In an emerging asset class that splits its marketplace between hundreds of different trading venues, sophisticated investors may hunt for arbitrage opportunities—this, in a nutshell, is why many have been chasing Bitcoin arbitrage for the last decade.

Even after ten years of maturation, Bitcoin is certainly still apt for arbitrage opportunities—that’s why SFOX offers a comprehensive arbitrage alert system—but the precise method a trader uses to try to capture arbitrage could make the difference between a sustainable strategy and a fool’s errand. In particular, while it might seem intuitive to capture Bitcoin arbitrage by opening and maintaining accounts at multiple Bitcoin trading venues, this strategy actually introduces trading inefficiencies that can erase the margins from any arb opportunities you may find.

On the other hand, a single point of access to the entire Bitcoin market can allow a trader to overcome these inefficiencies, seamlessly identifying and capturing Bitcoin arbitrage from a single interface that’s facilitated over $12 billion in transaction volume among leading crypto funds and traders since 2014. Today, we’re taking traders behind the scenes of how SFOX’s single point of access to the global crypto market makes sophisticated trading strategies like Bitcoin arbitrage uniquely feasible at scale.

The Problem: Bitcoin Arbitrage Fails If You Introduce Your Own Inefficiencies in an Effort to Capture Market Inefficiencies

Whether you’re talking about Bitcoin arbitrage or silver arbitrage, the name of the game is to recognize and profit off of pricing inefficiencies—for instance, buying BTC on an exchange where someone is selling it for $X and selling it on another exchange where someone is looking to buy that much BTC for $Y, where Y>X. However, the path you take from buying the asset to selling the asset makes a difference—and some of the most common paths run the risk of bogging you down with inefficiencies that materially outweigh the potential arb you could have captured.

Broadly speaking, there are three buckets of inefficiency to which an ill-conceived Bitcoin arbitrage strategy can fall victim: capital inefficiencies, operational inefficiencies, and infrastructural inefficiencies.

Capital Inefficiencies

For larger traders and funds looking to operate a strategy at scale, opening and managing crypto trading accounts at multiple venues can initially seem quite appealing: with some portion of one’s funds available at all major crypto trading venues, one can theoretically choose to trade on whichever exchange currently has the best prices available—not to mention that this puts one in a position to buy BTC from one venue and sell it on another venue when Bitcoin arbitrage opportunities arise.

However, the devil is in the details, and the details make this strategy much less appealing in terms of efficiently and scalably deploying capital. In the first place, if one is maintaining holdings at multiple trading venues in order to arb BTC or secure the best BTC price when trading, then, necessarily, one will only be able to deploy a fraction of one’s capital with each trade. Even if a fund only spreads its capital across three exchanges, that means they’ll only be able to execute trades with one third of their capital at a time, assuming an equal distribution of funds across the exchanges. That introduces a significant scale limitation on active crypto traders.

On top of that, traders specifically looking to execute Bitcoin arbitrage strategies at scale can find themselves hampered by the costs—both in terms of money and time—required to maintain a proper balance of funds across trading venues. In order to reliably capture arbitrage while maintaining accounts on multiple trading venues, one must have both USD and BTC holdings on these various venues so that one can simultaneously buy and sell BTC on the appropriate venues when mispricings arise (assuming that BTC/USD is the pair that one is arbing). That requires active monitoring and reallocation of funds to ensure that particular trading accounts don’t run out of BTC or USD as arbs are executed—and that process can cost bps (in wire, network, and trading fees) and time (especially in the transferring of BTC). The result is that the Bitcoin arbitrage opportunity may be gone by the time one’s funds are in position in the appropriate accounts, or else the fees incurred may have canceled out the arbitrage altogether.

Operational Inefficiencies

Beyond the actual feasibility of trading on multiple accounts, this approach to crypto markets invites acute operational headaches. Case in point: if any trader is looking to ruin their relationship with their accountant, they might consider simply dumping transaction reports from multiple crypto trading venues on their desk!

Especially in this era when many trading venues are only just beginning to take crypto reporting seriously, the reporting tools available can vary widely, both in terms of formatting and in terms of the actual information available, from one venue to another. This can make basic operational tasks comically challenging—setting aside the matter of filing taxes, for instance, the even more basic task of understanding one’s P&L can require some serious heavy-lifting when adjudicating multiple proprietary, incommensurable transaction reports.

This problem shows its true colors, though, when we consider the most basic “operational” task a trader might complete on a regular basis: simply determining which trading venue has the best price for BTC at any given time. It’s all well and good to say that one is going to open multiple trading accounts in order to capture Bitcoin arbitrage or always find the best price when buying or selling BTC, but how does one expect to actually track the prices of BTC on all of these venues at once?

- A trader might all the accounts open in separate tabs on a browser and feverishly check them manually, but that’s neither scalable nor sustainable.

- A trader might engineer a single, automated stream tracking and comparing prices on all the trading venues in question, but that’s easier said than done. This kind of system requires years of time and millions of dollars to build in a reliable and secure way (trust us: that’s exactly what we built at SFOX!).

Infrastructural Inefficiencies

Finally—yet perhaps most significantly in the current market environment—are the risks of infrastructural issues that may arise from trading from accounts at multiple venues.

Multiple trading venues introduce multiple potential points of failure in one’s trading infrastructure, which has the potential to significantly undermine a robust trading strategy—especially given the fact that trading venues have recently been wont to experience unexpected outages during times of increased market volatility. At best, an unexpected outage can undermine one’s ability to capture Bitcoin arbitrage opportunities, which, historically, have cropped up more frequently in times of higher market volatility; at worst, sudden exchange outages can leave one unable to edit one’s open orders on the exchange in question.

Bitcoin arbitrage is a delicate balancing act between capitalizing on market inefficiencies without falling prey to other market inefficiencies in the process; and, when one tries to arb from distinct accounts at multiple crypto trading venues, those potential inefficiencies are legion. SFOX’s integrated platform, in contrast, was custom-made to make Bitcoin arbitrage and other global crypto trading strategies reliably efficient at scale.

The Solution: A Maximally Efficient Trade-Routing System that Captures Marketwide Crypto Prices without Requiring Separate Account Management

Over the last 6 years, SFOX has engineered, maintained, and continually improved a crypto trading platform that solves the above inefficiencies through a deceptively simple model: its smart-routing order types intelligently route traders’ orders to the trading venues with the best prices, allowing them to capture Bitcoin arbitrage and otherwise secure best-price execution on their trades without introducing the problems that come from opening and managing accounts at a diversity of crypto exchanges.

Putting Capital to Work Efficiently on All Crypto Trading Venues

At the heart of SFOX’s model is the trading platform that allows traders to trade on all major trading venues without actually maintaining accounts or funds on those venues: SFOX itself connects with those venues and maintains its own funds on those venues, allowing traders to view and execute trades on all of those venues from one integrated order book while using SFOX as the actual counterparty for all the trades being executed.

One consequence of this model is that traders and funds don’t need to split their capital between multiple balance sheets at multiple exchanges: by using SFOX, they can trade using 100% of their capital and have that capital automatically routed to the trading venue with the most advantageous pricing.

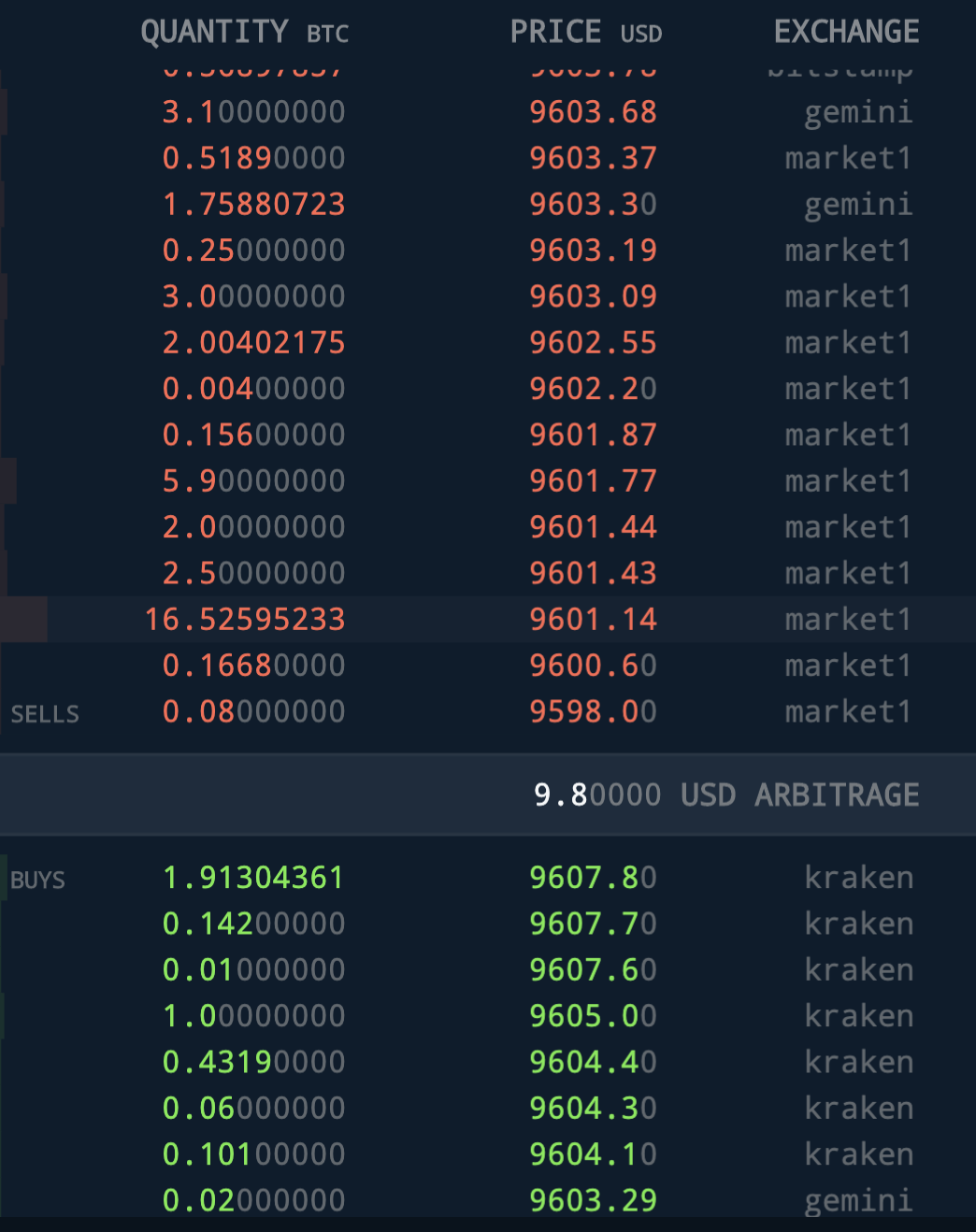

The capital efficiency of this model is even more obvious to traders running serious Bitcoin arbitrage strategies: the only “transfers” or “balancing” they need to manage are fund deposits into their SFOX account. Once their USD or BTC are in their SFOX account, those funds can be routed to any major crypto exchange or OTC desk using SFOX’s smart-routing order types in an average of 5 milliseconds, capturing mispricings almost instantly without incurring transfer or network fees in the process. In fact, SFOX’s order book actually shows “arb” in place of “spread” when an arbitrage opportunity appears, making it all the easier to recognize and capture crypto mispricings.

Operational Unity is Operational Efficiency

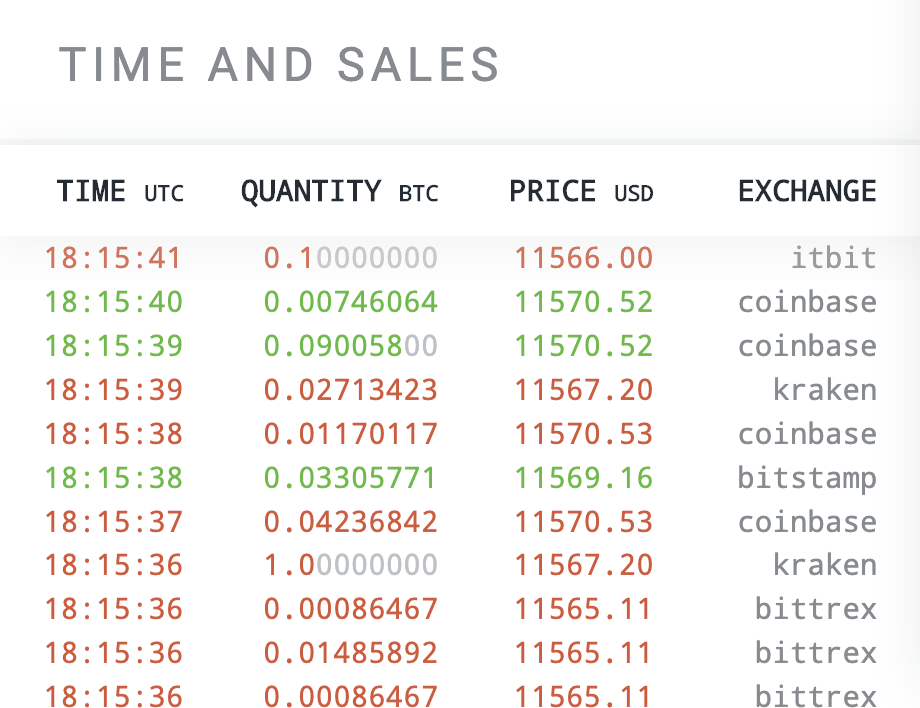

A lot of operational magic happens when crypto trading takes place within a single, globally integrated ecosystem. Instead of managing multiple tabs or jerry-building a homemade system to track marketwide crypto prices, SFOX funds and traders see order-level price data from across the market in real-time, leaving no ambiguity as to where the best pricing opportunities are—and providing the necessary tools to immediately capture those prices. If a marketwide order book isn’t enough, SFOX’s UI also features a Time and Sales module that provides a real-time feed of the actual trades being made: how large the trade is, where the trade happened, and whether the order’s taker was buying or selling.

A single trading interface also means a single transaction report that captures a trader’s entire trade history on SFOX in an easy-to-interpret table, providing all the difficult-yet-necessary details like USD values for crypto-to-crypto trades. That means fewer headaches for active traders—and their accountants!

Serious Infrastructure for Serious Traders

The proof of SFOX’s infrastructure is in the numbers: 99.99% uptime since its launch in 2014. SFOX’s trading platform stays online when one or several of the trading venues to which it’s connected experience downtime; this means that in times of market volatility, if an exchange were to experience “unexpected downtime,” an SFOX trader would not be locked out of trading as a result of that outage. To the contrary: they would have the freedom to trade that volatility and potential arbitrage opportunities, if they so wished, across all the trading venues that remained online—and they’d be able to do so from a single-login account.

By the way: for more advanced and automated traders, SFOX also has a reliable and thoroughly documented API, which allows traders to plug into and leverage all of these platform benefits in an automation- and bot-friendly environment.

It’s All About Tools

Newcomers to crypto trading often warn others not to get caught “holding the bag,” referring to the risk of taking a sizable position in an altcoin, watching its price spike, and failing to sell it before the price recedes.

For more sophisticated crypto players, though, there’s a much subtler risk of bag-holding of which to be mindful: the risk of creating more inefficiencies for oneself than the market inefficiencies one is trying to capture through a trade.

The world of crypto is especially risky in this regard: as an emerging market, one might be rightly tempted by the potential mispricings one could potentially capture through strategies like Bitcoin arbitrage, yet in many cases, the infrastructure for professional trading is itself inefficient.

On the other hand, you could choose SFOX and join a community of sophisticated traders who have been quietly getting edge on the crypto market for over half a decade. Sign up for free now and check out all the tools at the pro crypto trader’s disposal.