Over the past year, the public attention on cryptocurrencies like Bitcoin has brought a diverse range of people together in one sector: everyone from technology enthusiasts to financial institutions is trying to understand what the future of crypto will look like and how they can profit from it.

That’s gotten a lot of people interested in trading for the first time. If you don’t have experience buying and selling something like securities, trying to trade crypto can feel like learning to swim in the deep end of a pool. That’s why we’ve created this glossary of foundational trading concepts to help you get oriented as you start buying and selling Bitcoin, Ether, and more.

Types of Assets

Fiat

Fiat refers to government-issued currencies, such as the U.S. dollar, the euro, and the renminbi. These typically are contrasted with cryptocurrencies, although those two categories are beginning to blur as governments, like the government of the Bahamas, plan to issue their own cryptocurrencies.

Cryptoasset

Cryptoassets are assets in the form of a digital token, secured by cryptography and built on blockchain technology. The term refers to the token itself rather than the software upon which it is built. For example, Ethereum’s cryptoasset is ether (ETH). In some cases, including Bitcoin, the software and the cryptoasset bear the same name — for those currencies, you can distinguish between them because the name of the software is capitalized (“Bitcoin”) while the cryptoasset is written in all lowercase (“bitcoin,” or “BTC”).

Altcoin

“Altcoin” is a term primarily used by Bitcoin maximalists, proponents of Bitcoin who think that it is superior to all other cryptocurrencies. They use this term to denote any and all cryptocurrencies that are not BTC.

Stable Coin

Stable coins are cryptocurrencies intended to maintain a stable price and value, in contrast to the other extremely volatile cryptocurrencies. Tether, for instance, is a project that issues tokens with value pegged to particular fiat currencies — for example, the USDT, a token designed to always be worth $1 USD.

Types of Cryptoassets

Bitcoin (BTC)

Bitcoin (BTC), conceived in a white paper by Satoshi Nakamoto in 2008, was the first modern cryptocurrency that paved the way for the larger cryptocurrency ecosystem. It is still the largest cryptocurrency by market cap. Its primary use cases are as a form of digital currency and as a digital store of value.

Ethereum

Ethereum (ETH), the second-largest cryptocurrency by market cap, was proposed by Vitalik Buterin in a 2013 white paper. This blockchain is intended to function as a kind of global, decentralized computer, with a Turing-complete programming language and a layer of smart contracts that allow developers to create everything from decentralized applications to tokens powering ICOs.

Litecoin

Litecoin (LTC) is a “clone” of Bitcoin released in 2011 by Charles Lee, but with a larger pool of total coins, shorter block processing times, and a different hashing algorithm. Lee believed that BTC was better suited to be a store of value, like gold, rather than a true currency. He created LTC to be the digital equivalent of silver: it’s in the same asset class as Bitcoin’s digital gold, but LTC is designed to be less valuable and easier to transact with.

Bitcoin Cash

Bitcoin Cash (BCH) forked from the Bitcoin network in August of 2017. Its developer team forked it with the intention of focusing more exclusively on the use case of a cheap, fast, convenient form of widely accepted digital cash.

Bitcoin SV

Bitcoin SV (BSV, “Satoshi Vision”) forked from Bitcoin Cash’s blockchain in November 2018. Its creation was the result of a disagreement over Bitcoin Cash’s direction: the Bitcoin SV developers believe that their version of the cryptocurrency best reflects Satoshi Nakamoto’s original vision of what Bitcoin should be, as outlined in the Bitcoin white paper, Nakamoto’s forum posts, and Nakamoto’s emails. Bitcoin SV rejected certain updates adopted by the main Bitcoin Cash chain, including the introduction of code supporting smart contracts and canonical transaction ordering.

Ethereum Classic

Ethereum Classic was created in the wake of the DAO hack, which resulted in the theft of 3.6 million ETH. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. This minority refused to accept the revised code and became the Ethereum Classic currency. From these beginnings, Ethereum Classic has developed into something like a more conservative version of Ethereum, focused on immutability above all else.

Basic Concepts

Exchanges

An exchange is a marketplace where people are able to buy and sell assets. The New York Stock Exchange (NYSE), for example, is a place where people are able to buy and sell stocks. There are a number of cryptocurrency exchanges set up today and that number is increasing all the time. Some of the major exchanges include:

- Kraken, headquartered in San Fransisco, CA

- Gemini, headquartered in New York, NY

- Bitstamp, headquartered in Luxembourg

- Bitfinex, headquartered in Hong Kong

- itBit, headquartered in New York, NY

All cryptocurrency exchanges are not created equal. Different exchanges let you buy and sell different cryptocurrencies; different exchanges set different prices for their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently.

Bid Price

The bid price for a given asset is the maximum price that someone is willing to pay for that asset. You can think of this as the “demand” side of “supply and demand.”

Ask Price

The ask price for a given asset is the minimum price for which someone is willing to sell that asset. You can think of this as the “demand” side of “supply and demand.”

Bid-Ask Spread

The bid-ask spread is the difference between the bid price and ask price for a given asset. This spread is the profit that market makers earn by buying and selling the asset on behalf of investors. As an asset’s liquidity increases, this spread decreases correspondingly.

Volatility

Volatility is the size of changes in an asset’s value over time. If an asset’s value frequently fluctuates to a great degree — that is, if it’s highly volatile — then it’s typically thought to be a proportionately high-risk investment. The historically high volatility of Bitcoin is one of the reasons why some have been skeptical of Bitcoin’s capacity to act as a store of value. Volatility is also what gives traders the opportunity to profit through day trading and swing trading (see below).

FOMO

Fear of missing out (“FOMO”) is modern slang for a timeless, irrational behavior: worrying that you’re missing out on a great opportunity and therefore jumping into an investment. In the cryptocurrency space, otherwise inexplicable influxes of buyers have been attributed to FOMO.

FUD

Fear, uncertainty, and doubt (“FUD”) is modern slang for the “opposite” of FOMO: irrationally worrying that a particular investment or sector might collapse. In the cryptocurrency space, otherwise inexplicable sell-offs have been attributed to FUD.

Sell Wall

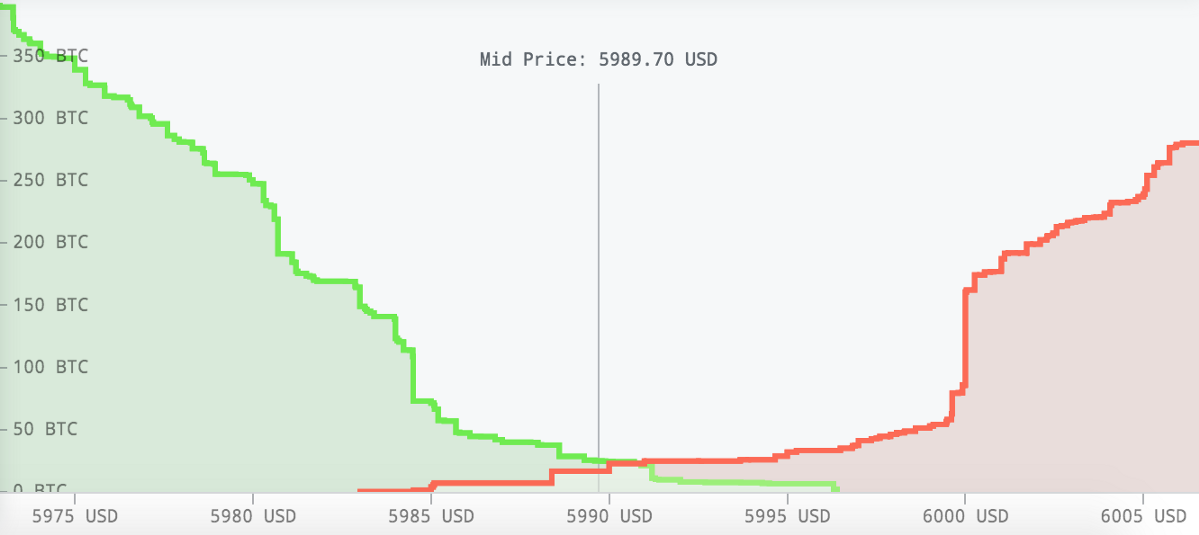

Sell walls are a large number of sell orders, typically placed on the order book all at once, at a seemingly undervalued price. They look like this:

The standard explanation for sell walls is that a group of rich individuals is manipulating the market to drive down an asset’s price before it takes on a large position in it. Here’s how that explanation goes:

A group of high-net-worth individuals (HNWIs) all want to buy a particular cryptocurrency, but they don’t want to move the market with a large order because that will end up making them pay a premium for their trade. Therefore, each member of the group buys only a small fraction of the position they ultimately want to take (e.g., 100,000 of the cryptocurrency rather than 500,000), and then they all simultaneously flood the market with underpriced sell orders.

Because the market is flooded with so much selling volume, the buying pressure can’t eat through the wall quickly enough — and anyone who wants to liquidate their own positions in this cryptocurrency will now have to sell at a price lower than that of the sell wall. This drives down the cryptocurrency’s price further, to a point at which the group of HNWIs feels comfortable buying the quantity they initially wanted. Once they’ve done so, they remove the sell wall — and the price of the cryptocurrency rises accordingly.

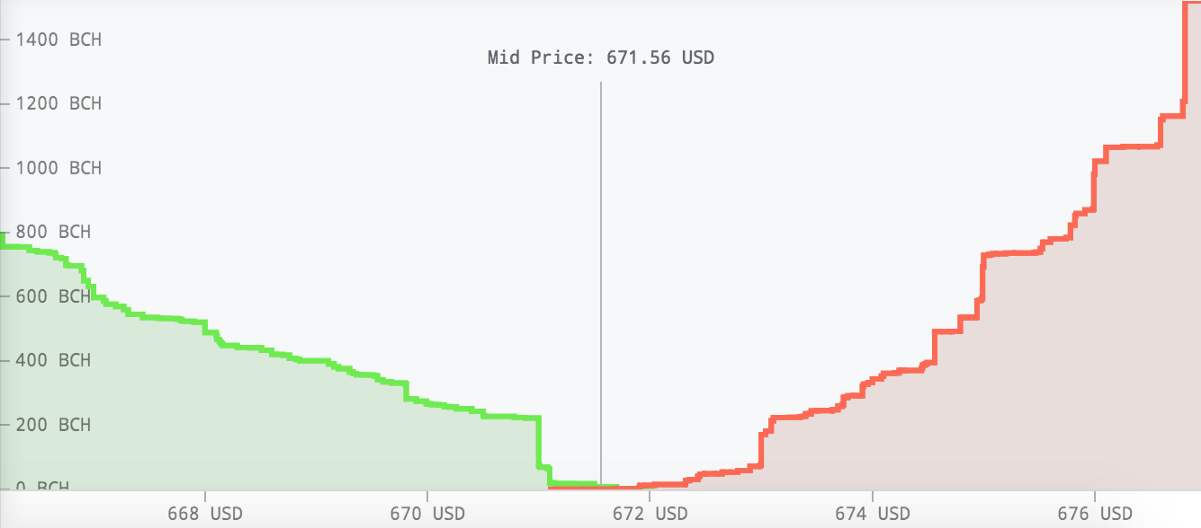

Buy Wall

A buy wall is basically the opposite of a sell wall: a large number of buy orders, typically placed on the order book all at once. It looks like this:

There are at least a couple of reasons why HNWIs would put up a sell wall. One is to ensure that the cryptocurrency’s price doesn’t drop below the position of the sell wall (since anyone else who wants to buy the cryptocurrency quickly will have to execute their trade at a price higher than that of the sell wall). Another is to try to drive the cryptocurrency’s price up before the HNWIs sell some or all of their position in it.

Buy the Dips

“Buy the dips” is a motto reflecting the philosophy that one should buy a cryptocurrency when its price has significantly dropped, with the expectation that it will bounce back eventually (especially if the cryptocurrency has compelling underlying value). It’s the second half of Warren Buffett’s timeless advice: “Be fearful when others are greedy, and greedy when others are fearful.”

Bull Trap

A bull trap is a false signal that a cryptocurrency’s price is about to rise, when it is actually about to fall. It gets its name from the fact that it ends up trapping bullish traders in bad trades.

A typical example of a bull trap is when a cryptocurrency looks like it is about to break through a certain resistance level but subsequently fails to do so.

Bear Trap

No, we’re not talking about the kind that will gore your leg in the woods!

A bear trap is the opposite of a bull trap: It’s a false signal that a cryptocurrency’s price is about to fall, when it is actually about to rise. It can trick bearish investors into shorting the cryptocurrency or selling off their position in it.

This often happens when it appears as if a cryptocurrency is about to break through a particular support level, but the support level ends up holding instead.

Bull Trend

A bull trend is a long-term, upward trend in the overall cryptocurrency market. How different people specifically define it varies, but it’s typically on the order of months or years rather than days or weeks, and it’s associated with indicators like a positively sloped moving average (MA).

Bear Trend

A bear trend is a long-term decline in the overall cryptocurrency market. “Long-term” usually means at least a few months (e.g., the bear trend beginning in mid-January of this year), and is represented by indicators like a negatively sloped MA.

Market Makers

Contrary to some increasingly common colloquial uses of the term, a “market maker” is not someone who is rich enough to move the entire market with their trades. Rather, a market maker is an entity who provides liquidity to an exchange by placing limit orders on its order book so that trades can be made at a range of prices. Many exchanges provide rebates to makers for this added liquidity.

Moon

In crypto slang, “moon” has multiple connotations. Most simply, a cryptocurrency going “to the moon” refers to its price skyrocketing, either in the short-term because of some kind of announcement/market sentiment, or in the long-term because of the cryptocurrency’s real value. “Moon lambos” are the lavish cars that some intend to buy once their crypto holdings go to the moon. They are not Lamborghinis that one drives on the moon.

Sometimes, though, there’s also a bit of derisiveness behind the use of the term “moon”: It can be used to refer to people who are undereducated about the crypto space and are merely buying up coins with the expectation of making a quick, huge profit. This kind of subtle mockery is typically what’s happening when people post “when moon?” on crypto traders’ discussion forums.

Slippage

Slippage refers to the difference between the price at which a trader expects a trade to execute and the price at which it actually executes. There are a number of reasons why slippage would occur — for instance, if a trader places a market order when the market is especially volatile, or when a trader places a trade large enough to move the market.

Imagine a situation in which the top-of-the-order-book price of Bitcoin is $8100 USD and you’re hoping to buy 100 BTC. Chances are good that there won’t be enough volume near the top of the order book to actually let you buy that much BTC at $8100 USD per coin: instead: you’ll end up needing to go deep into the order book to fill your order, meaning you’ll end up paying more than you expected — maybe up as high as $8200 or $8300. Worse, if you telegraph your large order to other traders and bots on the exchange, they might recognize the buying pressure and drive up the price of BTC even more as you’re trying to buy it. These are two classic examples of slippage in action.

Resistance

Resistance, typically mentioned in reference to technical analysis, is a price level at which the selling pressure on an asset is historically greater than the buying pressure, meaning that the asset encounters “resistance” from the market when it attempts to break through that price level. One basic tactic of day trading is shorting an asset when the asset is nearing a resistance level and the trader expects it won’t break through the resistance level.

Once an asset does break through a resistance level, that level often turns into a support level.

Support

A support is typically discussed in terms of technical analysis: It’s a price level at which the buying pressure on an asset is historically greater than the selling pressure, meaning the asset encounters “support” when its price attempts to dip lower than that level. A basic method when attempting to secure profit, especially in a volatile market like crypto, is to buy into a cryptoasset when it’s around a level of support and the trader expects that the support will hold.

Once an asset does break through a support level, that level often turns into a resistance level.

Liquidity

Liquidity, roughly speaking, is a measure of how easy it is to convert an asset into cash quickly and without loss. The easier this is, the more liquid an asset is. One facilitator of liquidity in the cryptocurrency trading world is the presence of many different limit orders creating depth in an exchange’s order book.

Moving Average (MA)

A moving average is a method used in technical analysis to smooth out smaller fluctuations in an asset’s price: It’s the average price of an asset over a number of periods of a given length. Moving averages come in different varieties, but the most common types are the exponential moving average, which determines the average price of an asset while giving more weight to more recent prices, and the simple moving average, which determines the average price of an asset without any time bias.

Confluence

Confluence is the presence of multiple indicators or analytical methods all indicating the same upcoming movement in an asset’s price. This is a way of mitigating trading risk by waiting for multiple signals all forecasting the same thing, rather than just trading on the basis of a single indicator.

Contagion

Contagion refers to a disturbance that spreads from one market to another and has the potential to disrupt trading strategies that focus too heavily on market correlations.

For example, one might try to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have a disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. But if this is a case of contagion, the entire crypto market might be heading for a dip, meaning that one will have lost money by taking a long position on the disproportionately cheap cryptocurrency.

Black Swan

A black swan event is something that is virtually impossible to predict and has a huge impact on the market. A standard example of a black swan event was Zimbabwe’s peak inflation rate of almost 80 billion percent back in 2008. Part of responsible risk management in trading involves considering the possibility of these impossible-to-predict, marketwide changes — especially in an extremely volatile market such as crypto.

Why call this kind of unpredictable event a “black swan”? It pays homage to the idiosyncratic history of humankind’s knowledge of swans. Back in the 2nd century, the Roman poet Juvenal coined the phrase “rara avis in terris nigroque simillima cygno” to identify something as impossible. In English, this means “a rare bird in the lands and very much like a black swan” — a bird that, at the time, was thought to not exist.

17th-century Europeans commonly used this phrase to call something out as impossible — until, that is, Willem de Vlamingh and his team of Dutch explorers discovered black swans in Western Australia in 1697. No longer was the black swan a symbol of impossibility: instead, it evolved into a symbol of something seemingly impossible that could later become a reality. Nassim Nicholas Taleb popularized the term’s use with regard to financial markets in his 2001 book, Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets.

High-Net-Worth Individual (HNWI)

A high-net-worth individual (HNWI), broadly speaking, is a person who trades large enough amounts of an asset that the trades can move the market for that asset.

HNWIs can be formally defined in a number of ways, but a common method of identifying them is seeing whether they qualify as an accredited investor: a person or entity who, according to the SEC under Regulation D, has a reduced need for the protection of regulatory disclosure filings due to this person or entity’s financial sophistication.

If you’re a person, you qualify as an accredited investor if you meet one or more of these conditions:

- You’ve had an annual income of $200,000, or $300,000 jointly with a spouse, for the last 2 years, with expectations of that income continuing

- You have a net worth of $1 million or more, either individually or jointly with a spouse

- You’re an executive officer, general partner, or director for an issuer of unregulated securities

An entity is an accredited investor if it consists of people who are accredited investors, or if it’s a private business development organization or company with assets in excess of $5 million.

Whale

“Whale” is a colloquial term for the biggest players in the cryptocurrency trading game — these include not only HNWIs but also large institutional investors, such as hedge funds. It’s thought that whales are often responsible for atypical market phenomena, such as buy walls and sell walls.

Value at Risk (VaR)

Value at risk (VaR) is a statistical method of measuring a portfolio’s risk: It’s the maximum amount of value that one could expect to lose over a given time horizon. For example, if your crypto portfolio has a “95% 2-week VaR of $100,000 USD,” that means that there is 95% confidence, statistically speaking, that your portfolio will not lose more than $100,000 USD of value over the next two weeks.

Put Options

A put option is a contract that gives its holder the right (not the obligation) to sell a specific amount of a given asset within a certain time frame. As the underlying asset depreciates in value, the put option itself appreciates; therefore, buying put options on an asset like BTC is a method of shorting it.

All-Time High (ATH)

ATH is shorthand for all-time high, the highest price that an asset has ever had. A common fear in trading crypto is that FOMO will lead one to irrationally buy an asset at or near its ATH.

All-Time Low (ATL)

ATL is an acronym for all-time low, the lowest price that an asset has ever had. Traders often fear that emotional forces like FUD will lead them to sell off an asset at or near its ATL.

Bag holder

A bag holder is an informal term for someone who holds an asset that continually decreases in value, to the point of being worthless. In the cryptocurrency space, this term is sometimes used pejoratively to refer to people who continue to hold onto an asset due to faith alone, long after all indicators point to the unlikelihood of its value ever increasing.

Return on Investment (ROI)

The ROI, typically expressed as a percent, is a measure of the efficiency of an investment. It’s usually calculated as follows:

For example, if you bought 1 BTC for $6,000 USD and sold it a month later for $6,600 USD, your ROI (ignoring fees, for simplicity’s sake) would be $600 USD / $6,000 USD = 10% in 1 month.

Bollinger Bands

Bollinger Bands — named after their developer, trader John Bollinger — are the lines two standard deviations above and below an asset’s simple moving average. They’re commonly used as indicators in technical analysis:

- When an asset is trading near its upper Bollinger Band, it’s considered overbought.

- When an asset is trading near its lower Bollinger Band, it’s considered oversold.

- When an asset’s Bollinger Bands are close together (a “squeeze”), it’s thought to be likely that the asset’s price will become more volatile in the future.

- When an asset’s Bollinger Bands are far apart, it’s thought to be likely that the asset’s price will become less volatile in the future.

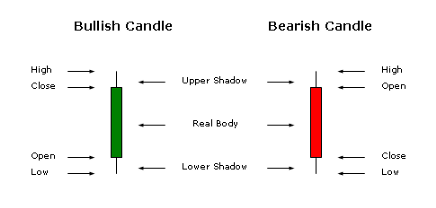

Candlesticks

Candlesticks are a graphical representation of an asset’s trading history. They’re often used in technical analysis because the shapes of candles are thought to be useful indicators of where an asset’s price might be heading next. Different candlestick charts use candlesticks to represent different amounts of time. For instance, on a 1-hour candlestick chart, each candlestick represents a trading period of 1 hour, whereas the candlesticks on a 15-minute chart represent trading periods of 15 minutes.

The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: A “bullish” green candle indicates that the asset closed higher than it opened, and vice versa for “bearish” red candles. The top and bottom of a candle’s true body indicate the open and close prices of the asset. The top of a bullish candle is the price at which it closed the period, and its bottom is the price at which it opened the period; vice versa for bearish candles. A candle’s shadows — the lines protruding from the top and bottom of its true body — indicate the maximum and minimum price of the asset during the candle’s period.

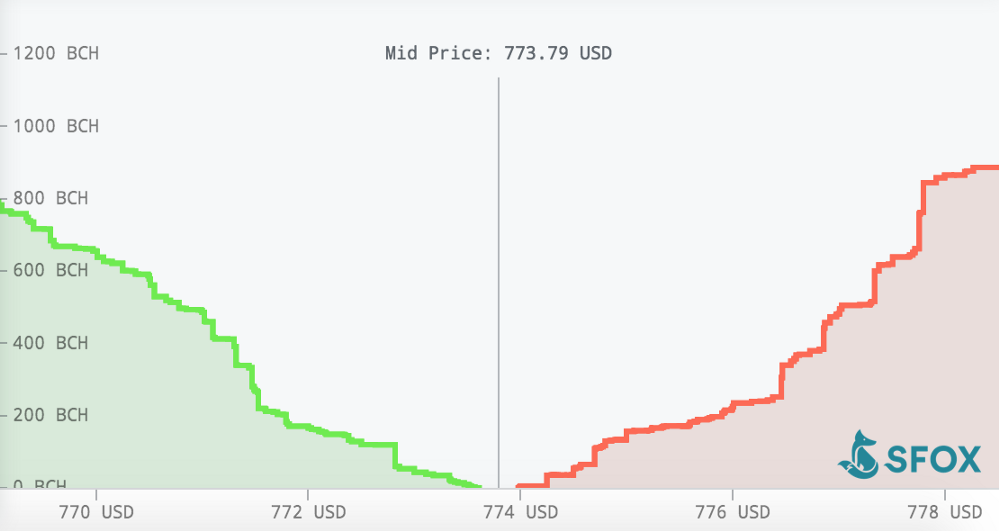

Depth

Depth refers to the ability of a market for a specific asset to sustain large orders of that asset without the asset’s price moving significantly. The more open limit orders there are on both sides of an exchange’s order book for an asset, the more depth that book has. Depth is also closely tied to liquidity: The more depth an order book for an asset has, the more liquidity the order book provides to that asset.

Depth charts graphically represent the depth of order books, showing the volume of open orders at various price points and illuminating phenomena like buy walls and sell walls.

Security

Wallets

When it comes to managing your cryptocurrency holdings, it’s important to understand who actually has your holdings. If you have your holdings in a wallet — whether that’s a hardware wallet, a software wallet, or a paper wallet — you control your private key and actually have custody over those holdings. On the other hand, when you buy and hold cryptocurrencies on most exchanges, they store those holdings in wallets of their own. That’s why some people worry about centralized cryptocurrency exchanges: if they’re hacked, their investors’ money could vanish overnight.

Hot Storage

Hot storage is any kind of cryptocurrency wallet that is connected to the internet — for example, a web wallet or mobile wallet. They are typically thought to be the least safe wallets because they are susceptible to hacks, though they’re also usually easier to recover than cold-storage wallets if you forget your password — provided that the company providing the wallet also provides a password reset option.

Cold Storage

Cold storage is any kind of cryptocurrency wallet that is offline — e.g., a paper wallet or hardware wallet that is not connected to the internet. They’re thought to be especially secure because your private keys are kept away from places where hackers or other entities can find them. But they can also be harder to recover if you forget or lose your information (since, oftentimes, no one else has that information).

Paper Wallet

A paper wallet — named such because it is often literally printed on a piece of paper — is a cryptocurrency wallet generated by a site like bitcoinpaperwallet.com. It’s a combination of a private key and public key that’s totally offline, making it secure against theft but also virtually impossible to recover if lost.

Hardware Wallet

A hardware wallet is a unit of security-audited hardware that stores your private keys and allows you to send, receive, and store cryptocurrency. They’re thought to be some of the most reliable, safest storage solutions available. At the moment, Trezor and Ledger are the leading hardware wallets out there.

2-Factor Authentication (2FA)

2-factor authentication (2FA) is a second method of verification, beyond your password, to make your trades and other transactions secure. There are multiple methods of 2FA, including pieces of hardware (see U2F, below) and software like Google Authenticator.

Never enable text messages or phone calls as a method of 2FA. This is one of the worst possible security practices because hackers are very skilled at calling your phone company, convincing them that they’re you, and then using text-message or phone-call 2FA to access your accounts.

Universal 2-Factor (U2F)

A universal 2-factor (U2F) is a sort of specialized, encrypted USB drive that you insert into your computer as a method of 2-factor authentication. At the moment, YubiKey is one of the leading U2Fs available.

Multisignature (Multisig)

Multisignature (multisig) refers to cryptocurrency transactions that require more than one signature to be approved. This has lots of applications, but its primary utility when it comes to trading is 2-factor authentication: If you have 2FA enabled, then each “factor” — e.g., your password and U2F — is a signature that’s required before your trade can be executed.

Strategies

HODL

The term “HODL” comes from when Bitcoin forum user GameKyuubi drunkenly misspelled that he was holding Bitcoin in December of 2013, despite its price crashing. HODL has become synonymous with the “trading” philosophy of buying Bitcoin (or other cryptocurrencies) and holding it indefinitely. The rationale behind this philosophy varies. Many who are entering the space with little trading experience believe that they will make more money in the long run by holding than they would by trying to catch the highs and lows of the market. Others — true Bitcoin maximalists, for example — believe that cryptocurrencies will ultimately replace fiat currencies, in which case it would be irrational to sell any cryptocurrency for fiat.

Dollar-Cost Averaging

Dollar-cost averaging is the strategy of buying a particular dollar amount of an asset on a regular schedule, e.g., X amount every hour or X amount every day. The idea behind this strategy, which plays well with HODLing, is to gradually take on a position in an asset like Bitcoin in a way that resists the short-term swings of the market.

Diversification

Generally speaking, diversification is a method of managing the overall level of risk in your portfolio by investing in a range of assets that aren’t perfectly correlated with each other, securing better profits (on average), and minimizing the risk of losses. It can be hard to diversify within the crypto sector at this early stage of its existence, but there are a few rules of thumb that are good to follow:

- Use Bitcoin as the foundation of your crypto holdings. As the cryptocurrency with the biggest market cap, Bitcoin is almost like an index fund for the crypto sector: if crypto as a whole succeeds, then Bitcoin will succeed.

- Holding Ether is a good way of betting that blockchain will have applications beyond being a mere store of value, since most other use cases are being built on Ethereum in one way or another.

- Holding Bitcoin Cash is a good way of investing in the use of cryptocurrencies in commerce.

Arbitrage

Arbitrage is the strategy of profiting by simultaneously buying and selling an asset in order to take advantage of market inefficiencies by the same asset being priced differently in different places. Especially in this early stage of cryptocurrency’s history, where liquidity varies widely from one exchange to the next, there are numerous opportunities to exploit pricing differences between exchanges to profit through arbitrage.

Swing Trading

Swing trading is the strategy of buying an asset at a low price and selling it at a high price at a relatively high frequency — typically once a day or once every few days. The high volatility of many cryptocurrencies has led many traders to focus on this kind of strategy, though that high volatility can also make the strategy costly if you time your trades poorly.

Day Trading

Day trading is like swing trading but with a higher trade frequency. As the name suggests, day traders trade multiple times per day, typically trying to routinely profit from small fluctuations in a market.

Margin Trading

Margin trading is the practice of buying an asset using funds borrowed from a broker. This is a risky method of trading because, if the assets end up decreasing in value, the trader can be left in significant debt — it’s possible to lose more money than one initially invested.

Leverage

Leverage is the additional buying power created by margin trading, allowing you to effectively pay less than full price for an asset using borrowed funds. Leverage is typically represented as a ratio: for example, if you have $10,000 in a trading account and borrow another $10,000, then you have 2:1 leverage.

Pump and Dump

While “pump and dump” is technically a strategy, it’s better identified as a kind of fraud. This is the term for when someone uses false or misleading news or information to artificially pump up an asset’s price so they can dump the asset for a profit before it crashes back down to earth.

Anyone can be guilty of this, by the way — not just big institutions or high-net-worth individuals. The next time someone recommends a cryptocurrency you’ve never heard, ask yourself: “Why might this person be trying to get me to buy this?” Sure, they might believe in the cryptocurrency’s value proposition, but they also might be running a good old-fashioned pump and dump.

Hedging

Hedging is an action you take to mitigate the risk of a trade. For example, if Bitcoin’s candlestick chart is suggesting that the market is very indecisive, and you think the price is about to go up, you might buy some more BTC while simultaneously shorting a correlated asset (e.g., ETH). Neglecting to hedge is one of the easiest ways to overexpose yourself to risk — especially if you’re day trading.

Going Long

Going long on a cryptocurrency means that you’re buying it with the expectation of selling it at a higher price (without hedging). It doesn’t necessarily mean that you’ll be holding your position for a long time, though: Day traders “go long” when they buy a stock and sell it for a higher price an hour later.

Going Short

Going short on a cryptocurrency is a way of profiting by betting that its price will go down. There are two standard ways to short an asset:

- Buy put options on the cryptocurrency: an agreement allowing one to sell a certain amount of that cryptocurrency at an agreed-upon price, which appreciates as the cryptocurrency depreciates.

- Borrow a certain amount of the cryptocurrency from a broker, immediately sell it, and then later buy back the same amount of that asset — hopefully at a lower price — to repay the broker. This is inherently quite risky since there’s no limit to how much money you can end up owing the broker if the asset goes up in value after your initial sale, rather than down.

A less risky way of pseudo-shorting a cryptocurrency is to sell off a certain amount of your own holdings in the cryptocurrency, with the expectation that the price will drop, and then buy more of the cryptocurrency at the reduced price. Notice, though, that this isn’t quite the same as what we discussed above. For this strategy to work, you’re not just betting that the cryptocurrency’s price is going down; you’re also betting that it’s going to come back up.

Risk On, Risk Off (RoRo)

Risk on, risk off (RoRo) trading is a style of trading according to which you modulate your risk appetite in response to the perceived level of risk in the overall market or economy: When the general cryptocurrency market seems especially risky, you make (relatively) less risky investments (e.g., holding Bitcoin); when the general cryptocurrency market seems less risky, you make (relatively) riskier investments (e.g., trading other tokens).

Technical Analysis (TA)

Technical analysis (TA) is a trading strategy that emphasizes using mathematical patterns and indicators to predict where an asset’s price will go in the future. Some focus on TA to the exclusion of all else, reading charts without reading any actual market news — though this isn’t recommended.

Fundamental Analysis (FA)

Fundamental analysis (FA) is a trading strategy that emphasizes trading based on the intrinsic value of the asset. Traders consider a wide range of quantitative and qualitative data in an attempt to determine this intrinsic value. Especially in these early days of crypto, a lot of fundamental analysis amounts to trying to determine which cryptocurrencies have compelling long-term value propositions rather than being mere get-rich-quick schemes.

Shilling

Similar to the pump-and-dump strategy, shilling refers to the act of disingenuously spreading potentially false news about an asset in which one has a vested interest.

This is particularly prevalent and problematic in spaces like Reddit and Facebook, which are intended to be spaces where individuals share content that genuinely interests them: It’s easy for a shoddy crypto company to set up a bunch of Reddit accounts to advertise their brand by posing as interested individuals on crypto-related subreddits and submitting links to that crypto company’s content. That’s one of the reasons why you should take market sentiments expressed on forums with a grain of salt.

Penny-jumping

Penny-jumping is a strategy used to front-run large orders, typically executed by trading bots. For example, if a trader issues a large BTC buy limit order at $5,000 per coin, then the bot may place an order at $5,000.01. If the price of BTC goes down, it sells back to the big buy order. But if the price of BTC rises, the bot’s order fills above the big order on the order book and can sell at a profit if the big order is re-entered at a higher price. SFOX’s Hare algorithm is designed to protect traders from penny-jumping bots.

Smart Routing

A smart order router is a software program that uses algorithms to maximize trading profits by picking the best opportunities on different exchanges. The SFOX Tortoise algorithm is one example of smart routing: it picks the cryptocurrency exchange that offers the best price, thereby increasing one’s return potential.

Types of Trades

Market Order

A market order is what happens when you make an agreement with an exchange to buy or sell a certain amount of an asset immediately at the best available price. Depending on the size of your order and the trading volume on the exchange, this can end up giving you an extremely suboptimal price, though it allows you to execute your trade quickly.

Limit Order

A limit order is an agreement that you make with an exchange to execute a trade only at a certain price point or better. If that price point ends up never being reached, your order may never be executed. Limit orders also allow you to set a time limit on the order, after which the trade won’t be executed at all.

Stop-Loss order

A stop-loss order is a trade that you put in place for an exchange to immediately execute if an asset reaches a particular price point. As the name suggests, this kind of order is designed to limit your losses: if you’re invested in Bitcoin and want to make sure you don’t lose too much money in the event of it tanking, you can make a stop-loss order to ensure that your Bitcoin will be sold immediately if the price dips below a certain point.

Take-Profit Order

A take-profit order is the “other half” of a stop-loss order: whereas a stop-loss order is put in place to limit one’s losses, a take-profit order is put in place to secure one’s profits. When this kind of limit order is put in place with an exchange, you will automatically sell the asset in question, immediately, if its value reaches a certain price.

OTC Trades

Over-the-counter (‘OTC’) trades are how many high-net-worth individuals and institutional investors make their especially large trades: they use a broker who directly connects them with an entity willing to buy or sell the asset in question at a particular price. This is intended to avoid losing money by executing a trade so large that it moves the market — but the peculiar information asymmetries involved in such a trade make it easy to make a mistake that ends up offsetting the potential advantages of OTC trading.

Gorilla Trades

Gorilla trades are one of our trade algorithms designed for executing large trades without inadvertently moving the market. This method of trade finds the best way to execute a large order by only showing smaller pieces of it on the order book, preventing it from getting buried deep in the order book. It’s best used when there are medium levels of activity in the market.

Polar Bear Trades

Polar bear trades are one of our trade algorithms designed to optimize the price on large orders. It is a hidden order that automatically trades on the top of an order book once a set limit price is reached. It’s best used with thin spreads and small quantities on the top of the order book.

Sniper Trades

Sniper trades are one of our trade algorithms, a hidden order optimized for speed. This algorithm is ideal for getting the best possible price on a large order quickly, as you would want to do when the markets are especially volatile and you’re worried about prices dropping drastically.

TWAP Trades

Time-weighted average price (‘TWAP’) trades are one of our trade algorithms and are like a more sophisticated method of dollar-cost averaging. These trades allow you to specify n, t, and p such that you buy or sell n of a cryptocurrency over t hours for an average price of p.

Iceberg Order

An iceberg order is a very large order that’s been divided into a large number of smaller limit orders in order to hide the overall quantity being bought or sold, with the hope of avoiding moving the market with your trade. It’s called an iceberg because the amount of crypto you see in the order is just the tip of the iceberg.

Immediate-or-Cancel (IOC) Order

An immediate-or-cancel (IOC) order must be filled immediately, and any portion of it that cannot be filled immediately is canceled. If you think the crypto market is just about to dip, and you want to get as much of your BTC stack as possible out right now, before the dip, this order type is a natural choice.

Fill-or-Kill (FOK) Order

A fill-or-kill (FOK) order is similar to an IOC order, except it cannot be partially filled: It must be filled in its entirety immediately; otherwise, it is canceled. If you’re trying to execute a large order on multiple exchanges, this is a good way to test the order on all of those exchanges to see if it goes through, without needing to manually cancel the orders that aren’t immediately filled.

Post-Only Order

Post-only orders are something like the opposite of an FOK order: They are accepted only if they do not immediately execute. This prevents the order from taking liquidity out of the market, and it typically allows traders to earn some kind of rebate or fee associated with acting as a market maker.

All-or-None (AON) Order

An all-or-none (AON) order will be filled only if it can be executed in its entirety; it’s like an FOK order, but without the time limit. This can be useful if you’re trying to ensure that you get a certain price point for all of a moderate-sized order.

Trade Wisely

It’s easy to get sucked into the hype of cryptocurrency and dive into trading without a solid understanding of what you’re really doing. That way lies madness: if you’re shooting in the dark, any bulls-eyes you hit will be rare and purely accidental.

Take the crypto craze as an opportunity to learn about the concepts and strategies that underpin sound investing. Armed with more knowledge, you’ll be able to take advantage of the opportunities in this new sector without taking on outsized risk.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.