For years, SFOX has provided sophisticated crypto traders and funds with a reliable stop-loss order type: just set a price point for bitcoin or any of the other major cryptocurrencies on SFOX’s platform, and you’ll automatically execute a market sell order at the next available price if that cryptocurrency reaches your specified price point.

Today, we’re excited to announce that we’ve added the “other side” of stop-loss to the SFOX trading platform: you can now use the buy stop order type when trading bitcoin and other cryptocurrencies.

The buy stop order type is a key part of several classic trading strategies and has unique applications in the new world of crypto trading. Read on to learn how it works, how it might be deployed in three different trading strategies, and how to use it directly from your SFOX account.

How the Buy Stop Order Type Works—in Crypto and Elsewhere

While it’s not yet a mainstay in the younger crypto market, the buy stop order is essential to the toolkit of sophisticated traders in more mature markets, such as forex.

A buy stop order is the “opposite” of a stop-loss order: whereas stop-loss executes a market sell order if and when an asset’s price drops to a specified trigger price, a buy stop order executes a market buy order if and when an asset’s price rises to a specified trigger price. For instance, if a trader had their SFOX account funded with $20k USD and BTC was trading at $9,500, that trader could set a buy stop order to buy 1 BTC at market price once the price of BTC hit a trigger price of $10,500.

Notice that, also like the stop-loss order type, a buy stop order’s trigger price isn’t the same thing as a limit price: because the goal of a stop-loss or buy stop order is to enter or exit a position as soon as the asset reaches a certain price, these order types execute market orders, which may incur some slippage. In our above example, that means the SFOX trader may end up buying 1 BTC at a price slightly higher than $10,500—but, thanks to SFOX’s smart-routing order technology and access to liquidity from every single major crypto exchange, they’d incur less slippage than they would at any other venue.

Three Use-Cases for the Buy Stop Order Type in Sophisticated Trading Strategies

It might seem counterintuitive to set an order to buy an asset at a price higher than its current price, but this kind of tactic can be a linchpin in certain strategies—in particular, they’re a convenient way to automatically enter a position once the asset has confirmed a trend that a trader is projecting.

Sophisticated traders already use buy stop orders in a number of trading strategies, and crypto funds have plenty of ideas of new use-cases for this order type in the world of crypto. Here are three possible ways that the buy stop order can be deployed in crypto trading strategies.

Breakout Strategies

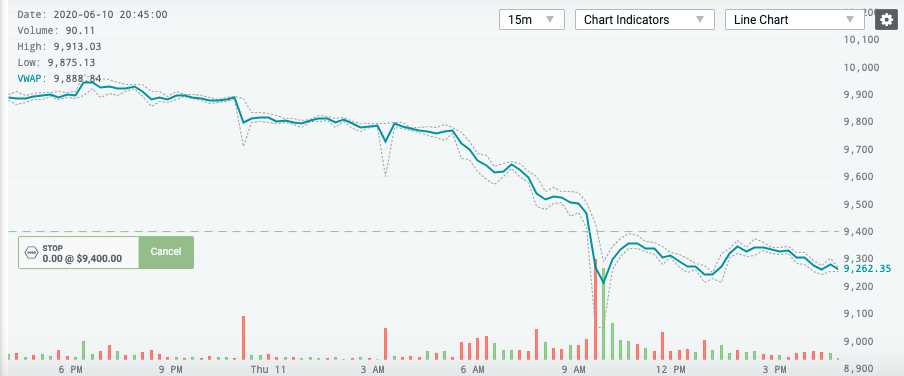

Breakout strategies are common for funds and traders driven by technical analysis or momentum. The basic thesis behind this strategy is that an asset that’s trading within certain support and resistance levels has the potential for a significant rise or dip in price in the event that it “breaks out” beyond those levels of resistance or support. For instance, if a trader took BTC to have stabilized within the $9212.61 – $9389.80 range following its dip to $ 9043.58 on June 11th, they might take a price like $9400.00 to be established as a resistance level and place a buy stop order to buy BTC if it “breaks out” of its range by surpassing that price point.

Source: SFOX Trading UI.

Contrariwise, a trader with this sort of strategy might have set a stop-loss order ahead of that June 11th dip if they’d observed that BTC had been trading within the range of $9559.30 and $10185.94 for 3 days—perhaps setting the order to sell if BTC hit a price of $9500. In this way, buy stop orders and stop-loss orders are two sides of the same coin for technical traders.

BTC/Altcoin Strategies

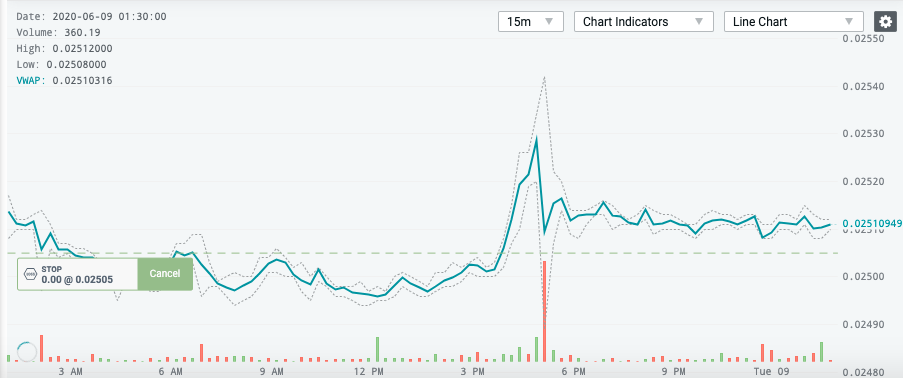

For traders and funds who are trading a mix of BTC and other cryptocurrencies, or “altcoins” (e.g., ETH), buy stop orders and stop-loss orders can serve as an advanced way of managing positions in BTC and altcoins as their relative prices change. For instance, if a trader were trading ETH and BTC, they might want to move some of their BTC holdings into ETH if ETH/BTC breaks out from a particular resistance level. On the below chart, for example, if the trader on a 15-minute chart saw ETH/BTC trading between 0.02495 and 0.02505 for 3 hours on June 8th, 2020, they might set a buy stop order for ETH/BTC at 0.02505, which would have executed once ETH/BTC broke out of that range:

Source: SFOX Trading UI.

On the other side of the coin, if a trader with this strategy were in ETH, they could set a stop-loss ETH/BTC order to move their ETH into BTC if ETH/BTC broke through a given support. In this way, a combination of carefully managed buy stop orders and stop-loss orders make BTC/altcoin strategies uniquely feasible for traders and funds looking to maximize their crypto upside.

Risk-Management on Short Positions

Buy stop orders can be particularly useful as a risk-management tool for traders and funds who are short-selling cryptocurrencies like BTC, BCH, or BSV. If a trader were short on one of these cryptocurrencies and wanted to protect their downside, they could set a buy stop order above a certain threshold in order to take on a long position in the asset’s price started to move significantly against their short position.

How to Set a Buy Stop Order on SFOX

Trading bitcoin and other cryptocurrencies with buy stop orders is now uniquely possible on SFOX, which connects you, from one trading account, to all major crypto exchanges on one integrated order book. This means that your trigger prices are more receptive to where the market is actually going: rather than setting it on a single exchange’s order book, which might jump anomalously to an above-market price for just a moment, SFOX’s buy stop orders look at the average price of the asset in question across the entire market over the last 60 seconds in order to determine whether or not your trigger price has been hit.

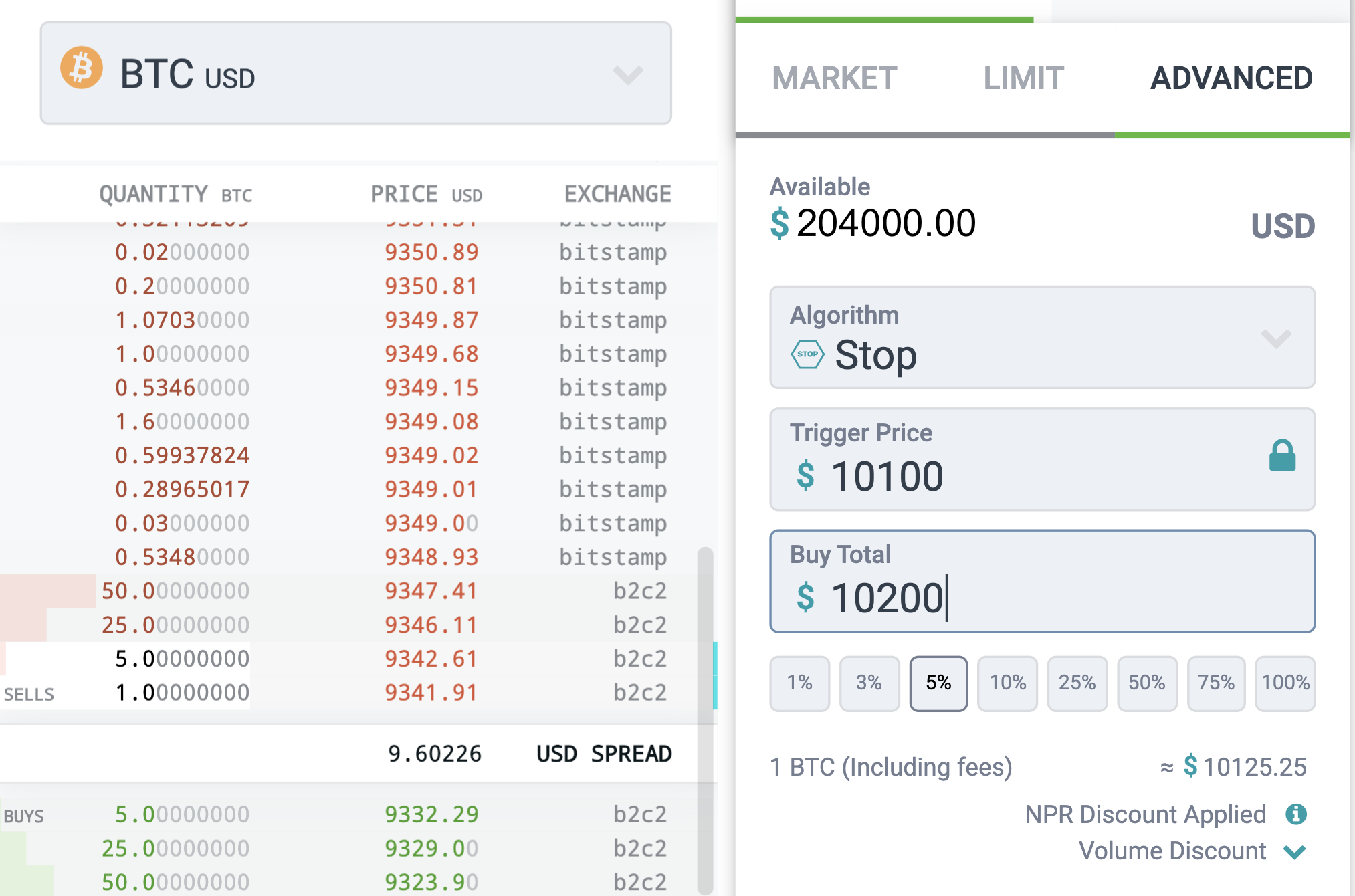

To set a buy stop order, just log into your SFOX account, and then follow these six steps:

- Select the asset pair you want to trade

- Select “Advanced” under the “Buy” tab in the Order interface

- Select “Stop” from the “Algorithm” dropdown

- Set your Trigger Price

- Select the “Buy Total” (the total amount you want to spend on your market buy order if and when your Trigger Price is hit)

- Submit your order with the “Buy” button at the bottom of the interface.

Crypto traders and funds are just as sophisticated—if not more so—than traders in more established markets. SFOX is proud to be furnishing them with the tried-and-true tools they need to execute their strategies and even to imagine entirely new strategies. We can’t wait to share more features like this one with you in the coming weeks, months, and years.

Ready to see how buy stop can supercharge your own trading strategy? Open your SFOX account now.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service, or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.