Trading is all about generating consistent, long-term returns on an investment. Having a solid trading strategy and utilizing careful risk management are crucial to this process, as is having the best cryptocurrency trading tools. However, understanding current market conditions could also help to improve the returns earned from one’s trading strategy.

Gaining insight into trends, tools, and practices offers traders an edge in the market. This article will cover what a trading edge means, how to find one in the cryptocurrency market, and how to incorporate it into a trading system.

Finding Your Edge in Crypto

In general, an edge is something that gives you an advantage over your own past performance, or over other people. Let’s say a basketball team plays another team on their home count, giving them a familiarity with the terrain that allows them to do better than their visiting opponents. That “home-court advantage” constitutes an edge. You can gain an edge in any activity where you’re quantifying your success, and that applies to trading as well.

A trading edge is something that gives traders a quantifiable advantage in a given trading scenario. This could be an observation of a certain market pattern, an actionable insight into market-moving events surrounding a cryptocurrency, or a technique used in placing trades.

In crypto, exchanges suffer from a lack of liquidity that causes price differences and arbitrage opportunities. For crypto traders, buying and selling funds for the best possible price is the goal, and anything that increases the profit margin when trading is an edge.

Let’s take a look at some examples of edge and how to find them.

Market Data

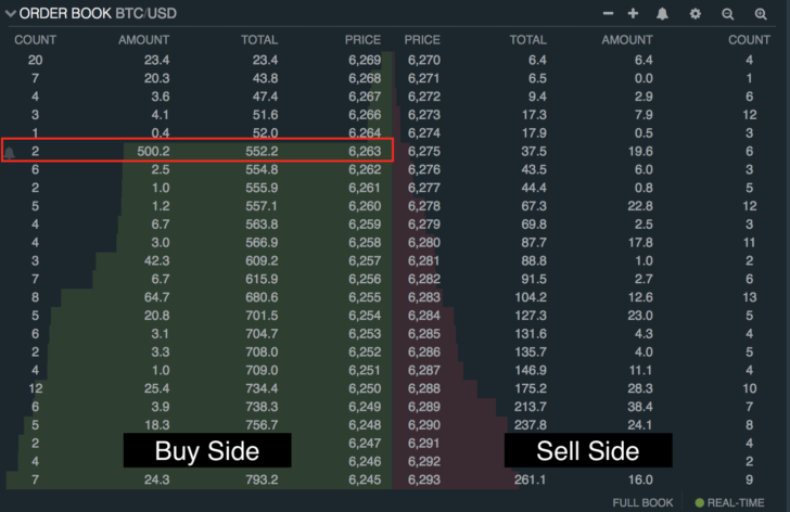

Having access to different sources of market data can give traders an edge over the market. For example, analyzing the order book of a cryptocurrency exchange may offer insight into short-term market sentiment. This is an example of market data which virtually all traders will see, and will give an edge to those who know how to read it. The image below shows a “buy wall,” a large buy order of over 500 bitcoins placed on the Coinbase Pro exchange.

The highlights on each row of orders show the density of supply on the sell side vs. the demand on the buy side. In this case, demand is higher than supply. If the order of 500.2 BTC at $6,263 stays open, that sum of BTC needs to be sold at that price before the price can drop any lower. Because it’s a large order, it acts as a line of support — other people viewing the order book can see that there’s a major “wall” between them and a lower price.

Some buyers may infer that the price is going to get higher and place their own buy orders to get in before it’s too late, and this act of FOMO can trigger upward momentum. This isn’t necessarily an intrinsically sound inference, though, as the demand these buyers perceive in the order book may be artificial.

Whales often create large buy orders so they can sell their holdings at an inflated price, or the reverse. As we can see, being able to read the order book isn’t a substitute for a trading strategy; it is, however, one of many edges that can be used as part of a trading strategy.

Broader Data Sources

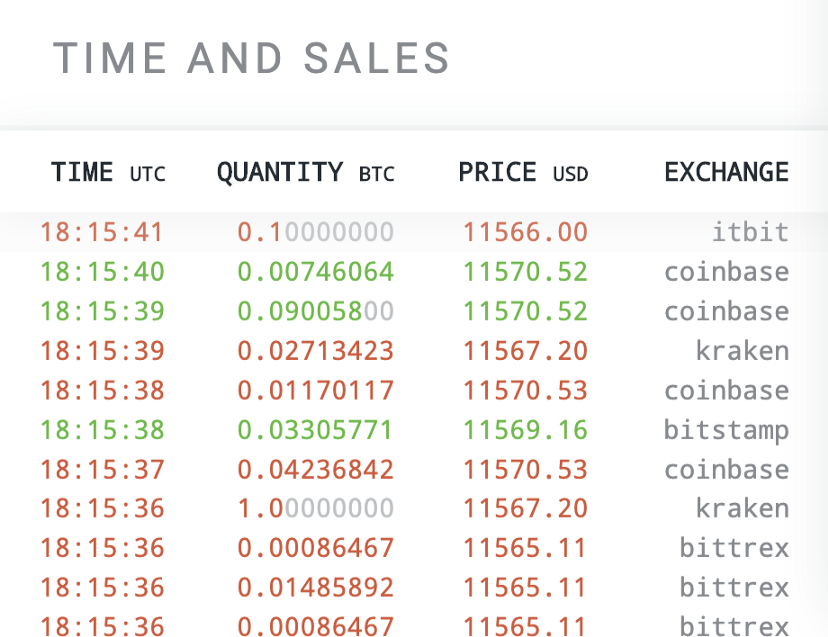

One way to see beyond whale activity on individual exchanges is to view trade direction on the wider market. FoxEye is a suite of SFOX trading tools that allows users to view and analyze the crypto market. The Time and Sales tool in FoxEye offers a live feed of trades for a given crypto asset across many different exchanges, giving traders a broader sense of the current market sentiment for that asset. Unlike the above example, not every trader on the market has this information, giving those who do an advantage over the rest.

Instead of monitoring a crypto’s trading activity on one exchange, users can see market-wide performance, including trade amounts, trade times, price direction, and the relevant exchange. If the Time and Sales tool shows a rapid influx of new trades, this could indicate strong market activity, while less frequent trading could indicate a slower market. Users can see the rate of trades executed at a higher price than the previous trade, shown in green, while the reverse is shown in red. This is the kind of market-wide data that traders could potentially use as an edge — for example, if one exchange on the Time and Sales interface has a lot of green trades while many of the rest have red, this could present an arbitrage opportunity, and finding arbitrage is a type of edge.

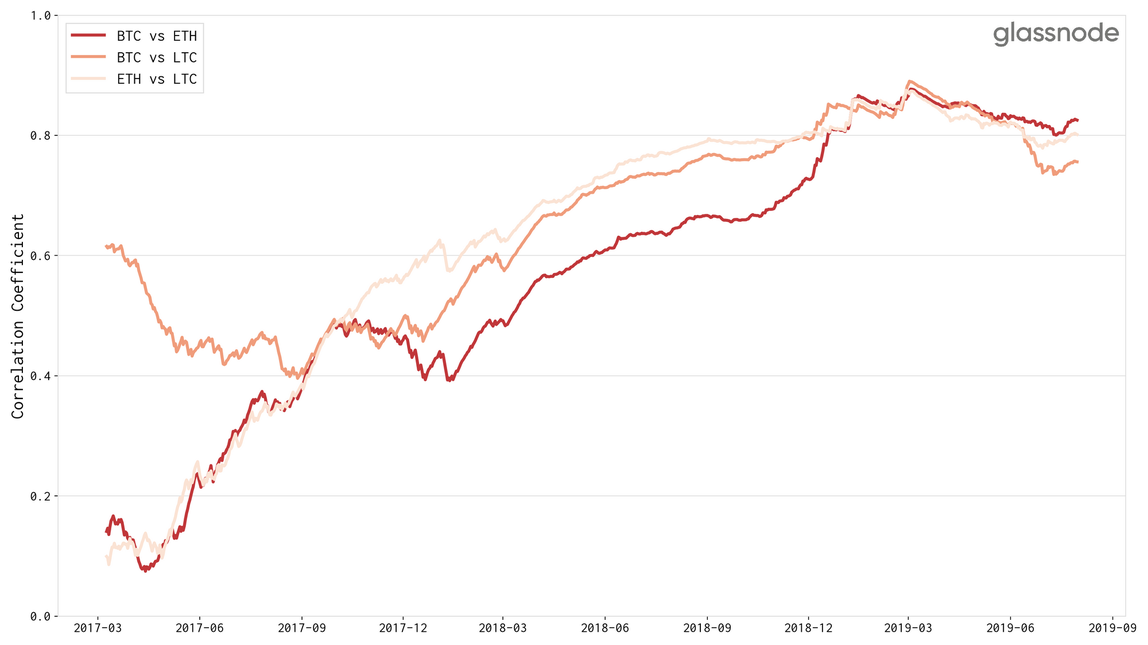

Traders can also get valuable market data from places like Glassnode, a site that offers on-chain analytics, actionable market insights, and crypto reports that can give traders a feel for the overall market or the performance of individual assets. The image below shows price correlations between LTC, ETH, and BTC. Monitoring market trends and inter-currency correlations can be used to give traders an understanding of how the price action of one coin may be affected by that of another.

The Glassnode report on the correlation between these currencies found that when their prices are correlated, their on-chain activity levels are often also correlated. By comparing the currencies with over a dozen metrics, including fees and the number of sending addresses, Glassnode came to the conclusion that “If it becomes too expensive to send bitcoins over the [Bitcoin] network, the activity in the Litecoin network increases.” This kind of niche insight can be a valuable tool in trading — all the more when not many people are using it yet.

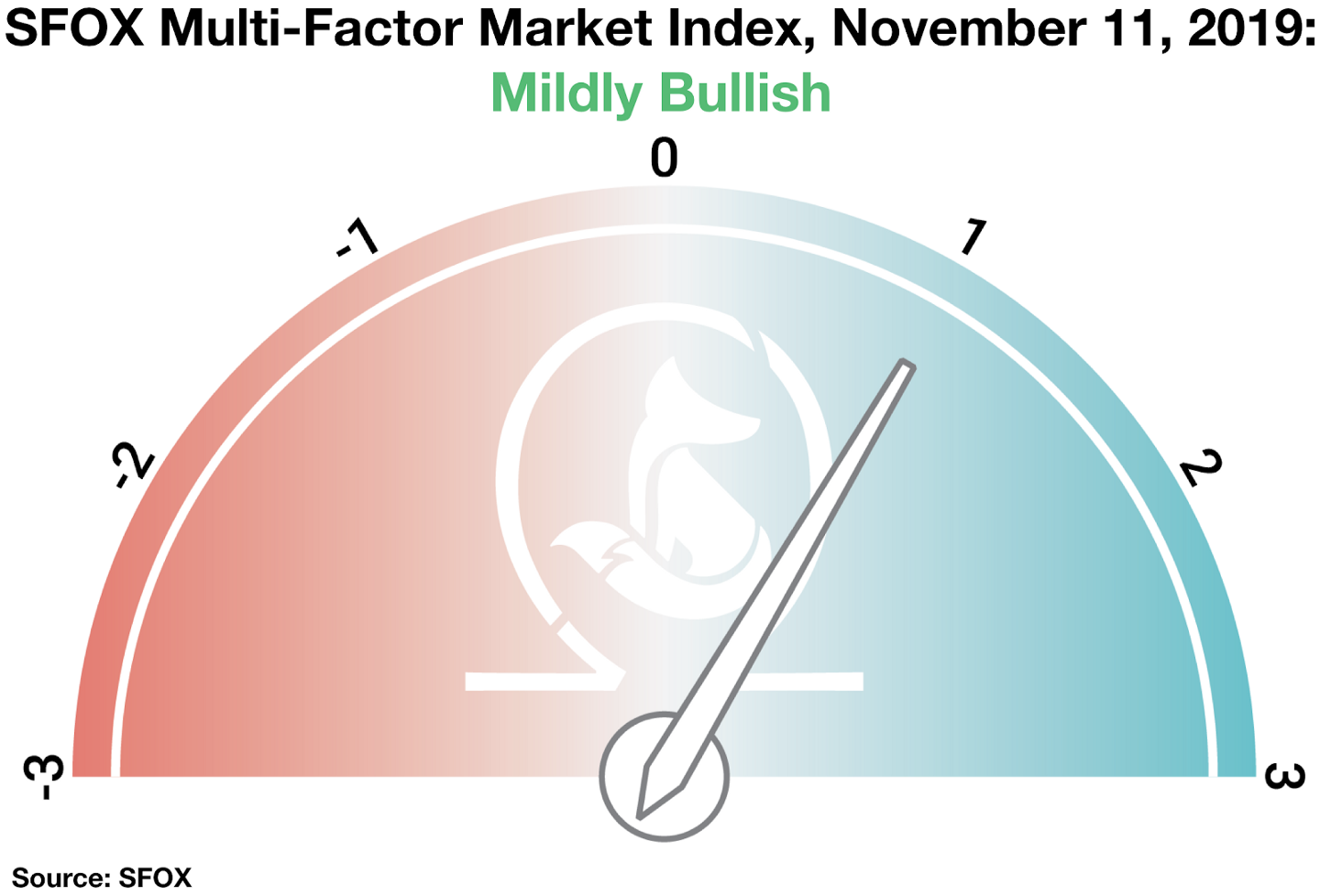

SFOX also offers reports that can give traders an advantage: volatility reports. Our latest volatility report reveals findings from the SFOX Multi-Factor Market Index, which moved from neutral to mildly bullish as of November 11, citing unexpected bearish signals in terms of institutional and enterprise interest in Bitcoin.

The report also indicates that market movements have been correlated with mainstream media news on Facebook’s Project Libra and China’s sentiments toward blockchain, making these items worth keeping an eye on in future. Like with the other data sources, following these reports and reading them early can give traders more context and a better understanding of the market they’re trading in.

Building Strategies with Edge

Data sources are among the many ways traders can find an edge. But how are edges incorporated into trading strategies? We’re going to continue looking at examples of edges and think about how to build out trading strategies with them.

Data-Based Trading

Let’s say a trader has gone through reports like the ones provided by SFOX and Glassnode. They’ve been studying order books, reading on-chain data, and developed a better sense of when and how the market has moved around historically, thereby cultivating an edge. One way to develop that edge into a strategy would be to backtest it against more historical data. Traders can order historical data for exchange order books and see whether their initial interpretation of particular buy and sell walls, for example, is generalizable to broader data sets.

Doing this could allow traders to identify a strategy for locating entry and exit points in the market based on their own criteria. Traders can combine their view of buy/sell activity in conjunction with various other market indicators to evaluate for themselves whether any of these combinations may potentially improve the results of their trading. With proper risk management, edge can develop into a full-blown trading strategy. Here’s an example of trader Quant Fiction building out and testing an edge based on market data:

Quant Fiction later posted that the results no longer applied to current market conditions, highlighting the temporal nature of some data-based edges in trading.

Algorithmic Trading

Algorithmic trading is one of the ways traders may try to improve their returns in the market. The majority of stock market trading is automated, with bots making trading decisions faster than would be possible for the human mind. There are many algorithms available to cryptocurrency traders now as well, offering a way for them to further develop their trading strategy.

For example, knowing where the market is moving is only half the battle. For many traders, it’s a struggle to have their limit order filled at the right price before the market moves and they’re undercut. Particularly for scalpers, these delays to market entry could potentially kill trades and result in lost opportunities or, worse, lost capital.

The ability to get an order filled fast at the right price is another example of an edge, and that’s what the SFOX Smart Routing algorithm is designed to do. Traders wishing to buy or sell larger amounts often need to go deeper into the order book to fill their order, and this can pose problems. With SFOX’s Smart Routing, orders are swept across all exchanges and liquidity providers, rather than on a single order book, reducing traders’ price slippage. Let’s imagine a trader wishing to buy 10 BTC in December at $7,195.10. With smaller orders at the top of the queue, the 10 BTC order would eat into the sell side of the order book, causing the trader to lose value as the order fills.

Even worse, other traders and bots could front-run the order, getting in ahead and delaying the order, causing the price to increase further. The SFOX Smart Routing algorithm breaks an order up into smaller amounts and distributes it across multiple exchanges, allowing for greater liquidity and agility. The process is automated, and our algorithm assesses the liquidity across many exchanges and places the order accordingly. SFOX offers a total of nine advanced algorithms, many of which cater to institutional traders placing large orders, and all of which could be used to give traders an edge in the market.

Adaptive Mindset

Perhaps the key takeaway here is that market edges do not necessarily last forever. Some edges offer an advantage for short time frames before the market catches on. Everyone is always searching for the next edge to give them an advantage over others. Traders don’t necessarily need to find one edge to hold onto forever; rather, traders may get into the mindset of identifying potential short-term and long-term edges and trying them out in safe environments such as historical data sets.

With an adaptive mindset, traders are considering:

- When to trade

- When not to trade

- Which new edge to experiment with

Whether scalping divergences or trading within certain market ranges, the goal is to minimizing the randomness and optimize the returns of a trading strategy by identifying anything in the market that may hold the potential to improve the likelihood of winning trades.

Let’s say a trader is aiming to trade on a day with low volatility, and news comes out of a widespread regulatory crackdown on cryptocurrency in a large market. This could create larger price swings than anticipated, and traders need to consider whether they’re comfortable trading in that environment. While it’s not possible to predict the market, considering the many factors influencing price activity can set the stage for whether the time is right to open a position.

Studying fundamentals, keeping an eye on global macroeconomics, and reading CoT reports could all potentially provide traders with their next edge, to be used until it no longer applies. Building an edge is about constantly expanding and refining trading techniques.

Stay Informed

Identifying edges and using them can simply be a case of immersing oneself in the market. Our blog was designed to help give traders an edge by learning about trading, cryptocurrency fundamentals, and the market as a whole. We have strategic guides on trading, detailed case studies, market reports, and much more, giving traders a better sense of when to start sharpening their tools and waiting for the potential entry points for their next trade.

Of course, the SFOX platform itself was also designed to allow users to develop their edge. Our platform offers unique arbitrage opportunities by scanning vast swathes of crypto exchanges and searching for the best price out of all of them, as well as automated trading features designed to help traders optimize return. You can sign up for an SFOX account here.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.