Since February, the price of bitcoin has rallied from $3,400 per BTC to around $10,800 today, a roughly 218% increase in six months. While this staggering rise in price harks back to the boom days of 2017, there are several fundamental factors that are different this time around.

Speculating on reasons behind a price move is simply that: speculation. It’s difficult to say for certain why bitcoin’s price has increased beyond something that is true of all markets: demand is outstripping supply. That being said, there are a number of macro factors around the market that may have contributed to the rise in price.

From the prospect of lower interest rates to the growth of institutional interest in this sector, there is a strong case to be made that, this time around, the price of bitcoin hasn’t been driven by retail investors afraid of missing out, but rather by a more mature and stable ecosystem. In this article, we’ll break down some of the most central of these factors that may have influenced bitcoin’s recent rally.

Looking to capture the best price execution on your BTC trades in volatile markets? Head to SFOX and trade algorithmically across all major exchanges from one account.

Institutional Interest Is Rising

One of the most prominent differences between the rally today and in 2017 is the level of institutional interest in Bitcoin. Much of the last rally coincided with retail investors who were afraid of missing out. At that time, many institutions that wanted to invest in bitcoin had to do so directly through an exchange or OTC broker. For many institutional investors with billions of dollars, this introduced custody and compliance concerns for what they saw as a speculative digital asset.

Today, the scene has transformed. Financial institutions can gain exposure to Bitcoin through a number of regulated venues, from the CME futures market to the Grayscale Investment Trust. While some of these venues have existed since 2017, trading volume on them hadn’t grown significantly until the past year — suggesting a parallel growth in institutional interest in Bitcoin.

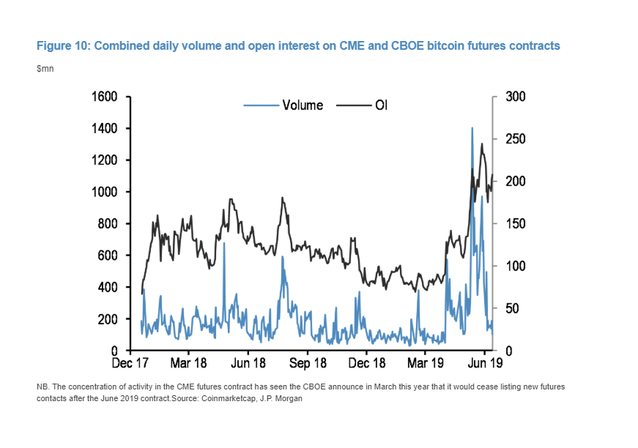

CME’s Bitcoin futures present what is perhaps the most obvious evidence of this: For the month of May, CME futures reported a notional trading volume of around $1.3 billion. The average daily volume on CME Bitcoin futures was around 13,600 contracts, or $515 million in notional value — up 250% year over year. Each contract represents six Bitcoin — or around $65,000 at today’s prices — not a sum targeted at retail investors.

The CME and the CBOE are currently the only regulated exchanges that offer Bitcoin futures — and the CBOE announced it was putting Bitcoin futures on hold in March. But while the CME dominates the market for regulated Bitcoin futures in the U.S., the planned launch of physically-backed futures on Bakkt, LedgerX, and ErisX promises to give the CME heightened competition for institutional customers.

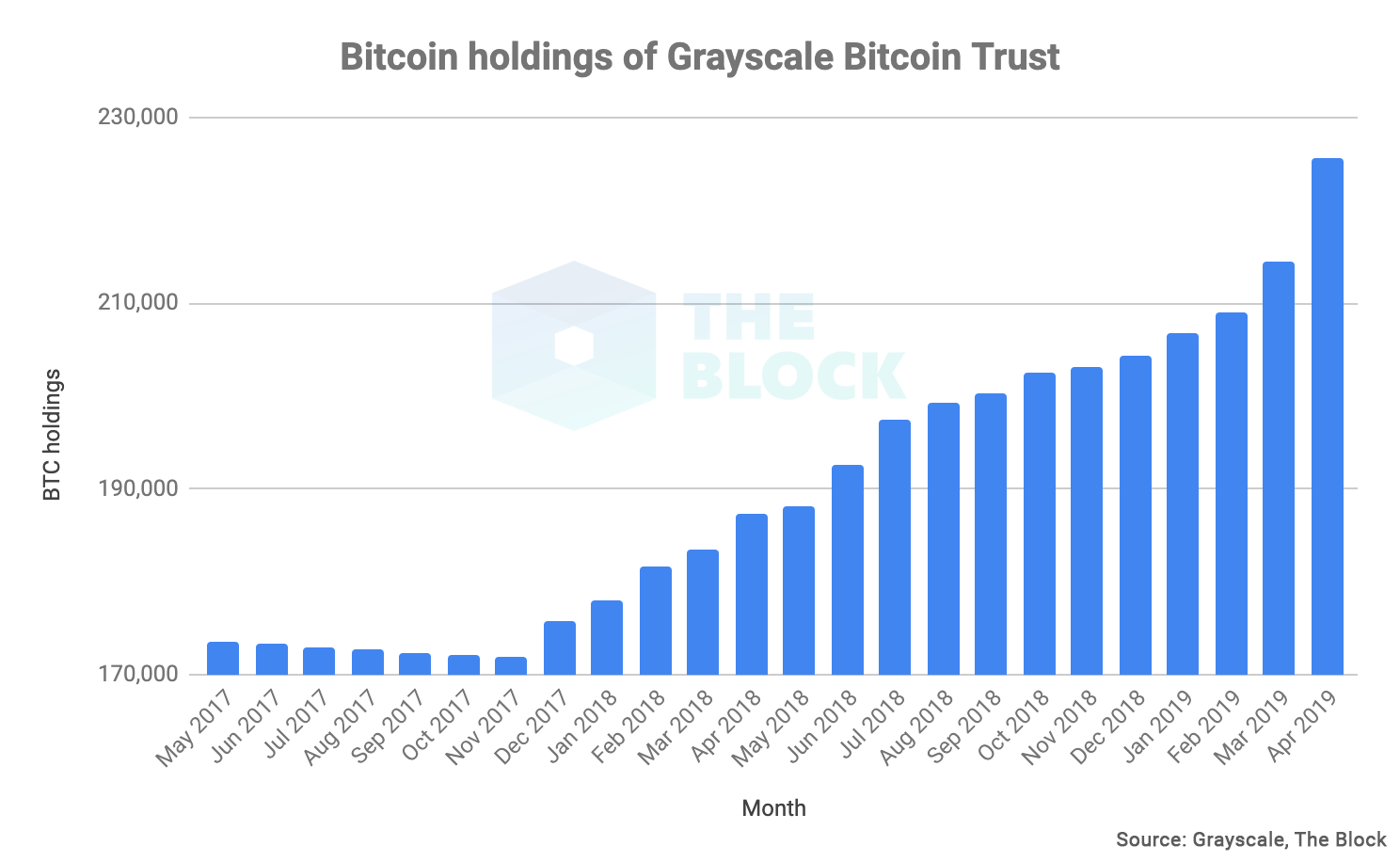

The Grayscale Investment Trust (GBTC) provides institutional investors with another way to gain exposure to Bitcoin. GBTC directly purchases and holds bitcoins for investors in cold storage. Accredited investors can purchase shares in GTBC — with a minimum investment of $50,000 — to gain exposure to the asset. GBTC reports that 66% of investment in the fund came from institutional investors. While Grayscale charges investors a hefty 2% annual fee, demand has only been growing along with the price of BTC. As of April 2019, GBTC’s Bitcoin holdings have grown to 225,638 BTC — or roughly 1% of Bitcoin’s circulating supply.

On a macro level, the cryptocurrency space has matured a lot since 2017. From the rise of institutional trading venues such as the CME to Facebook’s Libra, Bitcoin is shedding its previous “Wild West” image and is becoming more appealing to institutions. While this is aided by the rise of regulated, institutionally-focused platforms, that’s not the only thing that may have contributed to a rally in price. As we’ll discuss in the next section, a number of macroeconomic factors may help explain why larger investors are participating in Bitcoin.

Macroeconomic factors and a hedge against inflation

While Bitcoin is a peer-to-peer currency free from centralized control, it doesn’t exist in a bubble outside of global financial markets. Several macroeconomic factors may also have provided a tailwind for bitcoin’s price in the past few months.

The more Bitcoin matures, the more intertwined it becomes with broader economic forces, as various actors and institutions enter the market. While it remains speculative, there is a case to be made that Bitcoin’s price rise may have partly been in response to lower central bank interest rates and a worsening economic outlook. This is consistent with the SFOX research team’s recent market report indicating that investors may be viewing BTC as a global hedge.

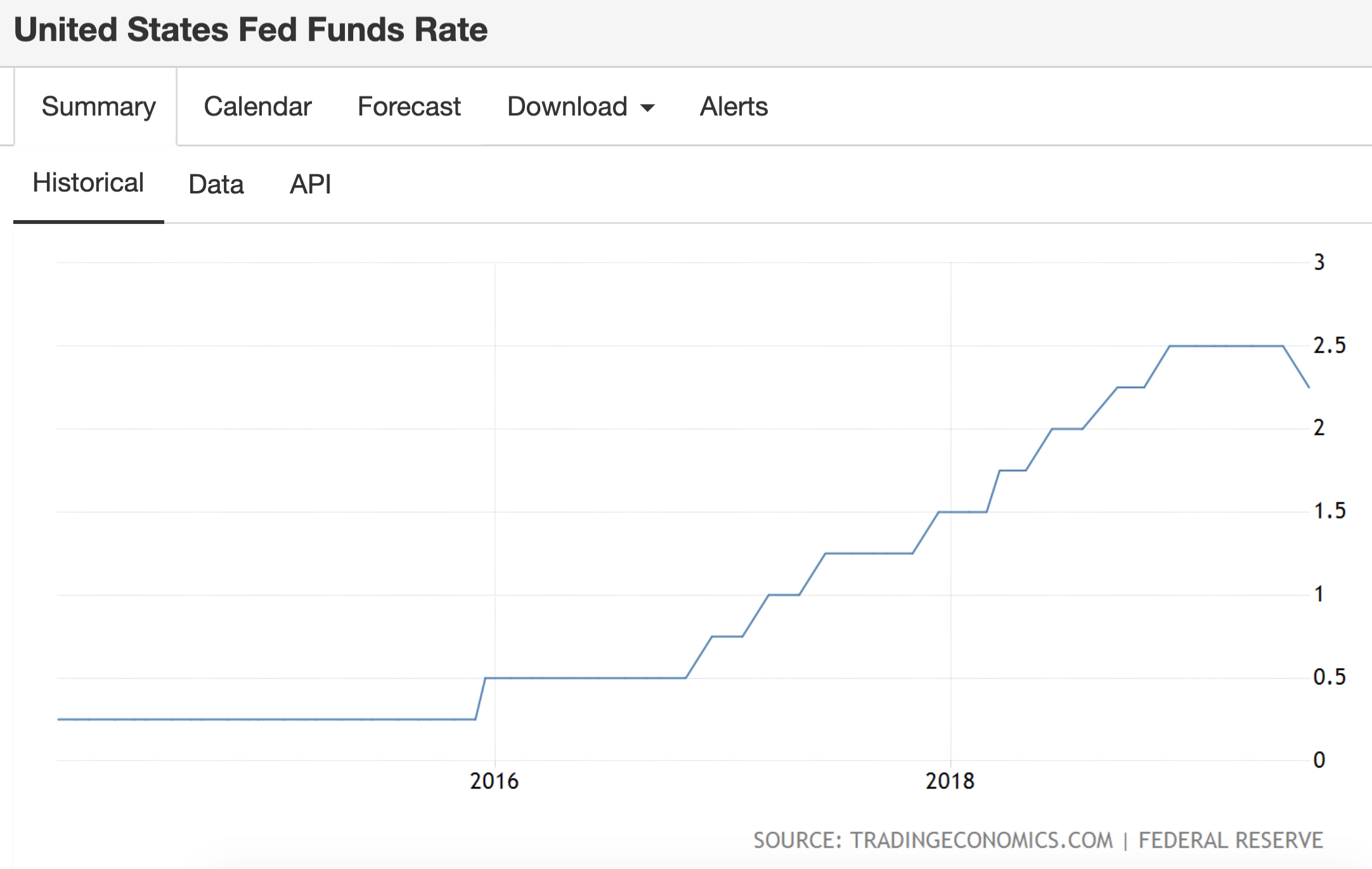

Last year, the Federal Reserve increased interest rates from 1.5% at the beginning of the year to 2.5% at the end of the year. Since the beginning of 2018, however, a more dovish Federal Reserve has kept interest rates at 2.5%, and, at its July 2019 meeting, it cut the rate 25 basis points to 2.25%. In other parts of the world, such as Switzerland, Sweden, and the Eurozone, central bank interest rates have actually gone negative. This move towards lower interest rates and prolonged quantitative easing is unprecedented. In the face of unpredictable monetary policy, Bitcoin, with a fixed 21 million BTC supply schedule written into the code, could have become much more appealing to investors seeking a safety raft in a tumultuous global economy and loosening monetary policy.

As a Financial Times article points out, bitcoin’s price increases have coincided with a rise in the price of more traditional safe-haven assets, such as gold, the Japanese yen, and the Swiss franc, which suggests that, like these other assets, Bitcoin might be functioning as a hedge against economic uncertainty.

Events such as a looming U.S.-China trade war and the threat of a weakening global economy may also be pushing investors further toward assets like Bitcoin. In recent weeks, the price of Bitcoin even appeared to be inversely correlated with a weakening Chinese yuan, increasing from $9,900 per BTC on August 1st to $12,100 on August 8th. During the same time period, offshore Chinese yuan fell roughly 2% form around $.141 to $.14.

While correlation does not imply causation, it’s possible that weakening domestic currencies and fear of a trade war are driving investors towards store-of-value assets such as Bitcoin.

The expectation of looser monetary policy lowers yields from assets, such as bonds, and may have potentially driven investors toward alternative assets, such as Bitcoin. Deutsche Bank’s head of fundamental credit strategy, Jim Reid, speculated: “If central banks are going to be this aggressive, then alternative currencies do start to become a bit more attractive.”

Supply and Demand

Bitcoin’s value is driven, in part, by its limited supply. New bitcoins are created in the form of block rewards, awarded to miners for solving a costly proof-of-work puzzle to generate new blocks and secure the network. Baked into Bitcoin’s protocol is a fixed supply of 21 million BTC, out of which 17 million have already been mined. The scarcity of Bitcoin has led many to refer to it as “digital gold.”

While the supply of Bitcoin increases over time, it can be thought of as a deflationary asset because one’s purchasing power with Bitcoin increases over time. This is due to the unique supply schedule of Bitcoin, which is programmed into the code. Every 210,000 blocks, or approximately four years, Bitcoin undergoes what’s known as a halvening, in which the block reward given to miners is cut in half. The next Bitcoin halvening will occur around May 16, 2020, reducing the reward for each new block mined from 12.5 BTC to 6.25 BTC. (You can track a variety of halvening information at https://www.bitcoinblockhalf.com/.)

While the next halvening is almost a year away, it’s possible that the event is being priced into Bitcoin today, potentially contributing to the dramatic rise in its price. This would be in line with historical price data around previous Bitcoin halvenings.

At the time of the last halvening, which occurred on July 9, 2016, the price was around $662 per BTC. In the following weeks, the price of Bitcoin remained relatively flat — and even dropped down to $536 per BTC at the beginning of August 2016. From July 2015 to July 2016, however, the price of BTC had more than doubled from $300 to $662. One possible factor contributing to that price increase may have been that investors were purchasing BTC ahead of the halvening date, in anticipation of the reduced rate of increase in BTC supply.

In the past couple of months, Bitcoin’s price has rallied from around $3,400 per BTC in February to over $10,800 per BTC today. Given the proximity of the next halvening in May 2020, it’s possible that investors may have again stocking up on bitcoin in the last few months, in anticipation of slower future growth in BTC supply.

The price isn’t always right

The 2017–2018 Bitcoin rally peaked in a bout of speculative mania, as sensationalist media headlines hooked droves of retail investors into the space. Today, while we’re seeing a similar run-up in price occur, the structure of the market is fundamentally different. A growing number of regulated trading venues are giving institutional investors wider access to the market — and growing volume suggests that they’re actually buying. While the previous rally was largely speculative, the data suggests that this time around, investors may be using Bitcoin as a hedge against broader economic interest — helping to validate a strong investment use-case for the asset.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.