In the genesis block of Bitcoin — the first block created on its blockchain — Satoshi Nakamoto appended the following headline from an English newspaper: “The Times 03/Jan/2009 Chancellor on Brink of Second Bailout for Banks.”

As a decentralized asset with a fixed-supply schedule programmed into the code, Bitcoin in many ways was intended as an antidote to the excesses of monetary policy and a centralized banking system.

In a forum post, Satoshi highlighted the problem succinctly:

Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

Today, Bitcoin has perhaps never been more relevant. In the wake of the 2008 financial crisis, central banks around the world fueled the economy with cheap money through quantitative easing and expanding balance sheets. Today, we may be starting to see some of the fallout.

Countries around the world, including Germany, Switzerland, and Japan, are seeing negative bond yields as investors search for safe assets. In the United States, the 30-year bond curve has inverted for the first time since 2007 — an infamous harbinger of recession. Meanwhile, less stable countries, such as Venezuela, are experiencing extreme hyperinflation.

Since Bitcoin’s creation, its supporters have proposed it as a means to help curtail hyperinflation and the poor monetary policies creating cheap money out of thin air. In this article, we’ll examine to what extent Bitcoin is actually being used as a hedge against global uncertainty and inflation.

Bitcoin as a hedge against inflation

One of the best-loved narratives by Bitcoiners is that the cryptocurrency can work as a digital gold that operates as a store of value and a hedge against inflation. They often back up this narrative by pointing to the adoption of Bitcoin in countries that are experiencing immense inflation, such as Argentina and Venezuela.

Unlike fiat currencies, where monetary supply is created by central banks, there will only ever be 21 million BTC — and nearly 18 million BTC have already been created. Every 210,000 blocks (or roughly four years), the amount of Bitcoin created by mining rewards is cut in half.

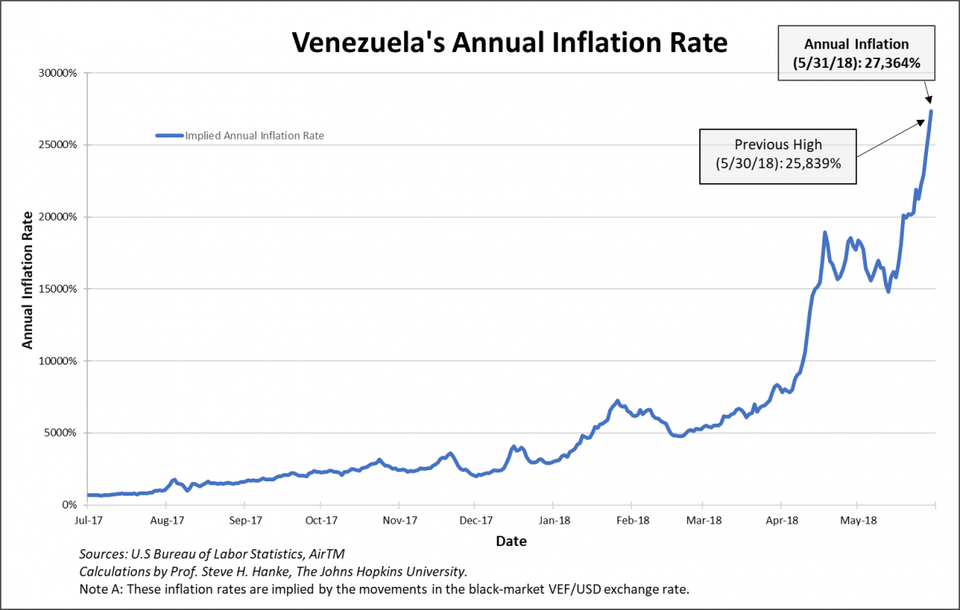

In Venezuela, a combination of economic sanctions and falling oil prices led the Maduro government to increase deficit spending and print more money. As a result, Venezuela has been experiencing hyperinflation since 2016. Currently, Venezuela’s annual rate of inflation is a whopping 282,972%.

In contrast, Bitcoin’s fixed-supply schedule, which is programmed into the code, makes the “hedge against inflation” narrative particularly compelling in the face of runaway monetary policy and economic crisis. In countries like Venezuela, where the government has introduced capital-flight measures, the censorship-resistant properties of Bitcoin also become extremely valuable: without your private key, no one can take away your BTC or control whom you can send it to.

While the narrative of Venezuelans using Bitcoin is enticing, it remains to be seen whether the data actually back this up.

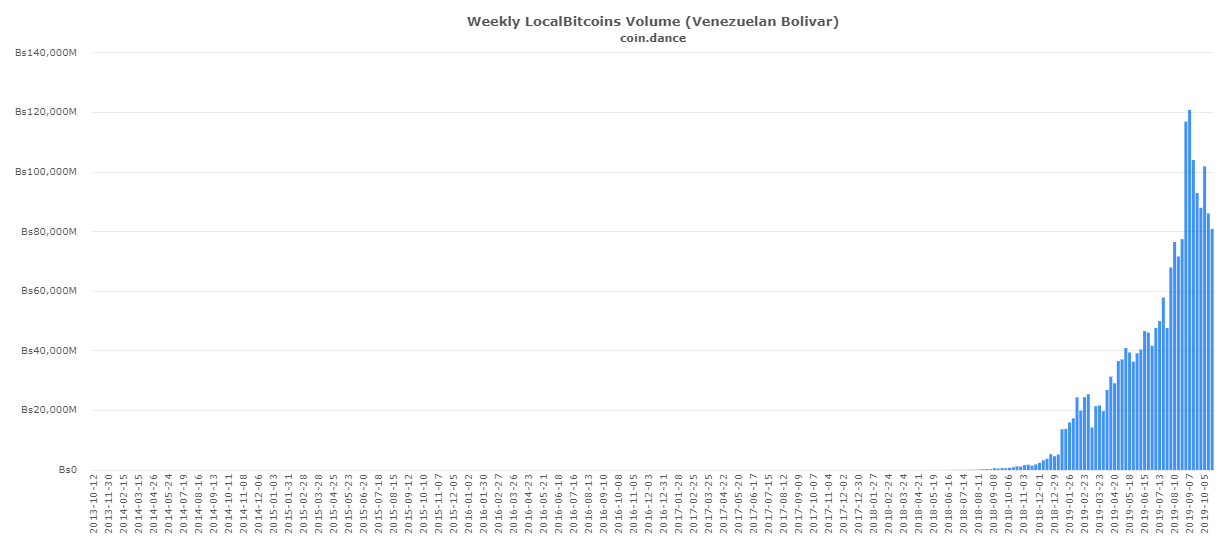

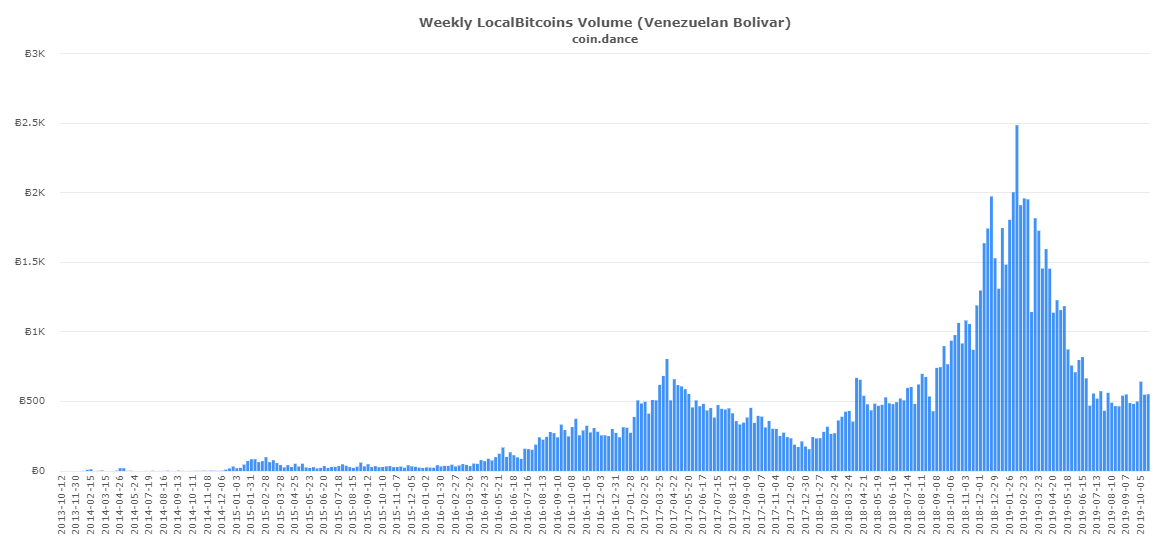

LocalBitcoins, a popular over-the-counter venue for buying and selling Bitcoin, shows explosive growth in volume for Bitcoin trading as measured in bolivar as inflation has spiked.

At a cursory glance, the data do seem to suggest that Venezuelans are buying more Bitcoin as inflation increases. In the week of August 31, LocalBitcoins showed its highest volume of Bitcoin traded ever, measured in bolivars, with nearly $117 million Venezuelan Bolívar of Bitcoin traded, or roughly $5.2 million at the time. While these data points have commonly been cited as proof of explosive adoption for Bitcoin in Venezuela, they can be somewhat misleading.

Looking at the volume of Bitcoin traded in Venezuela measured by actual BTC, we see a different story:

The amount of BTC traded in Venezuela on LocalBitcoins actually peaked in February 2019, at 2,487 BTC, and has fallen to roughly 430–560 BTC in recent weeks. The increase in bolivar-denominated trading volume in Venezuela perhaps better reflects the country’s economic crisis, as opposed to Bitcoin adoption.

As Diana Aguilar, a Venezuelan reporter for CoinDesk, wrote in an op-ed:

The fallacy that bitcoin could “save” a country’s whole economy assumes the country meets all the requirements for mainstream adoption. Just to start, there would be needed widespread computer and financial literacy, reliable electricity infrastructure, stable internet service and an economy that not only allows the majority of citizens to count on a device to keep their digital wallets but also the safe migration from fiat money to digital money.

While Bitcoin has many properties that can make it useful for Venezuelans, it remains to be seen whether people in countries like Venezuela are actually adopting Bitcoin in droves. To suggest that Venezuelans taking up Bitcoin at massive scale is perhaps misleading, and potentially even damaging. Bitcoin, despite its many merits, has a long way to go, and it’s far from providing a solution to the long-term economic crisis faced by Venezuela.

Bitcoin as a hedge against macroeconomic uncertainty

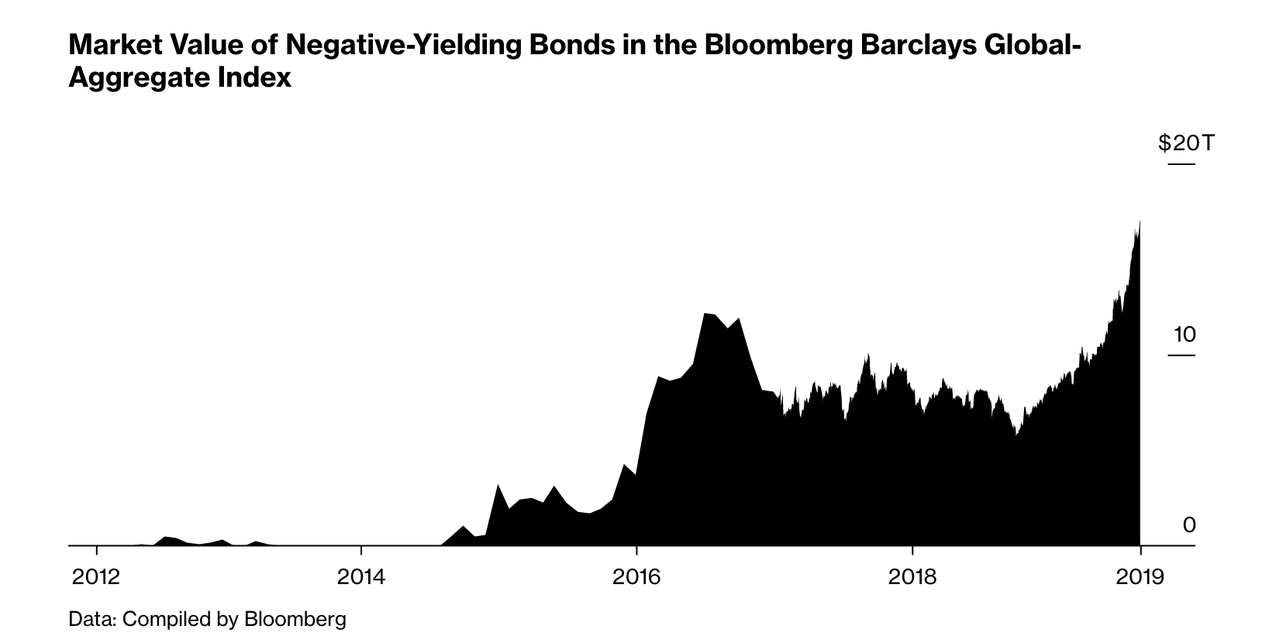

In August, the yield on 30-year German government bonds turned negative for the first time ever, reflecting high economic uncertainty and demand from some of the historically safest government bonds in the world.

As of August 30, 2019, there were $17 trillion in negative-yielding bonds around the world, from Japan to France, Germany, Spain, and Switzerland. Typically, government bonds represent a “safe” asset: since they’re backed by entire countries, there is little risk of default. In exchange for taking on the risk of default, bonds typically pay investors a discounted yield. However, when demand for the safety represented by bonds increases, bonds can actually yield negative rates, which means that investors pay for the privilege of parking their capital in these safe bonds.

This stockpile of negatively yielding debt could perhaps be traced to a decade of loose monetary supply and aggressive quantitative easing, which pumped the global economic system full of cheap cash. Bitcoin, as a fixed-supply-schedule asset, may be becoming an increasingly attractive hedge against systemic risk in the global economy.

In an article on Bitcoin and modern portfolio management, Galaxy Digital Research points out:

Bitcoin’s fixed supply and programmatic limit to stock-to-flow ratio changes offer potential diversification to the systemic risk of rapid monetary supply increases present in modern portfolios. Government-issued money is susceptible to rapid supply increases compared to its existing stock through central bank activity, and therefore has the potential to lead to a rapid loss of salability, diminishment of purchasing power, and wealth depreciation of its current holders as we have seen throughout the late 1900s and 2000s with the suspension of the gold standard.

It’s important to remember that Bitcoin remains a speculative asset, and there aren’t enough data to actually show whether investors are using Bitcoin to hedge their portfolios against a global economic collapse. However, one research study took a traditional portfolio of 40% equities allocated to the S&P 500 or SPX index and 60% to fixed income allocated in the iShares Barclays Aggregate Bond Fund or AGG and measured its performance since December 2013. They found that allocating 6% of that portfolio to BTC, 57% to the SPX, and 37% to the AGG resulted in a total 10.2% return since December 2013, n — higher than the 7.3% return of the ‘traditional’ 60-40 portfolio.

As Tim Enneking, Managing Director of Digital Capital Management and Mana Companies Asset Management, told us in an interview:

If a person wants to go into the crypto space, I would first say, to go back to my first principles of trading — not fiat trading, not crypto trading, just trading — the first principle is diversification. So, I would look at spreading your money around a bit in the crypto space, provided you have enough to do that. […] So at a minimum, I tell people, put one to two percent of your portfolio in the crypto space. It’ll probably turn into eight to ten percent of your portfolio — and I’ve had that happen several times, where guys came to me and said, “Look, I’m really sorry, but I have to sell some of your fund because it’s too big a piece of my investment portfolio now.” This is a good problem to have!

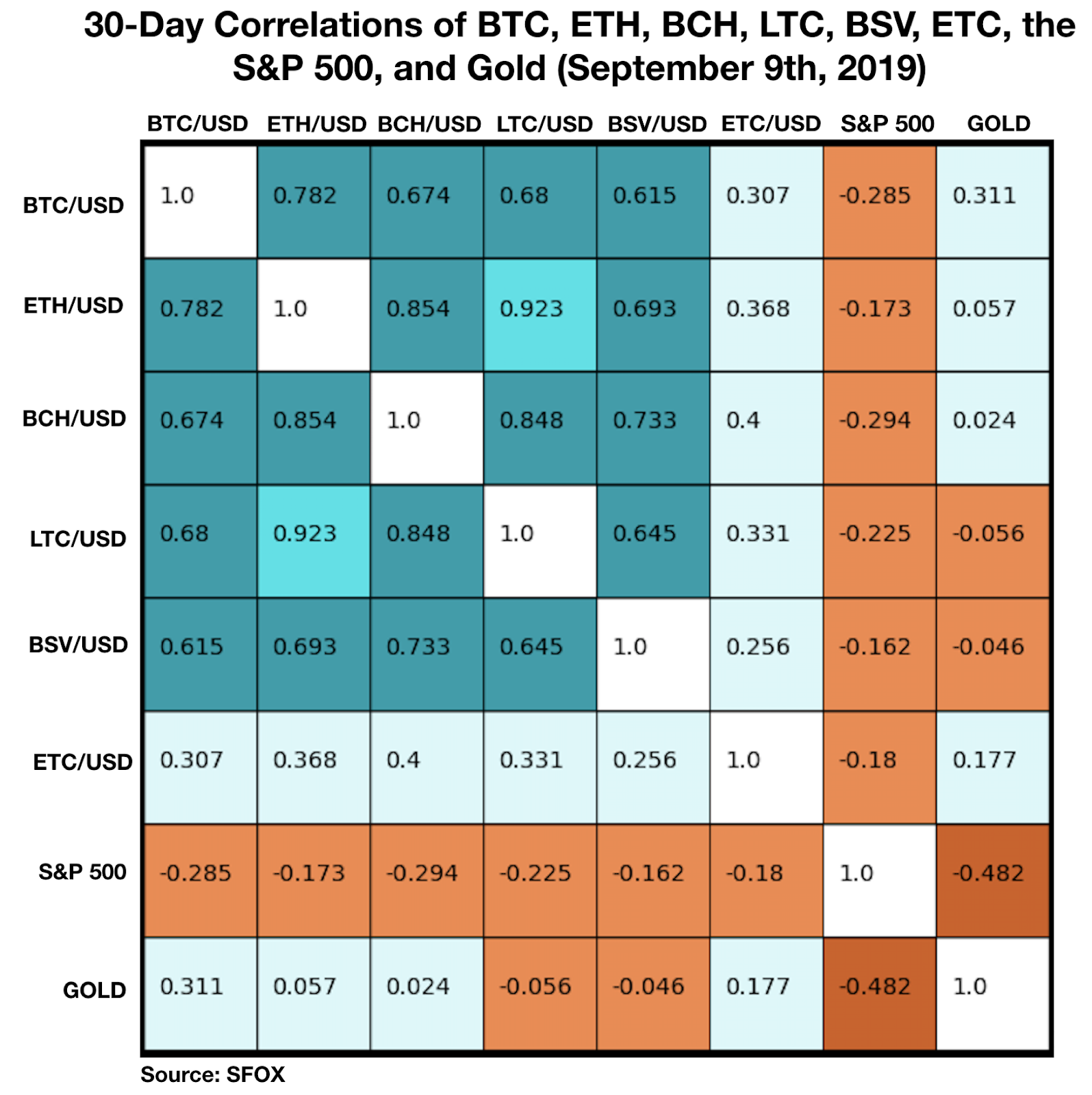

While allocating a portion of a portfolio to Bitcoin can produce stronger returns than a traditional portfolio, many hold the opinion that the reason why is that Bitcoin can act as a hedge to traditional equities and bonds. Looking at the data for the month of August, we saw a negative correlation of -0.285 between Bitcoin and the S&P 500, slightly lower than the correlation between -0.482 gold and the S&P 500. This lends some credence to the idea that Bitcoin may be useful, as an uncorrelated asset class, to diversify a traditional portfolio.

Bitcoin remains a highly speculative asset class

While Bitcoin has key attributes that may make it valuable as a hedge against macroeconomic factors in the future, it’s important to keep in mind that it remains today a highly speculative asset class that is extremely volatile. Bitcoin may be seeing some usage as a hedge against inflation in countries like Venezuela (which represents a unique case study) or against monetary policy, but we’re still a long way from widespread adoption. As the global economic outlook begins to cloud, we may be about to witness how Bitcoin performs as a hedge during a recession.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.