

OKEx is the international arm of the OKcoin exchange, which was founded in 2013 by Star Xu. Based out of Malta and run from Hong Kong, OKEx is reportedly the sixth-largest cryptocurrency exchange by trading volume. OKcoin has offered Bitcoin futures since 2014.

- Trading hours are 24 hours a day, seven days a week.

- Weekly, bi-weekly, and quarterly futures contracts are available. Futures contracts are settled on the Friday 12pm of the expiration week.

- Leveraged trading available at 10x or 20x position size.

- Beyond Bitcoin, futures trading is available for seven additional cryptoassets: Ethereum, Ethereum Classic, Bitcoin Cash, XRP, EOS, and Bitcoin Gold.

- $1.89 billion in notional daily trading volume as of May 31, 2019.

- Trading is unavailable in the United States, Hong Kong, Cuba, Iran, North Korea, Crimea, Sudan, Malaysia, Syria, Bangladesh, Bolivia, Ecuador, and Kyrgyzstan.

Know Your Counterparty

While the Bitcoin futures market is growing rapidly, it’s important to understand that not all of these platforms are created equal. This spans from the actual types of contracts being traded, to whether how they settle, to the amount of leverage available when taking a position. All of these factors are important, but equally important is the reputation of the entities you’re trusting with your money. Doing your own research and understanding whom you’re working with is crucial before diving into Bitcoin futures or any other financial instrument.

Fortunately for investors, there are more options for Bitcoin futures than ever before. Bitcoin futures may have begun largely on unregulated exchanges, but we’re seeing significant volume growth on regulated exchanges such as the CME. While there’s still a long way to go, it’s an important milestone in the continued financialization of Bitcoin.

Looking for the best price execution on crypto spot trading? Open your free SFOX account today.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.