When the crypto market is at its most volatile, you need to be able to execute trades at a moment’s notice. Unfortunately, this high volatility can force you to pay a huge premium to execute trades quickly if you don’t have the right trading tools at your disposal.

Imagine a scenario in which you have a 100-BTC position and the price of BTC jumps 10% in 15 minutes. There are high volatility and high trading volume but no obvious news, so you decide to sell your position for a profit as quickly as you can—before the price of BTC swings back in the other direction.

You may not realize it, but you’re now trapped in a dilemma: either you can sell off all of your Bitcoin as quickly as possible at a significant discount, potentially pushing down the market price in the process, or you can execute your trade more slowly and risk the price of BTC crashing while you wait.

This dilemma is why we developed Sniper: an institutional-grade trading algorithm built to execute large BTC trades as quickly as possible with as little slippage as possible.

Read on to find out how Sniper can help you with your quickest and largest trades, and then try it out directly from your SFOX account.

The hidden risks that hurt trade execution price

The explicit fees that exchanges show you for your trades aren’t the only ways your trades can cost you money — and the less obvious costs get magnified when you try to trade a lot of BTC quickly.

Factors like low exchange liquidity and large order size can lead to slippage in your trades: a worse price for your overall trade than you expected to get when you created your buy or sell order.

For example: suppose you’re trying to quickly sell off 100 BTC because the market is extremely volatile. You look at the order book and see that the current price for BTC is ~$4217.50 USD.

If you look at the quantities of BTC in the buy orders, though, you see that they’re way too small to accommodate a 100 BTC sell order at that top-of-the-book price. That means you’ll have to go deeper into the order book to sell all of your BTC, especially if you’re looking to do it quickly — and the deeper you go, the less your counterparties will be willing to pay for your BTC.

Worse, the very act of putting your large BTC order on the order book can shoot yourself in the foot. The large influx of BTC supply from your 100-BTC sell order can act as a sell wall that pushes the price of BTC down, getting you a worse price than you could have gotten for a smaller order.

You’ll also have to contend with the penny-jumper trading bots that are crawling over virtually every exchange: when you place an order, these bots instantly place small orders just in front of yours, preventing yours from filling and eating into your profits as you’re forced to adjust your order to increasingly bad price points.

These causes of slippage might be largely avoidable if you’re patient and have time to spare — for example, if you’re willing to wait hours, you could use a trading algorithm like our Time Weighted Average Price (TWAP) to gradually sell off your BTC in smaller amounts for a better price. If the market is extremely volatile, though, you might not be willing to risk the price of BTC nosediving as you wait for your trade to complete.

That’s when people get roped into biting the bullet and accepting significant slippage on their trades.

How Sniper minimizes slippage on large, fast crypto trades

With the crypto market being so volatile, we knew that sophisticated traders and institutional investors needed a way to quickly enter and exit positions with the minimum possible slippage. We built Sniper to do exactly that.

Sniper has six features that let you move large amounts of cryptocurrency quickly with minimal slippage.

- It’s a hidden order. Sniper orders don’t show up on order books, which keeps your order from being read as a sell wall or being front-run by bots.

- It can be either a limit order or a market order. You can set a limit price on Sniper order to make sure you don’t end up incurring more slippage than you’re willing to sustain — or, if you prefer to execute your order as quickly as possible even if it means going deeper into the order book, you can make it a market order instead.

- It’s an immediate-or-cancel taker order. Because Sniper is designed for trading when time is of the essence, it fills your order by immediately taking any orders available on the order book that are within your limit (if you set one). Any portion of your order that can’t be filled immediately is canceled.

- It slices your order. Sniper intelligently breaks your order into smaller fractions, preventing it from being recognized as a single giant order that would move the market.

- It uses smart-routing. Sniper connects to the many different exchanges that are integrated into SFOX’s order book and automatically routes the small fractions of your order to the exchanges that will get you the best price.

- It’s speed-optimized. Sniper is willing to incur some slippage in order to make sure that your order gets filled in a timely manner, since every second counts when the market is especially volatile.

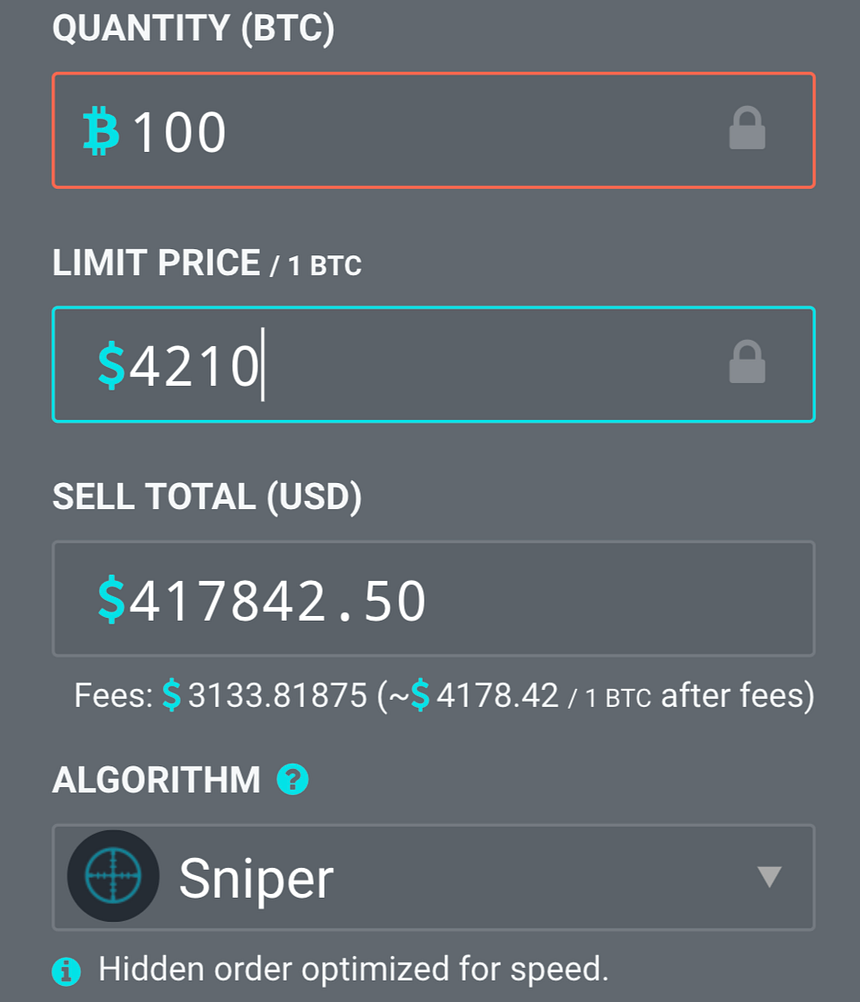

Let’s go back to our example of trying to sell 100 BTC when the top-of-the-book price for BTC is $4217.50 USD. If you use Sniper on SFOX, you can make sure that you execute this order right away with as little slippage as possible. Maybe you decide that you’re willing to accept slippage as long as the price you’re getting doesn’t fall below $4210.00. Set that as your limit price, and let Sniper fire away.

Now your order will be broken up and quickly, clandestinely executed across a range of exchanges to make sure that you get your limit price or better while moving the market as little as possible. You won’t get a price as good as you would if you were willing to slowly sell off your 100 BTC over a longer period — but, if the volatile market pushes BTC’s price down 10% in the next 15 minutes, you’ll be relieved that you exited your position quickly.

When not to use Sniper

To get the most out of Sniper, you also need to know when you’re better off using something else. Here are some situations when you’d be better off with another choice.

1. Don’t use Sniper when there isn’t much volatility in the market. If there’s not much trade volume and the price of your crypto is fairly stable, you’ll incur less slippage and get a better price if you’re willing to wait.

Instead of Sniper, consider our TWAP algorithm that trades a fixed percent of your overall trade over regular time intervals for a duration that you specify, from 1 hour to 24 hours. You could also use our Gorilla algorithm to gradually trade small portions of your order across multiple exchanges with the goal of getting the best price possible.

2. Don’t use Sniper when you’re trading a smaller amount. Sniper is specifically designed to handle the challenges of moving more than 10 BTC quickly with minimal losses. Trading a small amount of BTC with Sniper is like watering your houseplants with a firehouse: you’ll get the job done, but it’s way more power than you need.

For smaller amounts, instead of Sniper, consider our Hare algorithm that executes quick trades of lower quantities and saves you money by hopping over front-running bots.

3. Don’t use Sniper when you’re just starting out with SFOX. Sniper is an especially complex algorithm with a very specific use case, and it can be challenging to get ideal results with it when you’re new to SFOX.

Instead of Sniper, consider our Smart-Routing algorithm that breaks your order up and routes the pieces onto whatever exchanges will yield the best price, ensuring that you get a better price than trading on any single exchange.

If you’re missing your target, get a better gun

Even a few percentage points of slippage can be huge when you’re trading large sums of cryptocurrency. There’s no reason to settle for that as a necessary feature of the world: you just need tools that quickly and quietly move the kinds of orders that sell walls are made of.

Of course, having a sniper rifle doesn’t mean you should use it in every combat situation. Before you submit a Sniper order, ask yourself: “Is the market really that volatile, or am I just suffering from FUD?” If your emotions get the best of you, you might end up prioritizing order speed when you didn’t really need to.

But sometimes, you do need to. And when that happens, you’d better get your gun.

Want to see Sniper’s results for yourself? Head over to your SFOX account and see how it can minimize slippage on your largest, fastest trades.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.